UK inflation dipped from a 41-year high in November, raising the possibility that the worst of the cost-of-living squeeze is over.

(Bloomberg) — UK inflation dipped from a 41-year high in November, raising the possibility that the worst of the cost-of-living squeeze is over.

Consumer prices rose 10.7% from a year earlier, the Office for National Statistics said Wednesday, down from 11.1% in October. Economists expected a rate of 10.9%.

The slowdown indicated a respite from an almost unbroken string of soaring prices over the past 1 1/2 years. It will do little to shift the interest-rate debate at the Bank of England, where officials expect inflation to remain above the 2% target until well into 2024 despite the economy falling into a recession.

“While these figures suggest inflation has peaked, it nevertheless remains at a precariously high rate which is having a real impact on people and businesses,” said Suren Thiru, economics director at the Institute of Chartered Accountants in England & Wales. “With inflationary pressures looking more broad-based, the pace of easing is likely to be slow.”

What Bloomberg Economics Says …

“The fall in inflation in November will come as a welcome relief to the Bank of England and will probably tip the balance towards a 50-bp hike at its final meeting of the year. Still, with inflation in double digits, there isn’t room for complacency. Rates will keep edging higher in 2023 as the BOE adopts a smaller-for-longer strategy.”

— Dan Hanson, Bloomberg Economics. Click for the REACT.

Money markets pared wagers on Bank of England rate hikes by as much as 10 basis points, pricing the bank rate to peak at 4.68% by August.

Policymakers are expected to deliver their ninth rate increase in a year on Thursday in an effort to stop inflation from becoming entrenched, with further hikes signaled in the first half of 2023. The government and the BOE have put preventing a wage-price spiral at the top of the agenda.

“I know families and businesses are struggling here in the UK,” Chancellor of the Exchequer Jeremy Hunt said in a statement. “Getting inflation down so people’s wages go further is my top priority.”

The inflation decline was largely due to the cost of petrol and used cars, along with tobacco, clothing, computer games and hotel stays.

Fuel prices rose more slowly than a year ago, and the effect provided a sharp reduction in the pace of annual inflation.

Food and non-alcoholic beverages prices rose 16.4%, the most since September 1977, with bread and cereals gaining the most in that category.

“While we expect inflation to continue on its downwards trajectory and return to the Bank of England’s target of 2% in the first half of 2024, there is a risk it may prove more persistent as higher costs are passed on more widely,” said Yael Selfin, chief economist at KPMG. “However, the weaker economic environment could also see inflation undershoot its target.”

Core inflation, which excludes energy, food, alcohol and tobacco prices, eased to 6.3% growth from 6.5% in October.

Alcohol prices in restaurants, cafes and pubs rose sharply, particularly for whiskey, wine and gin.

Services inflation held steady at a 30 year high of 6.3%. The elevated levels raise concerns that above-target inflation will persist unless the BOE continues to act forcefully to tame price growth.

“Tobacco and clothing prices also rose, but again by less than we saw this time last year,” said Grant Fitzner, chief economist at the ONS. “This was partially offset by prices in restaurants, cafes and pubs which went up this year compared to falling a year ago.”

Evidence is mounting that inflation has peaked in the US too, stoking hopes that the Federal Reserve will be able to pause its rate-hiking cycle soon. US consumer prices rose 7.1% in November and have declined in each of the past five months.

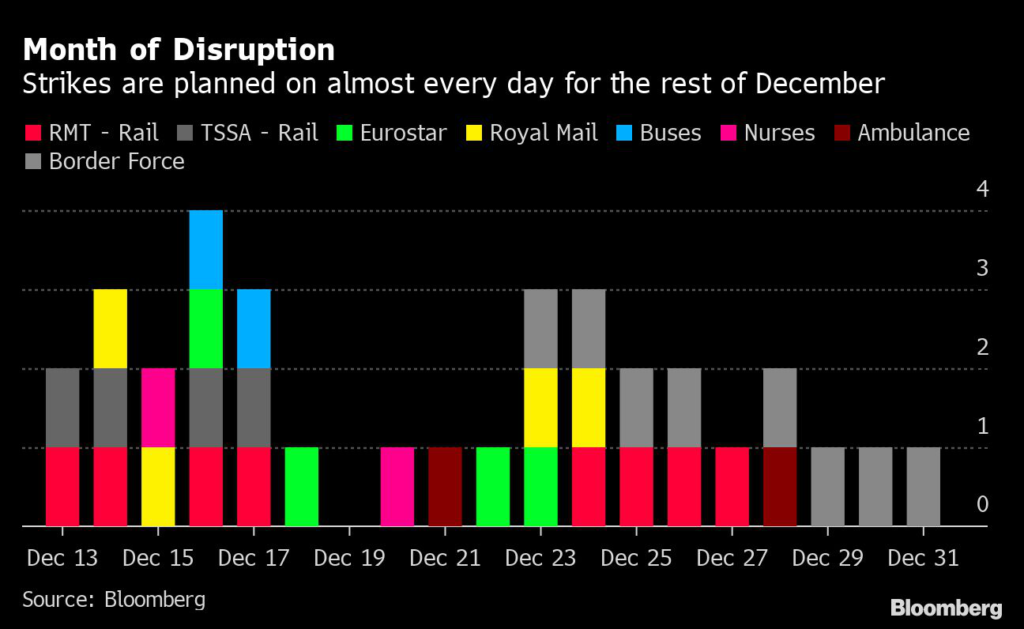

UK inflation by contrast has risen faster than expected in most of the past 1 1/2 years, fueling demands from workers for higher pay. Unions representing train drivers, nurses and border agents plan strikes between now and the end of the year, putting pressure on Prime Minister Rishi Sunak’s government to ease wage restraints.

Unlike the US, where gasoline prices have tumbled and power markets are mostly insulated from overseas trends, UK energy prices have spiraled ever higher this year after Russia choked off supplies of natural gas to Europe.

Producer input and output prices are normally released alongside the CPI data. However, the ONS decided not to publish them this month following the discovery of problems that are now under investigation.

–With assistance from James Hirai.

(Updates headline and third paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.