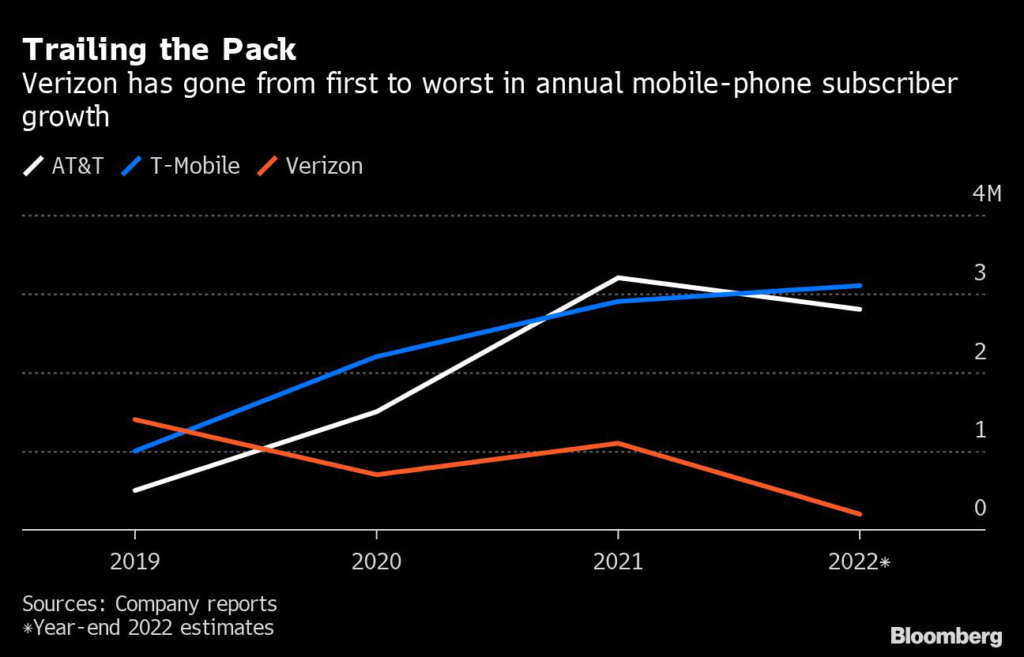

For Verizon Communications Inc. investors, 2022 can’t end fast enough. By the time the books close, the largest US wireless carrier will have logged a third-straight year of below-industry growth, going from first to last in mobile-subscriber gains.

(Bloomberg) — For Verizon Communications Inc. investors, 2022 can’t end fast enough. By the time the books close, the largest US wireless carrier will have logged a third-straight year of below-industry growth, going from first to last in mobile-subscriber gains.

“Verizon bungled 5G and lost its network leadership position,” said Roger Entner of Recon Analytics, a boutique advisory group.

Some investors worry Verizon will ignite a costly price war to win back market share, hurting all of the players as they continue to spend billions of dollars on network expansion and upgrades. The last few years have been marked by more stable industry pricing, record high margins and low customer churn.

This isn’t how the era of better, faster wireless service — known as 5G — was supposed to unfold for the No. 1 US provider. Verizon headed into the decade with a reputation for the best network and service. But management was outflanked by T-Mobile US Inc.’s rapid ascent in network quality, as well as lower prices, and out marketed by AT&T Inc.’s free-phone giveaways.

“The Verizon brand was closely tied to its network prowess,” said Tammy Parker, an analyst with GlobalData, a consulting company. “But it’s difficult to pin down what exactly Verizon stands for now, and that’s a tremendous problem.”

The latest trouble erupted last week, when the head of Verizon’s consumer division departed. It’s the second time in a year that the chief of the company’s largest business got the boot. Chief Executive Officer Hans Vestberg is overseeing that operation for now.

Verizon shares reflect all that concern. The stock is down 29% this year and near an 11-year low, including a loss of more than 2% Friday in New York to $36.96. That compares with an 19% drop for the S&P 500 in 2022. No. 2 T-Mobile is up 20% while AT&T, the No. 3 player, is down over 1% after unwinding years of investments in media and pay-TV businesses and refocusing on phone service.

Next year looks challenging, too. Analysts expect Verizon revenue to rise 1% in 2023, trailing T-Mobile again.

Vestberg, who has taken on the duties of his departing consumer chief Manon Brouillette, isn’t tipping his hand, saying he’ll be guided by “what’s happening in the market.”

“There might be segments where it makes sense to increase prices,” Vestberg said at a UBS investor conference in New York on Dec. 5 “And there might also be areas where it make sense to be more aggressive.”

Still No. 1

The good news for Verizon is it’s still No. 1 by a wide margin, with 120 million regular monthly customers, compared with more than 90 million for T-Mobile and almost 84 million for AT&T. As the company builds out its 5G network, it can remind consumers about its record of superior coverage and reliability.

A Verizon spokesman said Vestberg wasn’t available to discuss the company’s strategy.

The 57-year-old Swede joined Verizon in 2017 as head of network technology after more than 20 years at telecom equipment maker Ericsson AB, where he rose to CEO and then was pushed out in 2016 amid slowing growth. He became CEO of Verizon in 2018, focused on ushering in 5G service.

However, the 2020 sale of Sprint Corp. upended the status quo. With that acquisition, T-Mobile gained airwaves that allowed management to build out crucial parts of its 5G network more quickly than either of its competitors.

Verizon is also having to contend with a reinvigorated AT&T. That company has begun a rebound by focusing on expanding its network, adding subscribers and reducing debt.

Price War?

Verizon, along with T-Mobile and AT&T, raised prices earlier this year to pass along higher labor and supply costs. Customers were willing to absorb the higher bills, showing just how essential wireless service has become.

A price war doesn’t figure into AT&T’s plans.

“What do you gain by lowering rates?” Chief Operating Officer Jeff McElfresh asked at the same UBS conference. “At what point do you lower so far just to match somebody else. It doesn’t seem like a winning strategy to me.”

In his public comments, T-Mobile CEO Mike Sievert now claims to have both the best network and the best prices. In reality, it’s too close to call. There’s no indisputable winner on network quality, and prices for unlimited plans by the big three all start at about $60 to $65 a month.

It’s not uncommon for each carrier to match the other’s free phone promotions and other perks.

“There’s kind of an industry collusion going on,” said Stephen Stokols, executive vice president of Dish Network Corp.’s retail wireless division, which is offering a low-priced $25 monthly mobile plan. “They are each getting their signals from the other.”

Turning Verizon around will be a challenge for Vestberg, who has never run a large consumer business.

That will involve more than just a new pricing or advertising strategy. Accelerating customer sign-ups requires getting back to what Verizon used to do well — improving the network, its reliability and the company’s message to consumers, Recon’s Entner said.

“It’s going to take strong leadership to break from what’s not been working,” Entner said. “Hans needs the courage to do that.”

(Updates stock price in seventh paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.