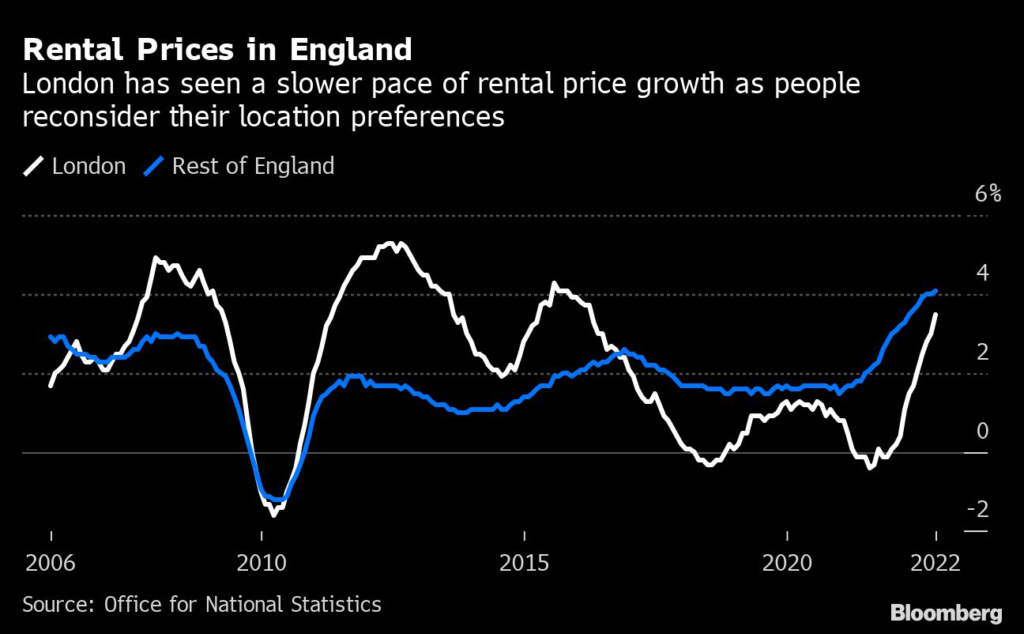

Housing rents rose further in November, but a slower pace of growth in London shows the continuing effect that remote working is having on consumer behaviors.

(Bloomberg) — Housing rents rose further in November, but a slower pace of growth in London shows the continuing effect that remote working is having on consumer behaviors.

Private rental prices across the UK increased by an average of 4% in the year through November, up from 3.8% in October, according to data from the Office for National Statistics on Wednesday. London and the North East saw the lowest growth, at 3.5%, which the ONS said could indicate a dissipating premium for living near the office in an era where more people can choose where they work.

Rents in Northern Ireland surpassed all other regions in the UK, with prices rising at more than double the pace of those in England, at 9.5%.

Separate data from the ONS showed that median rent between October 2021 and September 2022 reached the highest ever on record, at £800 ($990) a month. London landlords still charged the most, with median monthly rents at £1,475 — almost double the rest of England.

Bristol, Oxford, Cambridge and Brighton were the most expensive areas to rent outside of London.

The data adds to other evidence of rising costs for tenants, with rental stock still in limited supply and borrowing costs for mortgage-holders increasing. Mortgage rates, which soared to 14-year highs in the aftermath of the September mini-budget, increased costs for many landlords and discouraged others from renting out properties.

Property portal Zoopla reported that the cost of a new rental agreement rose 12.1% in the 12 months to October, far outstripping average annual wage growth of around 6%. Rent as a proportion of average earnings is now at its highest since 2009, accounting for over a third of a person’s income.

–With assistance from Damian Shepherd.

(Corrects to read £800 in fourth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.