South Africa’s inflation slowed to a five-month low in November, bolstering the case for a less aggressive interest-rate hike early next year.

(Bloomberg) — South Africa’s inflation slowed to a five-month low in November, bolstering the case for a less aggressive interest-rate hike early next year.

The headline consumer-price index rose 7.4% from a year earlier, compared with 7.6% in October, Pretoria-based Statistics South Africa said Wednesday in a statement on its website. The median of 13 estimates in a Bloomberg survey of economists was 7.5%.

The slowdown will be welcomed by the South African Reserve Bank’s monetary policy committee, which was surprised by October’s higher-than-expected outcome. While the panel officially targets price growth in a band of 3% to 6%, it prefers to anchor expectations close to the midpoint of that range.

Headline and core inflation, which excludes the prices of food, non-alcoholic drinks, fuel and electricity, remain elevated and suggest price pressures are becoming broad-based. That reinforces the hawkish tone of the central bank’s November MPC statement, when it raised borrowing costs by 75 basis points for a third straight meeting.

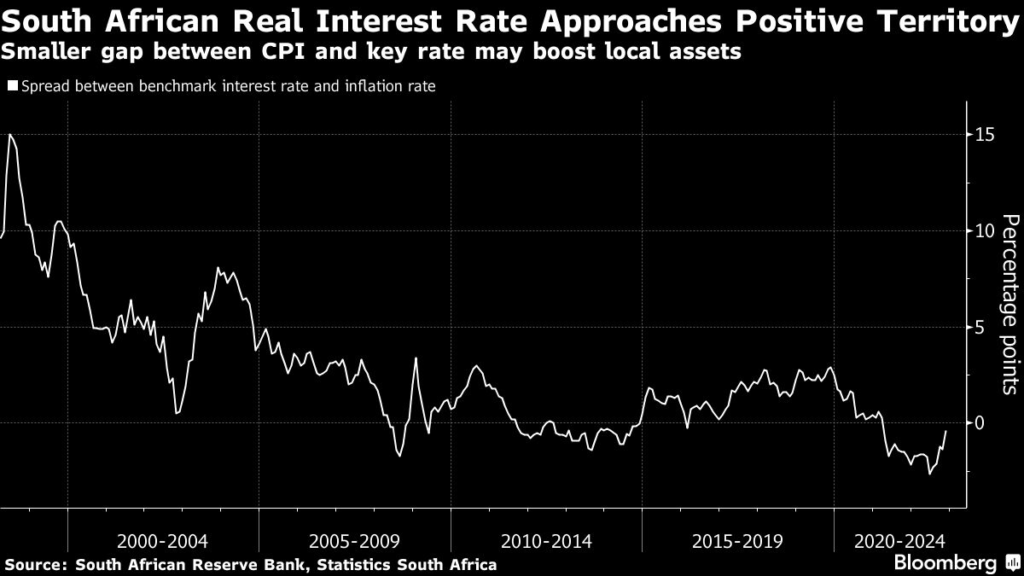

While other emerging-market central banks, including Brazil and Poland, held key interest rates at their most recent meetings, Reserve Bank Governor Lesetja Kganyago has yet to signal that the MPC may be close to pausing its hiking cycle or even slowing the pace of increases. That’s even as the benchmark repurchase rate of 7% is higher than the year-end 2025 level that the bank’s quarterly projection model, which the MPC uses as a guide, suggests it should be.

Kganyago ruled out the risk of overtightening at the MPC’s November press conference and affirmed its commitment to taming the “monster of inflation.”

Economists and traders expect the central bank to continue raising the key rate next year. Forward-rate agreements starting in two months, used to speculate on borrowing costs, show the market predicts the Reserve Bank will start to cool the pace of rate hikes, with traders pricing in an 80% chance of a 50-basis-point increase at the MPC meeting scheduled for Jan. 26.

The move by the Federal Reserve due later Wednesday will affect expectations for South Africa’s interest-rate trajectory. While the Reserve Bank doesn’t match the Fed move-for-move, a slowdown in the pace of US hikes will ease pressure on South African policymakers to bolster the differential that makes local assets attractive to foreign investors.

–With assistance from Paul Richardson.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.