Philippine Stock Exchange President Ramon Monzon said there were no fraudulent activities in the trading of PLDT Inc. shares before the company disclosed its 48-billion peso ($870 million) cost overrun. Shares of the Philippines’ largest phone company by revenue jumped as much as 5% Wednesday after a record plunge earlier this week.

(Bloomberg) — Philippine Stock Exchange President Ramon Monzon said there were no fraudulent activities in the trading of PLDT Inc. shares before the company disclosed its 48-billion peso ($870 million) cost overrun. Shares of the Philippines’ largest phone company by revenue jumped as much as 5% Wednesday after a record plunge earlier this week.

Citing the results of the exchange’s preliminary investigation, Monzon told ABS-CBN News that “we did not see any indication of any fraudulent trades prior to the disclosure.” The bourse found that a lot of the transactions were institutional, not personal trades, and mostly carried out by foreign brokers, he said.

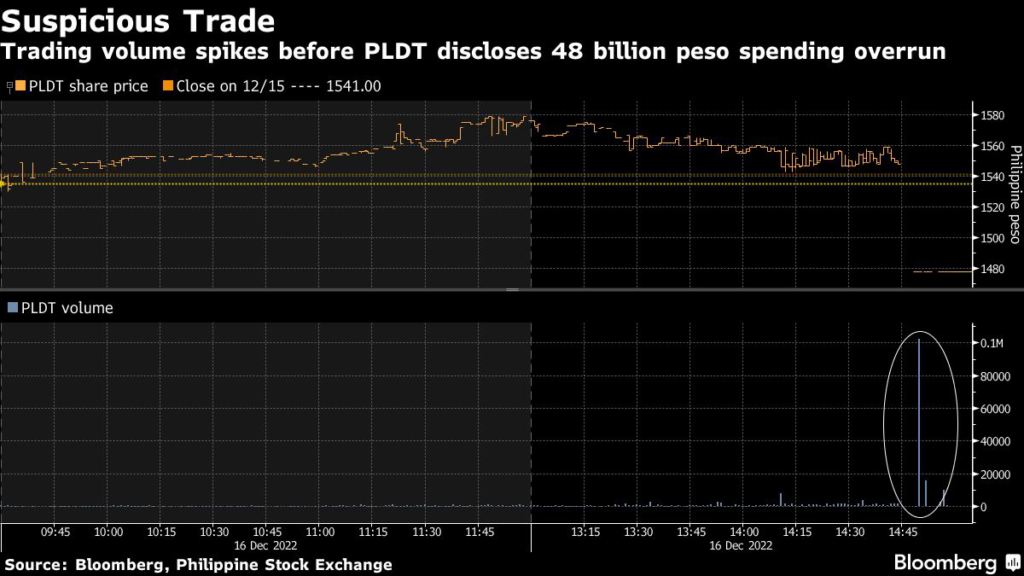

The exchange is looking at transactions in PLDT shares from late October up to Dec. 16, Monzon said in the report, the day the stock fell sharply just before the company announced the unaccounted spending over four years.

The Philippines’ Securities and Exchange Commission is doing a parallel investigation on the the trading and the unaccounted spending.

Volumes in PLDT shares spiked 10 minutes before stock trading ended on Friday, with more than 100,000 shares changing hands, according to exchange data compiled by Bloomberg. The Philippine units of Macquarie, JPMorgan, UBS AG and Credit Suisse facilitated the unloading of most of the shares during that period, the data showed.

PLDT shares have lost more than 16% since Dec. 16 when it made the disclosure, recovering some lost ground after sliding by a record 19% on Monday.

The stock’s selloff already prices in the budget overrun, and proceeds from tower sale “can partially offset its impact,” according to Morgan Stanley analysts Mark Goodridge and Yvonne To, who kept PLDT’s overweight rating.

PLDT is set to hold a briefing for investors and analysts later Wednesday where officials are likely to explain in detail what led to the unaccounted spending, how it will impact the company’s bottomline and ease concerns over its corporate governance and fiscal controls.

(Updates with share price, exchange data, investor briefing.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.