In a year when everything from stocks and bonds to cryptocurrencies have tumbled, an investment in Singapore’s most elite golf club stands out.

(Bloomberg) — In a year when everything from stocks and bonds to cryptocurrencies have tumbled, an investment in Singapore’s most elite golf club stands out.

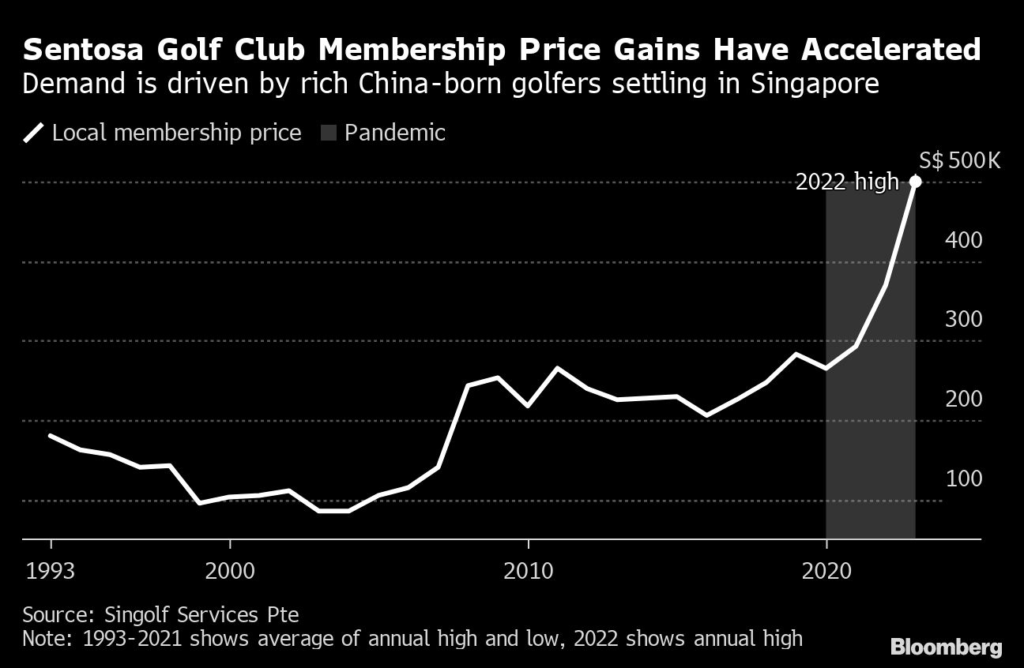

The cost for an expatriate to join the 36-hole Sentosa Golf Club overlooking the Singapore Strait has more than doubled since the end of 2019 to S$840,000 ($618,000), according to brokerage Singolf Services Pte. For citizens and permanent residents, the membership price has surged to as much as S$500,000.

It’s another way the city-state is defying gravity in a world upended by the global stocks implosion, strict Covid restrictions in China and Russia’s war in Ukraine. Prime real estate has never been more expensive, luxury-car sales are higher than ever and country clubs are thriving.

The manicured and almost crime-free financial hub has long attracted wealth from countries with more complicated prospects, led by rich Chinese settling in the city. Few venues exemplify the trend better than the championship course some rank top in Asia Pacific.

Set on a lush island south of Singapore’s rump, the facility is nestled between the Resorts World casino, Universal Studios, a marina that attracts ocean-going yachts from as far as the Caribbean, and native jungle pocked by battlements ruined during World War II.

Golfers will tell you there are few tougher or more precisely trimmed layouts in the region. Hardly a blade of grass on the fairways or grain of sand in the bunkers is misplaced on any given day as Bentley, Mercedes-Benz and Rolls-Royce sedans disgorge the smartly dressed who’s who of the financial community.

“These are the ultra-rich Chinese, for them it could be a small sum,” said Lip Ooi, an instructor at the public Marina Bay Golf Course. “If someone wants to find a golf club, and wants to only join the best, and because they are ultra-rich, of course they would go for Sentosa Golf Club.”

The Sentosa club declined to comment for this article.

The venue for high-profile tournaments including the SMBC Singapore Open and HSBC Women’s World Championship will return to the sporting headlines in April by hosting the LIV Golf League. The controversial series backed by Saudi Arabia features 48 of the world’s best players including Phil Mickelson, Dustin Johnson and Bryson DeChambeau.

At Sentosa, the rally in membership fees started during the pandemic as lovers of green fairways sought relief from the strictures of Covid lockdowns. Demand has since accelerated, driven by the prestige sought by wealthy foreigners, primarily from China’s mainland but also from countries like South Korea and Japan.

“People like Sentosa because it has this name. It’s for the rich and famous,” said Lee Lee Langdale, owner of Singolf Services and a broker of memberships since 1991. “But they run the club very well. Many mainland Chinese also live near Sentosa.”

@scanlandavid explains why pic.twitter.com/Ff6mNwOYST

— Bloomberg Quicktake (@Quicktake) December 16, 2022

Family Offices

Singapore’s reputation as a low-tax bastion of stability has made it a hub for the wealthy from across Asia. Mainland Chinese are by far the biggest factor behind a near doubling of family offices to about 700 at the end of 2021. Previously, the super-rich used Singapore as a business base. Now, many Chinese families are opting to live there as well.

“We see a huge demand that we didn’t see before the pandemic,” said Madeline Choo, manager of Active Golf Services Pte, another brokerage. “They need to buy a membership because they intend to stay in Singapore for very long.”

Those who can’t afford Sentosa or a clutch of other private clubs including Tanah Merah Country Club, Laguna National and Singapore Island Country Club, face a narrowing range of options after the government closed some courses to redevelop the land. Some golfers look outside Singapore for cheaper options.

“It’s getting a little bit expensive, but there is a chance for them to play in Malaysia” or the nearby Indonesian island of Batam, said M. Murugiah, president of the Singapore Professional Golfers’ Association. “It’s not that expensive like Singapore.”

In the city-state, club memberships are commonly transferable in an open market, and many have more than doubled in value in half a decade. The prospect that demand will outstrip dwindling supply has prompted some to treat it as a speculative investment, even buying into a range of clubs, said Lip, the golf instructor.

On Sentosa’s balmy terraces, as golfers dissect their matches with opponents over drinks, the market is a hot topic of discussion. Some are tempted to cash in before the boom falters.

“Quite a number of foreigners are waiting for S$1 million to sell,” said Langdale. “Whatever goes up must come down. And it will come down, it’s just a matter of time.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.