Japanese banks and insurers surged in Tokyo trading on prospects that their profitability will improve following the central bank’s surprise move to raise a cap on bond yields.

(Bloomberg) — Japanese banks and insurers surged in Tokyo trading on prospects that their profitability will improve following the central bank’s surprise move to raise a cap on bond yields.

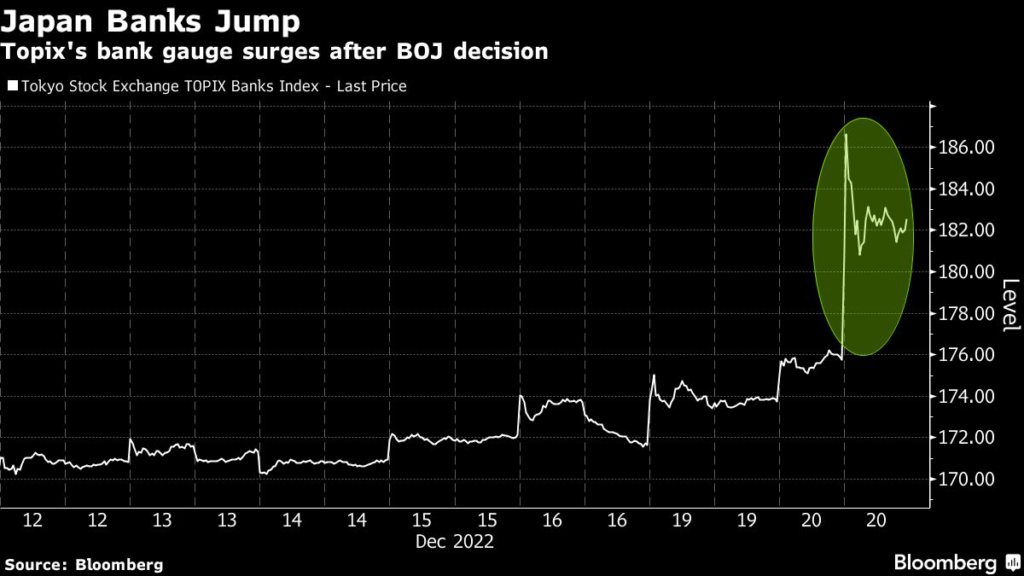

A Topix gauge of bank shares jumped 5.1%, the most since March 2020, on Tuesday after the Bank of Japan said it will allow 10-year yields to rise to around 0.5%, up from 0.25%. Mitsubishi UFJ Financial Group Inc., Japan’s largest bank, climbed 6%, also the biggest gain in more than two years. Insurance giant Dai-ichi Life Holdings Inc. advanced 9.4% to a record high.

The adjustment is a positive sign for financial firms that have seen their interest income crushed by years of rock-bottom rates as central bank Governor Haruhiko Kuroda sought to spark inflation in the world’s third-largest economy.

“Banks earn profits by lending money, and expectations that they can improve their profit margins have triggered the rise in stock prices,” said Tomoaki Kawasaki, a senior analyst at Iwai Cosmo Securities Co.

Kuroda said the measure will enhance the effectiveness of the BOJ’s yield curve control program and shouldn’t be interpreted as a rate hike. The central bank’s negative interest-rate policy — long maligned by banks — remains intact.

Still, analysts saw it as a positive sign that policy normalization is around the corner.

“The market is probably trying to price in what may be lying ahead, including changes in monetary policy,” said Hideyasu Ban, an analyst at Jefferies.

Raising the cap on long-term bond yields is unlikely to lift bank loan rates since they are mostly based on short-term benchmarks, according to Bloomberg Intelligence analyst Shin Tamura.

But the move should at least stop them from sliding, said Michael Makdad, an analyst at Morningstar Inc. in Tokyo.

“Loan rates in Japan have been declining since the global financial crisis,” Makdad said. “If the decline stops and stabilizes, already that’s a big change.”

The nation’s banks have room for valuations to rise further on a potential policy shift from the BOJ, dividend increases, more buybacks, and solid earnings, Toru Ibayashi, the head of Japanese equities research at UBS Group AG’s wealth management arm, wrote in a note last week.

For insurers, higher yields can boost investment returns and solvency ratios, said Bloomberg Intelligence analyst Steven Lam. “They’d be more willing to buy long-term bonds to reduce rate risks,” he wrote in a note.

–With assistance from Lisa Du, Takashi Nakamichi and Nao Sano.

(Updates with analyst comments in the fourth, seventh and eighth paragraphs)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.