In a year that’s seen the worst slump in initial public offerings since the financial crisis, investment bankers covering deals in the Middle East are busier than ever.

(Bloomberg) — In a year that’s seen the worst slump in initial public offerings since the financial crisis, investment bankers covering deals in the Middle East are busier than ever.

As listings dwindle in London, Hong Kong and New York, the United Arab Emirates and Saudi Arabia have emerged as new IPO hotspots buoyed by high oil prices and investor inflows. Listings in the region have fetched $22.6 billion this year — over half of the proceeds in Europe, the Middle East and Africa. Investor demand is strong, with this week’s dual listing of Americana Restaurants International Plc drawing $105 billion of orders for a $1.8 billion offering.

To handle the flurry of activity, global banks are drafting in otherwise idle teams in places like London to help, relocating staff or expanding. Goldman Sachs Group Inc. and JPMorgan Chase & Co.’s top IPO bankers for emerging markets in EMEA are spending more time in the region. Dubai’s biggest lender, Emirates NBD PJSC, hired three bankers to cover offerings, according to people familiar with the matter. Citigroup Inc., meanwhile, has boosted its regional investment banking team by 50% over the past two years.

“We always fly in specialists,” Miguel Azevedo, head of investment banking for the Middle East and Africa at Citigroup, said in a recent interview with Bloomberg TV. “I can tell you that the region has been the favorite destination for most of my colleagues over the last 12 months for sure.”

A representative for Emirates NBD declined to comment.

The Middle East frenzy — which has seen 42 regional listings in just over 11 months — is all the more significant given that new offerings are almost at a standstill in other financial centers as market volatility and rising interest rates impact deals. Eight out of this year’s 10 largest IPOs in EMEA are in the Gulf, setting the region on course for its second-best year for share sales, eclipsed only by 2019 when Aramco pulled off its record $29.4 billion listing. And the rush of deals is showing no sign of slowing.

Abu Dhabi National Oil Co. picked Goldman Sachs Group, Bank of America Corp. and First Abu Dhabi Bank PJSC as joint global coordinators for the IPO of its natural gas business next year, Bloomberg reported this week, in what’s set to become one of Abu Dhabi’s largest listings.

London, meanwhile, is having its worst year since 2009. One investment banker based in the UK capital joked that most of his local colleagues who handle IPOs are either in the pub or in Dubai these days.

Things aren’t much better in Europe where many offerings — like Eni SpA’s multibillion-dollar renewables arm and the $750 million listing of ABB Ltd.’s electric-car charging business — have been postponed because of market turmoil. Globally, the amount raised from IPOs this year has slumped 68% from a year earlier, the worst annual drop since 2008 when offerings fell 73%, according to data compiled by Bloomberg.

Push Back

But despite working on Middle East deals around the clock, the IPO boom isn’t translating into a fee bonanza for advisers. Americana paid about 194.4 million riyals ($51.7 million) in overall fees, or 2.9% in offering expenses, for its $1.8 billion dual-listing in Riyadh and Abu Dhabi. Saudi Aramco Base Oil Co. paid 85 million riyals, or 1.7% in fees, for its $1.3 billion offering.

In the US, the average fee is about five times that. Banks including Goldman Sachs and JPMorgan split about $60 million in fees from helping Peloton Interactive Inc. raise $1.2 billion in 2019.

One senior executive at a Wall Street firm in London, who asked not to be identified, said his bank has started to push back on accepting low fees from clients in the Middle East and won’t work on offerings that generate payments of less than $5 million.

Another banker at a US institution said that although many banks have minimum fee levels, there are always exceptions depending on the type of deal. Often, many banks are chasing one client, and some offer to work for free to build their franchise, the banker said, asking not to be identified.

HSBC Holdings Plc currently ranks as the top arranger for IPOs in the Middle East, with a 16% market share, followed by EFG-Hermes and Goldman Sachs, according to Bloomberg League Tables.

Global Cuts

In a sign of how much the global dealmaking drought has taken hold of the wider financial industry, Wall Street firms such as Morgan Stanley, Goldman Sachs and Citigroup are cutting investment banking jobs, including ECM specialists, in places like Asia. In Hong Kong, IPO proceeds have dropped 69% as the market reels from the effects of China’s Covid Zero policy and the travails of its property sector.

By contrast, the Middle East is attracting more interest — and bankers — to capture the flow of funds. A growing number of hedge funds are expanding in Dubai as other financial hubs like Hong Kong lose their appeal. Top US banks are regularly bringing fund managers to Saudi Arabia and the UAE to meet the flood of companies looking to go public.

The region “has the attention of the most senior individuals” at JPMorgan, according to Gokul Mani, head of ECM for emerging markets at the Wall Street firm. “We view the MENA and the emerging EMEA region as a top priority and clearly we are spending more time there.”

