Central banks have provided very little Christmas cheer for stock markets this week

Stock markets dropped further Friday on prospects of more aggressive rises to interest rates to fight sky-high inflation, renewing concerns over the global economy entering recession next year.

After a healthy rally in recent weeks fuelled by signs that price rises were slowing, the US Federal Reserve, European Central Bank and Bank of England this week crushed any Christmas spirit by hiking borrowing costs again by sizeable amounts and warning of more pain.

While inflation in most countries has started coming down — helped by a drop in energy costs — it remains at multi-decade highs.

Observers have warned that economies could be heading for a period of stagflation where prices keep rising but growth stalls.

“In a nutshell, it is all about fears over a sharper economic slowdown in 2023 than previously expected,” noted Fawad Razaqzada, market analyst at City Index trading group.

“While macro data have been weak of late, there was still hope that the downturn might be short-lived and that a recession might be avoided in some regions altogether, amid signs of inflation peaking in some regions like the US.”

The latest rate hikes came as data showed US and UK retail sales dropping in November as consumers — key drivers of growth — feel the pinch from high prices and rate hikes.

– Recession on horizon? –

“With central banks on both sides of the pond suggesting they have more work to tame inflation, hiking interest rates into a dimming macro environment will undoubtedly trigger a recession,” said SPI Asset Management’s Stephen Innes.

“The question is just how profound. Forget inflation; Asia traders are now worried about a global recession.”

Eurozone and London shares dropped in mid-afternoon trading, while Wall Street stocks also fell shortly after opening.

Earlier, Asia had also seen losses, with Tokyo closing down 1.9 percent.

