Turkey’s central bank is poised to move past its cycle of interest-rate cuts at the final meeting of a year when inflation reached near a quarter-century high.

(Bloomberg) —

Turkey’s central bank is poised to move past its cycle of interest-rate cuts at the final meeting of a year when inflation reached near a quarter-century high.

Policymakers last month spelled out plans to halt monetary easing after bringing their benchmark into single digits as demanded by President Recep Tayyip Erdogan. Standard Chartered Plc is the lone dissenter still expecting a 100 basis-point decrease on Thursday, with all other economists surveyed by Bloomberg seeing no change from 9%.

Governor Sahap Kavcioglu has defied economic convention in a year that saw the most aggressive global monetary tightening in decades. Four rounds of rate cuts in Turkey took the key rate down 500 basis points during a period when inflation topped 80%.

Lacking a buffer against market selloffs, Turkey has instead relied on fringe measures and currency interventions — which Bloomberg Economics estimates at $98 billion this year through October — to support the lira.

The central bank can probably maintain low policy rates in single digits until elections six months away, according to Barclays Plc economist Ercan Erguzel. Turkey has enough foreign-exchange liquidity to cover its financing gap during the period, he said in a report.

What Bloomberg Economics Says…

“The central bank’s current accommodative stance will weaken the lira and further pressure price gains. It will try to contain this negative feedback by relying on non-interest rate tools that have so far guided the financial sector toward lira-based assets and liabilities, favoring lending to exporters. We also expect the central bank to continue with its currency market interventions.”

— Selva Bahar Baziki, economist. Click here to read more.

Kavcioglu braved galloping inflation in the belief that lower rates have the power to curb consumer prices, a view so far not borne out by the evidence in Turkey.

The unorthodox approach has been a hallmark of Erdogan’s tenure as he increasingly tightened his grip over monetary policy in recent years. Three previous governors who didn’t toe the line ended up being removed by the president.

The outlook for prices has grown slightly less dire. Inflation slowed in November for the first time in over a year and a half, thanks in large part to the statistical effect of a high base in 2021.

The central bank expects inflation will end this year at about 65% — 13 times higher than its official target. Erdogan believes it will “tumble down” and reach around 40% next year.

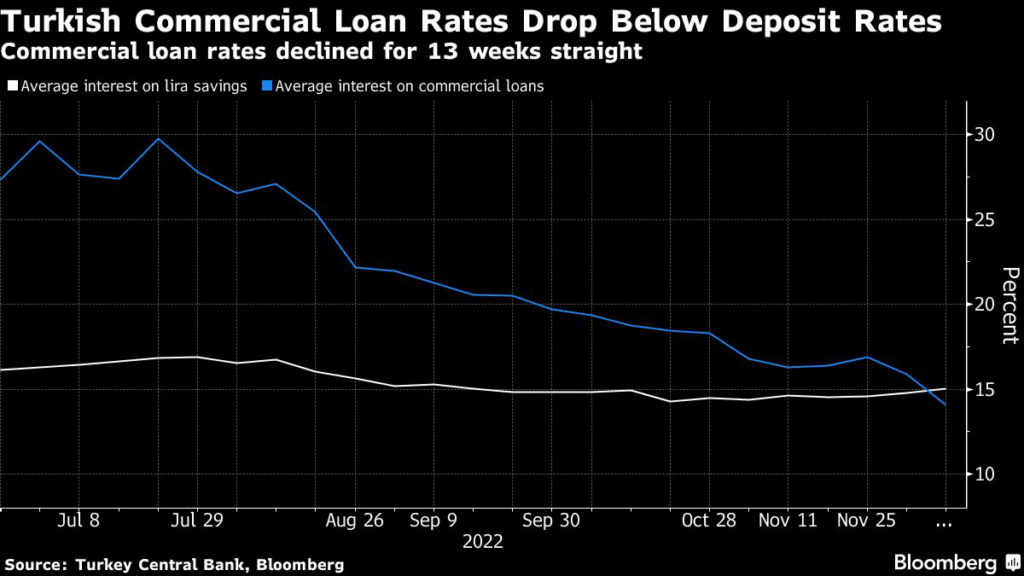

In relying on indirect regulations focused on lending and the use of foreign currency, the central bank has meanwhile contributed to distortions that brought the cost of commercial credit below rates offered for deposits.

Topping the agenda for the president ahead of elections is the need to kick the economy into higher gear after signs of a slowdown. To that end, this week he announced an $11 billion package of cheap loans backed by the government and targeting small and medium-sized enterprises.

Eager to cushion households from soaring living costs, Erdogan has also offered aid programs, affordable housing projects and subsidized utility bills. On Thursday, he plans to announce an increase in the minimum wage for next year.

But Erdogan is largely pinning the success of his campaign on low interest rates.

“We want investors to make investments,” Erdogan told his ruling party deputies in a speech on Wednesday. “Here you go 9%; now invest.”

–With assistance from Harumi Ichikura.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.