Houlihan Lokey Inc. recently expanded its capital markets division into the Middle East and will use its European equity capital markets bankers to pursue regional IPOs, said Andy Cairns, head of MEA capital markets.

Disappointing Debuts

Still, signs are emerging that some of the initial enthusiasm for new listings is starting to fade, with recent market debuts receiving a lukewarm reception.

Three out of five of Dubai’s IPOs are now trading below their listing price, which is disappointing for a drive that aimed to reinvigorate the city’s capital markets. Most recently, private school operator Taaleem Holdings slumped 15% on its debut despite drawing $3.7 billion of orders for its $204 million IPO. In Saudi Arabia, the Public Investment Fund’s $610 million stock exchange sale has left investors nursing deep losses, with shares about 20% lower than their offer price.

“Generally, there’s been a more cautious tone from investors when looking at traded stocks and the IPO pipeline,” said Samer Deghaili, HSBC’s regional co-head of capital financing and investment banking coverage. “Some businesses looking at the public market are revisiting their plans, considering whether they should slow down or whether valuations remain at a conducive level.”

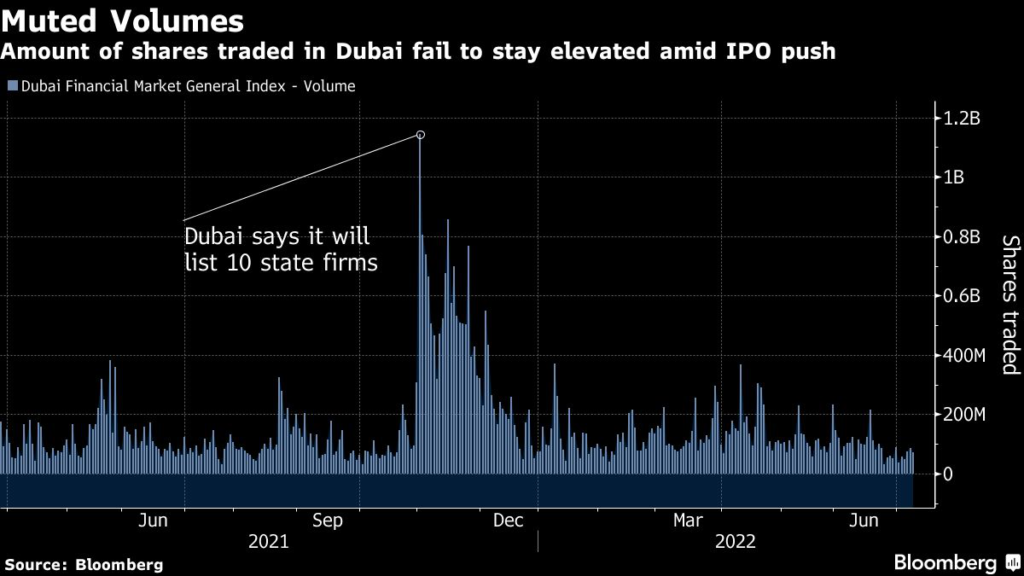

And the frenzy has failed to have the desired long-term effect of deepening the region’s stock markets. In Dubai, for example, the amount of shares traded this year so far is the lowest since 2011 and well below the average of 52 trillion shares traded in a year since 2003. In Saudi Arabia, the average yearly volumes on the Tadawul All Share Index are set for the lowest since 2019.

No Slowdown

But for now at least, demand remains strong — mainly among local investors — with most offerings being sold at the top end of the price range and covered within hours.

Orders are being driven by attractive dividend yields, the availability of leverage and a lack of deals elsewhere. International buyers are usually allocated between 15% and 30% of shares available, which can mean some portfolio managers receive so little stock they have to sell it.

“We would like to see a higher participation or a higher allocation to international investors, especially institutional ones that are longer term in nature because it helps promote the region and deepen the liquidity pool,” said Salah Shamma, Franklin Templeton’s Dubai-based head of equity investment for MENA.

Despite the headwinds, most Wall Street banks expect the IPO boom to extend into next year as demand for regional assets grows. Goldman Sachs is working on several mandates that may materialize in the next 12 months, while Citigroup expects about 10 more listings.

“I don’t foresee activity slowing down at least in the next 12 to 18 months. What happens beyond that, who knows?” said Andree Chakhtoura, Bank of America Corp.’s head of investment banking in MENA. “But so far, looking at the pipeline and bearing in mind what is coming and we know is coming, I don’t see anything slowing down.”

–With assistance from Dinesh Nair, Nicolas Parasie and Farah Elbahrawy.

(Updates with Adnoc hiring banks for an IPO in seventh paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.