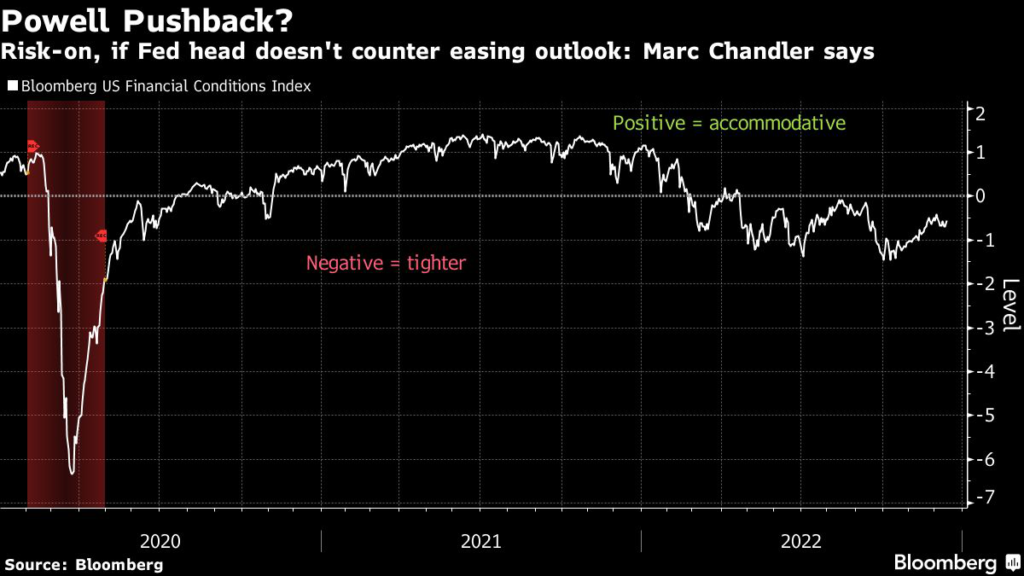

The stakes couldn’t be higher for Federal Reserve Chair Jerome Powell after a soft inflation report Tuesday supercharged an easing of financial conditions that had already been underfoot.

(Bloomberg) — The stakes couldn’t be higher for Federal Reserve Chair Jerome Powell after a soft inflation report Tuesday supercharged an easing of financial conditions that had already been underfoot.

Spiraling bond yields, a slide in the dollar and stock gains followed the consumer price report, with traders doubling down on bets the Fed will be able cut rates within a year.

That leaves the widely expected downshift in the pace of hikes to 50 basis points Wednesday as a mere sideshow to what Powell will say at 2:30 p.m. in Washington.

“Powell did not push hard against the easing of financial conditions when he last spoke.

Will he push harder today?,” Marc Chandler, chief market strategist at Bannockburn Global, said in a note. The market “remains convinced the Fed will cut rates before the end of next year.”

When the Fed’s boss spoke at the Brookings Institution last month he touched generally on financial conditions, but didn’t push back on market wagers that rates would start coming down later in 2023.

That was seen as dovish by traders, spurring a rally in both equities and bonds.

“The market is like horses being held at the gate. All they need is another nod from Powell, and they take off because the market wants to go,” Chandler said in a phone interview.

“It will be pure risk on, with stocks rising and yields falling.”

Equities rose Wednesday, while two-year yields — which are more sensitive to imminent Fed moves — retreated.

After this week’s inflation figures, swap traders pushed their outlook for the peak Fed rate down to around 4.8% — compared with well over 5% a few months ago.

By December 2023, traders see the Fed driving the funds rate to around 4.3% — representing about a half-point of policy easing by the end of 2023.

The current benchmark sits in a range between 3.75% and 4% after four straight 75 basis-point hikes.

Powell at the Brookings event stressed that borrowing costs would need to keep rising and remain restrictive for some time to beat inflation.

He said Fed officials were looking at financial conditions, adding that they were monitoring them in a slightly different way that in the past.

Though he didn’t say anything specific about Fed cuts being wrong-footed.

“The way we generally think about it is, we make our policy changes and they affect financial conditions,” Powell said in response to a question following his prepared remarks at Brookings.

“Actually, it works the other way around. And so we monitor the tightening of financial conditions.”

And clearly it works in the reverse case.

When financial conditions ease, the Fed notes that and deciphers how it is working through the economy and against their efforts to temper demand to bring inflation down further.

Rising stocks, a falling dollar and lower bond yields all serve to ease those conditions.

Read more: Four Things Traders Expect From the Fed Review Today

Chandler said a repeat of some general comments from Powell on financial conditions wouldn’t suffice — with a direct comment that traders pricing of cuts being wrong-footed is needed.

“If Powell does not push back on the easing of financial conditions, the market is going to take it like a bit in its teeth,” and run, Chandler said.

(Updates pricing)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.