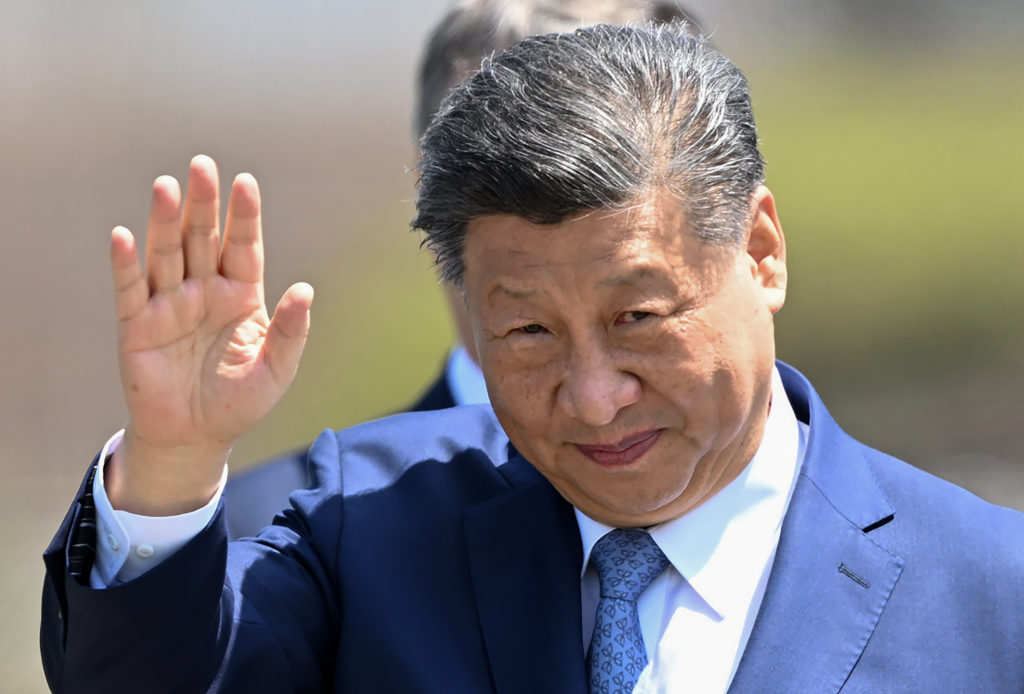

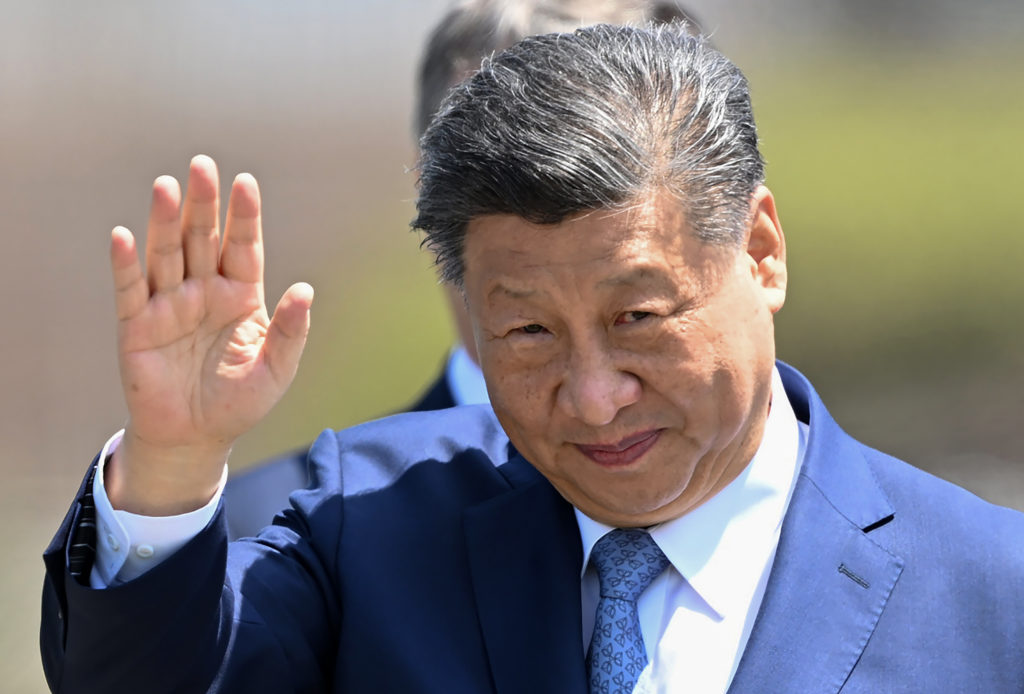

On the upside, Hong Kong rose on progress in talks over allowing US officials to audit Chinese firms listed in New York, easing concerns about a possible delisting of some big names such as Alibaba and Tencent.

The news provided a little more help to Hong Kong traders, whose sentiment has been lifted also by China’s shift away from the economically damaging zero-Covid policy as well as moves to open the city further to overseas visitors.

And a report in the city’s South China Morning Post said the border with mainland China would be fully reopened next month, providing another much-needed boost to the beleaguered economy.

However, the mood was soured a little by a US decision to put 36 Chinese companies including top producers of advanced computer chips on a trade blacklist, severely restricting their access to any US technology.

– Key figures around 1445 GMT –

London – FTSE 100: DOWN 1.2 percent at 7,337.14 points

Frankfurt – DAX: DOWN 0.4 percent at 13,932.71

Paris – CAC 40: DOWN 1.0 percent at 6,456.45

EURO STOXX 50: DOWN 0.6 percent at 3,812.40

New York – Dow: DOWN 0.6 percent at 33,005.58

Tokyo – Nikkei 225: DOWN 1.9 percent at 27,527.12 (close)

Hong Kong – Hang Seng Index: UP 0.4 percent at 19,450.67 (close)

Shanghai – Composite: FLAT at 3,167.86 (close)

West Texas Intermediate: DOWN 3.2 percent at $73.65 per barrel

Brent North Sea crude: DOWN 3.1 percent at $78.73 per barrel

Euro/dollar: UP at $1.0645 from $1.0627 on Thursday

Pound/dollar: UP at $1.2216 from $1.2175

Euro/pound: DOWN at 87.15 pence from 87.26 pence

Dollar/yen: DOWN at 136.90 yen from 137.80 yen