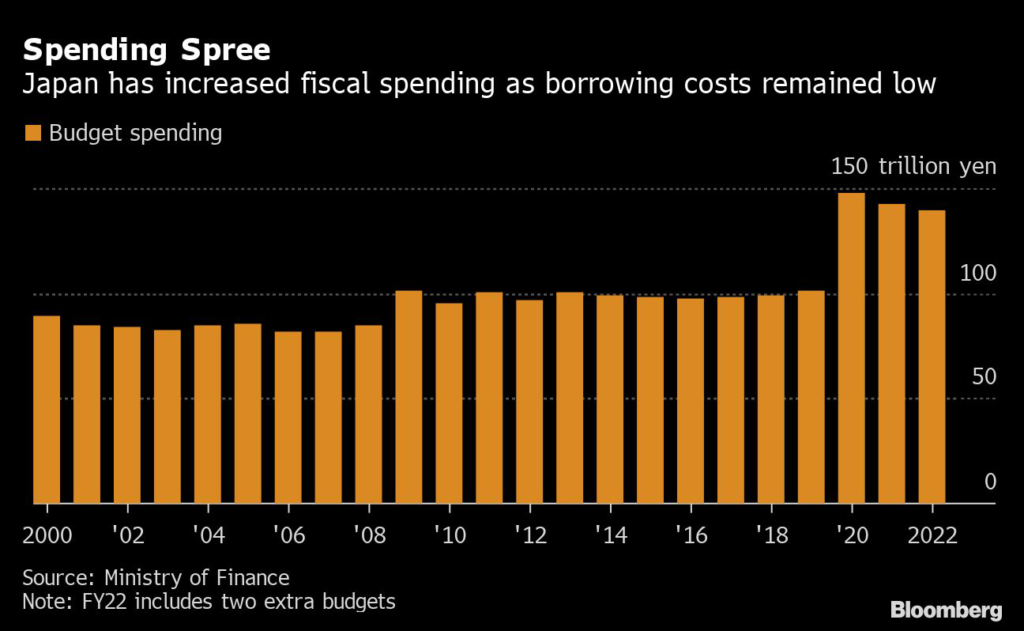

Japan will again resort to bond issuance to help fund another year of record spending, with the Bank of Japan’s surprise policy move this week set to put pressure on borrowing costs going forward.

(Bloomberg) — Japan will again resort to bond issuance to help fund another year of record spending, with the Bank of Japan’s surprise policy move this week set to put pressure on borrowing costs going forward.

The government will look to issue bonds worth more than 35.6 trillion yen ($270 billion) to finance an initial budget of more than 114.4 trillion yen for the year starting in April, according to a draft document obtained by Bloomberg.

The spending plan is expected to be approved by Prime Minister Fumio Kishida’s cabinet on Friday. The proposed budget comes at a critical time for Kishida as he grapples with a planned historic boost to defense spending amid falling approval ratings.

Kishida needs to fund it either with unpopular tax increases or fall back on the usual solution of adding to Japan’s massive debt pile, an option that is set to become more expensive as the central bank paves the way for policy normalization.

At risk is the idea that Japan can keep borrowing at ultra-low cost to fund ever increasing budgets to support an aging population. This week the BOJ jolted global markets with policy tweaks that left investors believing the world’s last anchor of low rates is now shifting toward raising borrowing costs.

“The BOJ has said this is not a rate hike, but the market is increasingly seeing it’s moving toward normalization,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. “I think it’s about time the government paid attention to the possibility that debt-servicing costs are likely to keep climbing.”

In a shock to the financial market, the BOJ on Tuesday doubled the upper limit of the 10-year sovereign debt yield to about 0.5%. The yield has been increasing since then and swap traders are seeing it go beyond the new upper limit.

Higher borrowing costs would make it harder for Kishida to boost spending by issuing more debt cheaply, which was a common tactic employed by former Prime Minister Shinzo Abe.

The doubling of the 10-year yield cap suggests the government may also have to increase the coupon it offers on fresh issuance of long-term debt. Existing debt that gets reissued will need to be more heavily discounted.

What Bloomberg Economics Says…

“A quick back-of-an-envelope calculation suggests an additional cost of around 550 billion yen for the government’s bond issuance next year based on the assumption that the BOJ’s shock decision added 20 basis points across the yield curve.”

— Yuki Masujima, economist

So far the assumed long-term interest rate for Japan’s budget, which is used to calculate interest payments for bonds over a range of maturities, is around 1.1%.

For decades Japan has leaned heavily on the bond market to finance its ever expanding spending. Under Abe’s hand-picked governor Haruhiko Kuroda, the central bank’s bond holdings have grown substantially, but the BOJ’s cap on yields has enabled the government to keep a lid on debt payment costs.

The borrow-cheaply-for-growth approach has pushed Japan’s public debt-to-gross domestic product ratio to more than 260%, the highest among major economies. Debt-servicing costs made up around a quarter of the initial budget this year as well.

Those costs will start to fluctuate much more if the BOJ further widens the movement range around its yield target, raises the target or scraps it altogether under a new governor. Kuroda is due to step down in April.

If the 10-year debt yield rose by 1% from the current assumed rate of 1.1%, debt-servicing costs would climb to 27 trillion yen in fiscal 2023, from the current 24.3 trillion yen, according to the finance ministry’s calculations.

“We are reaching the limits of having the BOJ buy and buy. It’s becoming obvious that we are reaching the point where revisions need to be made,” said Koji Nakakita, professor of social sciences at Hitotsubashi University.

The central bank’s latest move will likely throw some doubt on the views of Abenomics supporters in the LDP, he added. “Their idea that a lot of things can be paid for with bond issuance will become less persuasive. That includes defense spending. It finally feels like the end of the Abe era.”

It remains to be seen how the recent BOJ action will change the view of credit rating agencies including Moody’s and Standard & Poor’s. Both have recently named the BOJ a vital factor for deciding Japan’s creditworthiness.

The country has seen a deterioration of its ratings over the decades, and any downgrade could also raise borrowing costs for Japanese institutions overseas.

The government’s outlays are projected to increase and outweigh a record 69.4 trillion yen of tax revenue, according to the document. That’s partly because Kishida has pushed through a historic boost in defense spending to stave off threats from neighboring China, North Korea and Russia. Some 6.8 trillion yen will be earmarked for defense spending in the fiscal 2023 budget, the document said.

Kishida is trying to fund part of that increase with tax hikes while limiting further bond issuance. Though that looks like a more sustainable approach, it risks further lowering his already dismal popularity levels.

“Regardless of his approval rating, Kishida can’t continue to expand spending,” Hideo Kumano, executive economist at Dai-Ichi Life Research Institute said. “To strengthen his foundation for a long-term administration, Kishida needs to improve fiscal health.”

–With assistance from Toru Fujioka, Masaki Kondo, Emi Urabe and Takashi Hirokawa.

(Updates with figures from document obtained by Bloomberg and economist comment)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.