Chinese banks maintained their benchmark lending rates for a fourth month, with economists predicting a possible reduction to the mortgage reference rate in coming months to help the struggling property sector.

(Bloomberg) — Chinese banks maintained their benchmark lending rates for a fourth month, with economists predicting a possible reduction to the mortgage reference rate in coming months to help the struggling property sector.

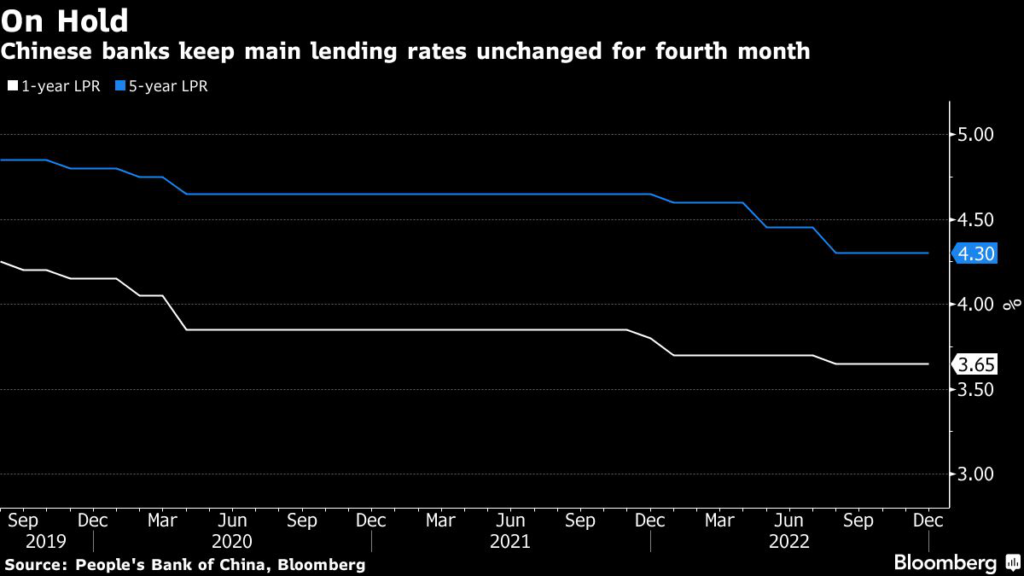

The one-year loan prime rate was left at 3.65%, the People’s Bank of China said Tuesday, in line with most forecasts in a Bloomberg poll of economists. The five-year rate, a reference for mortgages, was also kept unchanged at 4.3%.

Economists see an increasing possibility the five-year rate will be reduced in the next few months to stimulate housing demand after authorities hinted at further policy easing in the property market. The housing market is in its worst slump on record, with home prices falling for a 15th straight month in November.

A cut in the five-year rate “is still necessary,” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc.

The LPRs are based on the interest rates that 18 banks offer their best customers and are published by the PBOC monthly. They are quoted as a spread over the central bank’s rate on its one-year policy loans, known as the medium-term lending facility, which has been kept unchanged since August.

The PBOC has been injecting liquidity into the financial system in other ways. It reduced the reserve requirement ratio for banks this month, a move likely to bring down funding costs for banks, allowing them to lower loan rates in future.

What Bloomberg Economics Says…

We still expect banks to lower borrowing costs — the economy and especially the real estate sector — could use more monetary support. But it now looks like they will act in the first quarter of 2023. We expect the People’s Bank of China to lower its key one-year interest rate by 10 bps in 1Q23 — clearing the way for commercial banks to reduce their one-year and five-year LPRs.

David Qu, China economist

For the full report, click here.

The central bank is treading cautiously amid an uncertain economic outlook. Growth has slowed sharply in recent months and will likely remain under pressure after Covid restrictions were abruptly ended in December. However, economists expect a rebound next year and a possible pickup in inflation.

“Rising Covid cases means that cutting rates now has little impact for the real estate sector,” said Iris Pang, chief economist for Greater China at ING Groep NV, who forecasts a 15 basis-point cut to the five-year LPR in January. “There is no need to rush when part of the workers are sick.”

The average mortgage rate has already plunged to the lowest level since 2009 by the third quarter, PBOC data show, after three reductions in the five-year LPR this year and the lowering of the mortgage rate floor. But low confidence in the market, dimming job prospects and Covid curbs have offset the impact of the cheaper mortgages on buyers’ demand so far.

The PBOC has signaled it will keep monetary policy relatively loose next year. Deputy Governor Liu Guoqiang said over the weekend that monetary stimulus next year will at least match that of this year. Smaller rate hikes from the US Federal Reserve will also give the PBOC more room to maneuver as pressure on the yuan subsides.

Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd., also sees a chance for a lower five-year LPR, but forecasts the room for a reduction in the MLF rate is limited due to the pressure it would have on the yuan.

“Broadly speaking the PBOC will retain its easing bias to propel the weak economy amid the bumpy road to the post pandemic recovery,” said Cheung.

–With assistance from Qizi Sun and Chester Yung.

(Updates with additional details throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.