One of the world’s biggest managers of top-ranked ESG funds as defined under European rules is stripping the classification from roughly $14 billion of client savings.

(Bloomberg) — One of the world’s biggest managers of top-ranked ESG funds as defined under European rules is stripping the classification from roughly $14 billion of client savings.

The investment arm of Banque Pictet & Cie SA will remove the EU’s so-called Article 9 designation from four thematic equity funds, it said in an email on Friday. Instead, they’ll be registered under the less stringent environmental, social and governance (ESG) designation of Article 8, it said.

The four funds will “continue to promote environmental and social characteristics,” Pictet Asset Management said.

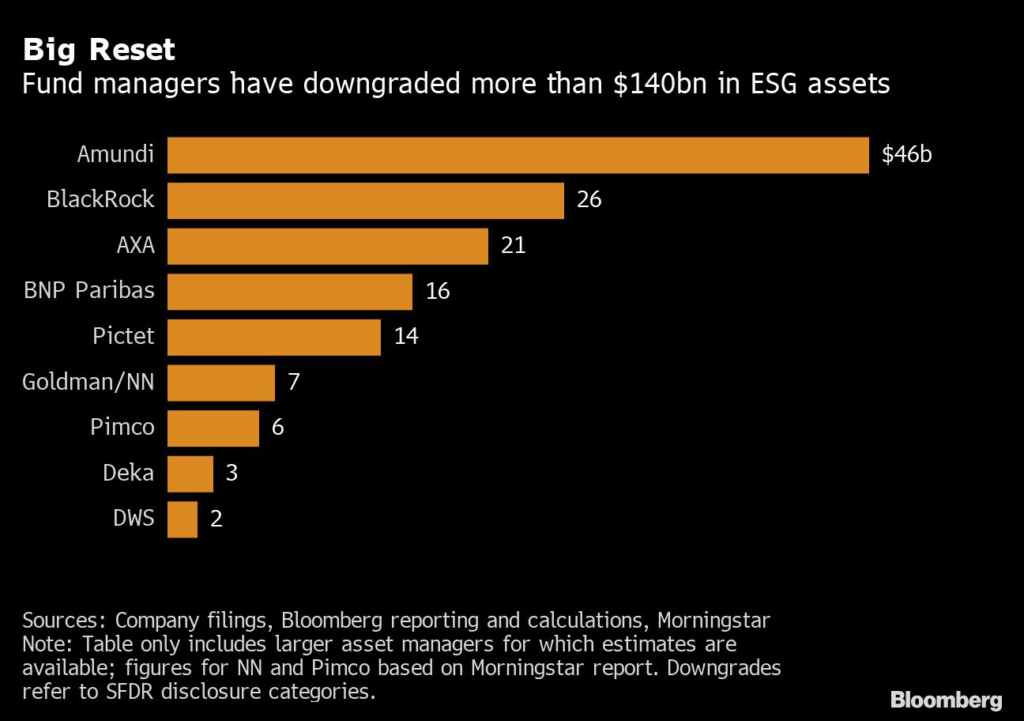

The decision brings to more than $140 billion the total amount in client assets to have been hit by a wave of downgrades that’s currently reshaping Europe’s ESG market. The upheaval, which follows stricter EU regulatory guidance, has angered investment clients, left fund managers venting their frustration publicly, and drawn criticism from national financial watchdogs.

Other asset managers to have been wrong-footed by the tougher EU guidelines include BlackRock Inc., which has downgraded $26 billion from Article 9, and Amundi SA, which stripped the tag from almost all the $46 billion it had registered in such products. Pictet’s investment clients were informed of its changes earlier in the day, with the new classification set to take effect from Jan. 1.

Since the Sustainable Finance Disclosure Regulation was enforced in March 2021, the EU Commission has clarified that Article 9 funds must be reserved for 100% sustainable investments, save for hedging and liquidity needs. It’s a requirement that many asset managers only started acting on in earnest in the latter part of this year, as they face a Jan. 1 deadline to provide quantitative proof of their ESG claims to meet so-called Regulatory Technical Standards.

The interpretation of SFDR “has evolved” over the past year, said Pictet, which had overseen €40 billion ($42.5 billion) worth of Article 9 products as of end-October, making it one of the very biggest in the market, according to Morningstar Inc. data.

“This is a nascent and important regulation and its evolution is natural as financial market participants and regulatory agencies find the right balance between classifications,” Pictet said.

But investment clients are starting to demand more transparency around the huge wave of reclassifications, amid concerns that some may reflect potential greenwashing risks.

“As it stands, the process of informing investors of changes is limited to companies posting a very basic explanation or motivation as to why they’re downgrading their funds, for example by pointing to the regulatory changes and requirements,” said Arnaud Houdmont, chief communications officer at Better Finance, Europe’s main organization representing the rights of retail investors. “But investors are rarely informed of key differences between such funds and need further clarity.”

Funds downgraded from Article 9 have instead become Article 8, which is a considerably bigger product category, covering roughly $4 trillion in client assets, according to data compiled by Bloomberg. The question now is how asset managers will treat that fund class in 2023.

Europe’s markets watchdog, ESMA, has proposed minimum thresholds that Morningstar estimates would mean only 18% of Article 8 funds could continue to call themselves sustainable. That has retail investors wondering what they’re left with, as funds that once carried the EU’s highest ESG tag suddenly get lumped in with a category whose ESG status is questionable.

The EU, which has signaled it will spend 2023 trying to stamp out greenwashing, has also acknowledged that SFDR may be in need of an overhaul, given the confusion gripping the industry. As a result, asset managers are still waiting for further clarification.

“Given the latest guidance from the regulatory agencies, we have decided proactively to reclassify the above four strategies,” Pictet said. It’s an adaptation that seems “prudent at this time.”

(Updates table with funds affected to show Pictet has confirmed the figures)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.