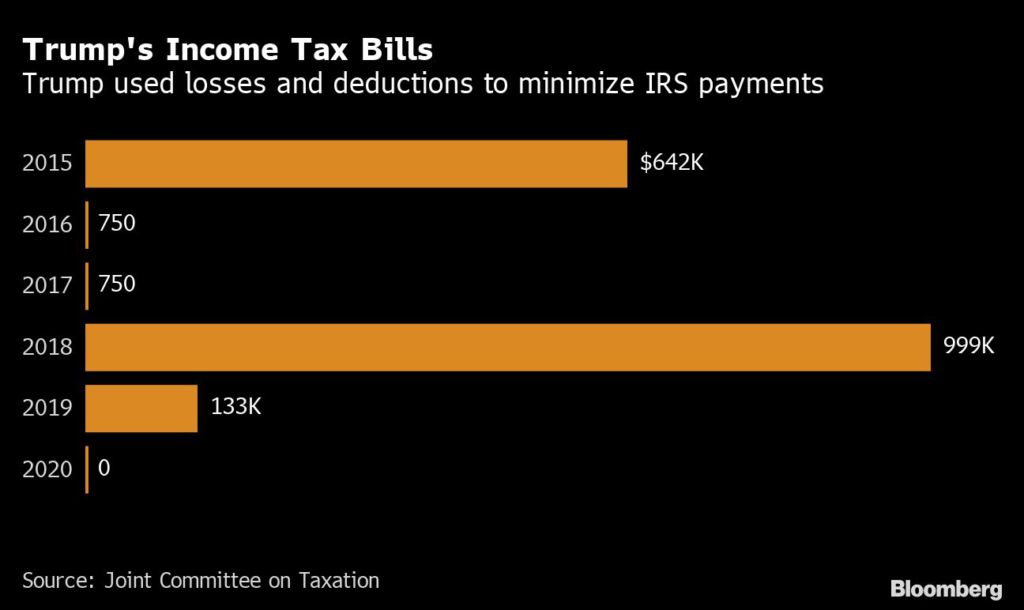

Former President Donald Trump’s personal and business financial losses have shielded him from paying much income tax since 2015, according to documents made public by the House Ways and Means Committee.

(Bloomberg) — Former President Donald Trump’s personal and business financial losses have shielded him from paying much income tax since 2015, according to documents made public by the House Ways and Means Committee.

The Democratic-controlled House panel voted on party lines to release six years’ worth of Trump’s personal and business tax forms late Tuesday. Those documents will be released in the coming days, but a summary report gives an initial look into the income, or lack thereof, he reported and the taxes he paid.

The documents raise questions about whether all the deductions and tax breaks claimed are legitimate, but the Internal Revenue Service hasn’t looked into the returns, because it didn’t conduct the mandatory presidential audits that are part of agency policy — a key finding of the House Ways and Means Committee.

Trump reported positive income in 2018 and 2019 and lost money the other years. His biggest negative year was in 2016, when he reported a loss of $32.4 million.

Federal income taxes are paid on earnings. Because Trump reported large losses instead of income for the years he was campaigning for president and in the White House, his personal tax liabilities were quite low. In 2018, the year Trump had the biggest tax bill — $999,466 — of the six covered by the report, he paid an effective tax rate of 4.1% on his income.

One of Trump’s businesses, DJT Holdings LLC, lost money every year from 2015 to 2020. In addition, the company generated big deductions, some of which have been flagged as being questionably large, creating even bigger losses. Some of those can be carried forward to the future to offset profits that may occur in the coming years.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.