China’s purchases of machines to make computer chips contracted in November to their lowest in more than two years, hammered by cratering electronics demand and new US export restrictions that are limiting the ability of Chinese firms to buy the most advanced equipment.

(Bloomberg) — China’s purchases of machines to make computer chips contracted in November to their lowest in more than two years, hammered by cratering electronics demand and new US export restrictions that are limiting the ability of Chinese firms to buy the most advanced equipment.

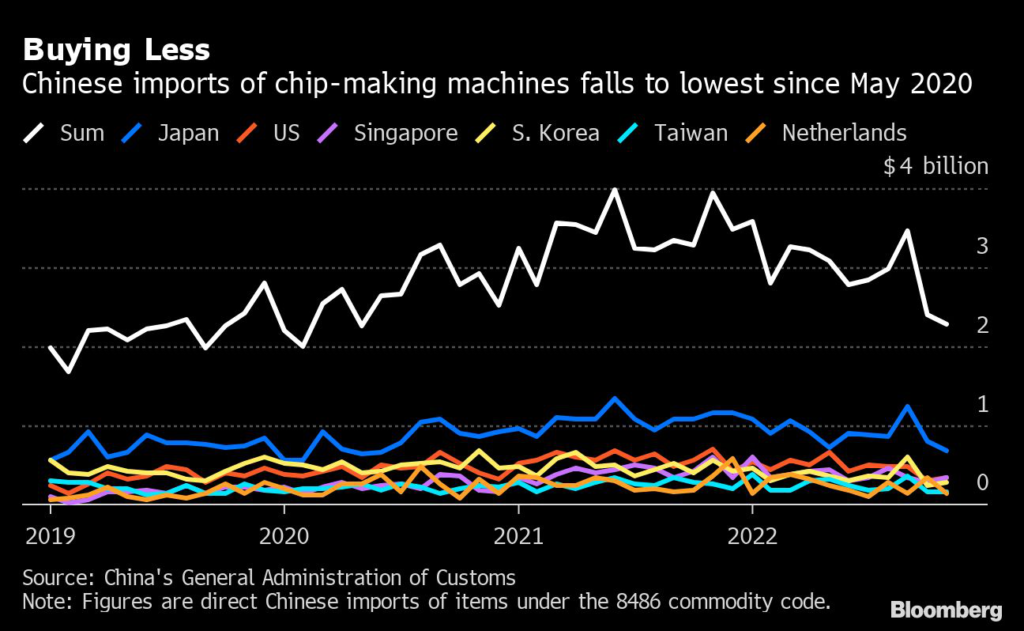

Chinese firms imported $2.3 billion worth of machines used in semiconductor manufacturing in November, down by more than 40% from a year earlier to the lowest level since May 2020, according to customs data released Wednesday.

Imports from the six major supplying nations including the US, Japan and the Netherlands all fell at a double digit pace in the month, even before some of those nations agreed to join the US in further limiting shipments of the most advanced gear to China.

Imports of computer chips also fell as makers of semiconductors for smartphone and PCs struggle with plummeting demand for their products less than a year after being unable to produce enough to meet orders.

The US sanctions announced in October have caused major foreign firms to limit or cease the supply to Chinese companies of equipment to make the most advanced chips, although machines used to make older and slower chips can still be shipped.

The US is negotiating with the Dutch and Japanese governments to convince them to join its unilateral sanctions, with people with knowledge of those talks telling Bloomberg that they are likely to adopt at least some of the sweeping measures of the US.

The three-country alliance would represent a near-total blockade of China’s ability to buy the equipment necessary to make leading-edge chips.

The US rules restricted the supply from American suppliers Applied Materials Inc., Lam Research Corp. and KLA Corp. Japan’s Tokyo Electron Ltd. and Dutch lithography specialist ASML Holding NV are the two other critical suppliers that the US needs to make the sanctions effective, so if their governments’ adopt the curbs too it would be a significant victory in the US attempt to cripple the development of China’s semiconductor industry.

China has filed a complaint with the World Trade Organization to try and overturn the export controls, although any decision on that will likely take years to be decided.

The trade data also showed that China’s purchases of computer chips were down by around 26% in November for a 2% decline in the first 11 months of the year.

Chinese demand for chips has been weak this year due to supply chain disruptions, a slowing domestic economy and falling demand globally for products such as smartphones. Micron Technology Inc., the largest US maker of memory chips, warned the worst industry glut in more than a decade will make it difficult to return to profitability in 2023.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.