UK retail sales unexpectedly fell in November as Black Friday failed to deliver its usual boost, deepening the cost of the living crisis engulfing the sector.

(Bloomberg) — UK retail sales unexpectedly fell in November as Black Friday failed to deliver its usual boost, deepening the cost of the living crisis engulfing the sector.

The volume of goods sold in shops and online fell 0.4%, the Office for National Statistics said Friday. Sales excluding auto fuel fell 0.3%. Economists expected a 0.3% gain on both measures.

The data underscore concerns that the UK is already in recession, as the Bank of England believes. Consumer spending accounts for two thirds of national output and is key for growth. Separate figures Friday show consumer confidence continues to linger around its lowest levels for at least half a century.

The decline last month was driven by online sales, with Black Friday on Nov. 25 helping less than in previous years. Sales of auto fuel, second-hand goods at auction houses and computer goods also declined.

That was partly offset by higher sales of food and drink, clothing and household goods, with shoppers attracted by discounts at department stores lasting for longer. However any hopes that the pickup might extend into December appear to have been dashed by a week of heavy snow, freezing temperatures and rail strikes that have hit retail and hospitality businesses hard.

The last few months have been volatile for retailers. Sales were hit in September by an extra bank holiday for Queen Elizabeth II’s funeral but rebounded strongly in October. The ONS revised down its estimate for September to a loss of 1.8% and revised up October to growth of 0.9%.

The BOE and private-sector economists say Britain is now almost certainly in recession, with GDP set to register a second consecutive quarter of contraction in the final three months of 2022. Soaring prices and interest rates have left households with less money to spend on non-essential items and piled pressure on companies.

Retail sales will shrink over the quarter unless December sees an increase of 3%. Business in November was 5.9% lower than a year earlier. Yet surging prices mean people are spending more to buy the same basket of goods. The value of sales has risen 4.2% over the same period.

Lisa Hooker, industry leader for consumer markets at PwC, said: “November’s retail sales figures starkly indicate the growing gap between how much we are spending and what we are getting in return, which reflects record high inflation.”

“Whilst these figures make worrying reading for the high street, shoppers told us that they planned to do the majority of their Christmas present shopping in December this year, which is later than in the past. Therefore the real test for the retail sector will be how it fares this month.”

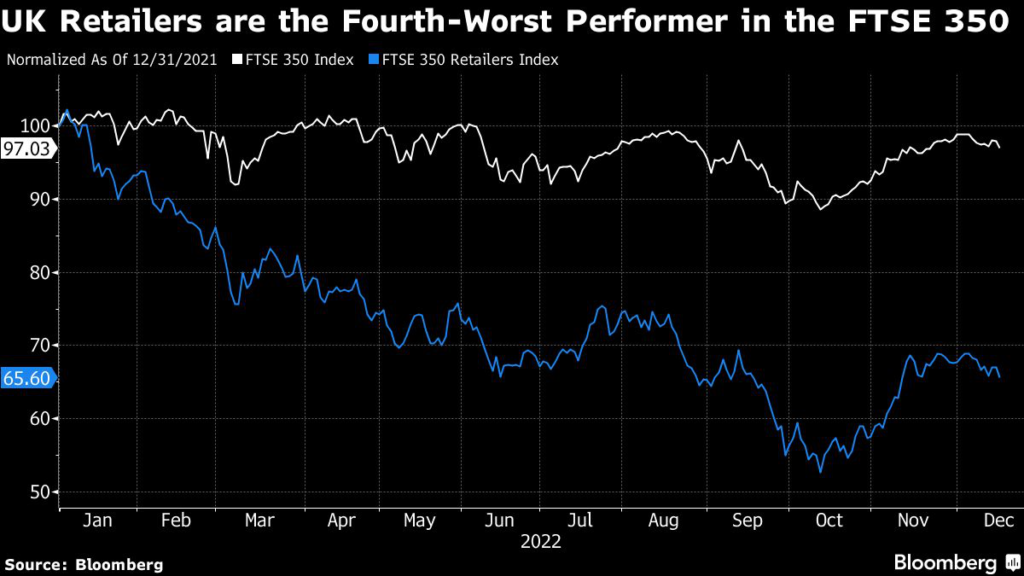

Retailer shares have slumped 34% this year, underperforming the broader FTSE 350 Index, as stores struggle with a combination of falling demand and rising costs.

On Thursday, electronics retailer Currys Plc cut its profit guidance, following similar warnings from firms including Next Plc and Boohoo Group Plc. Insolvencies in the sector are running at their highest level for a decade, with clothing retailer Joules Group Plc among the casualties.

–With assistance from Joshua Robinson and Joel Rinneby.

(Adds details from report, economist comment)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.