US inflation continued to ease into the end of 2022 and expectations of future increases dropped, reinforcing hopes that the worst bout of price pressures in a generation has finally passed.

(Bloomberg) — US inflation continued to ease into the end of 2022 and expectations of future increases dropped, reinforcing hopes that the worst bout of price pressures in a generation has finally passed.

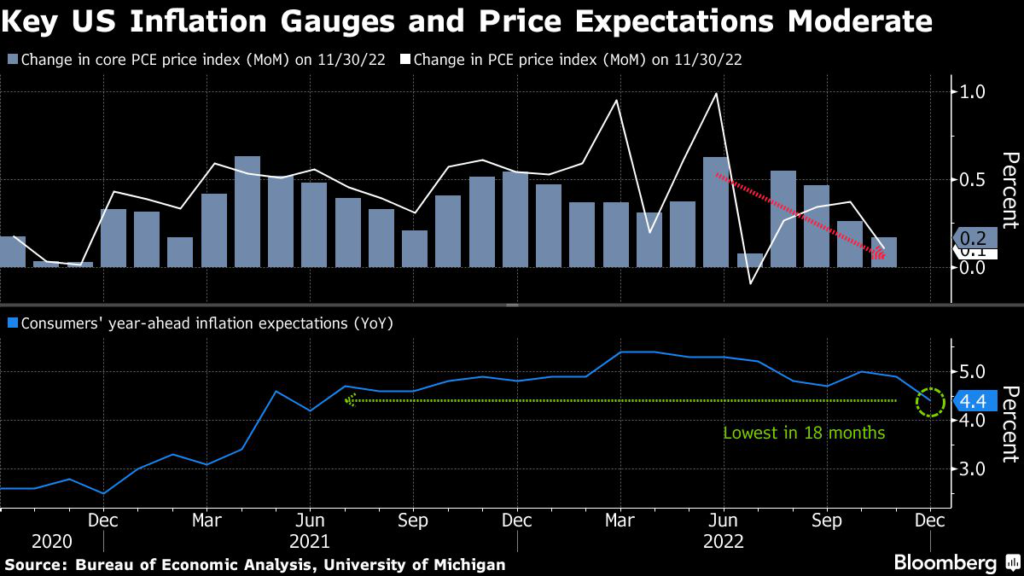

The Federal Reserve’s preferred inflation gauges cooled in November, including a headline annual measure that registered the smallest increase in over a year, according to Commerce Department data released Friday. Consumers’ year-ahead inflation expectations dropped this month to the lowest since June 2021, a survey by the University of Michigan showed.

However, wages are still climbing much too fast for the Fed’s liking. While the central bank is getting closer to the end of its interest-rate hiking cycle, the data suggest that borrowing costs will stay high for an extended period until policymakers are more confident that price pressures are on a sustained downward trend.

Inflation-adjusted consumer spending flat-lined in November, but officials will want to see more than a month of data to indicate demand is substantially cooling.

“All in all the data releases painted a picture of a slowing economy heading into the end of the year, which should help support a continued deceleration in inflation as we head into 2023,” Sam Millette, fixed income strategist for Commonwealth Financial Network, said in a note.

After reaching 40-year highs earlier in the year, price pressures are finally ebbing. The personal consumption expenditures price index excluding food and energy, which Fed Chair Jerome Powell has stressed is a more accurate measure of where inflation is heading, was up 4.7% in November, down from 5% in the prior month.

The overall PCE price index increased 0.1% and was up 5.5% from a year ago, the lowest since October 2021 but still well above the central bank’s 2% goal.

Even though that should come as welcome news to Powell and his colleagues, wage gains — particularly in the service sector — have remained stubbornly robust. Inflation-adjusted disposable income rose 0.3%. Wages and salaries, unadjusted for prices, were up 0.5% for a second month, the Commerce data showed.

While that’s been a boon for American workers, officials see it as potentially worrisome for the trajectory of price increases. Powell has zeroed in on compensation as a guide in the central bank’s inflation fight, which may support why the Fed sees borrowing costs staying higher for longer than investors do.

“Incoming data continue to present an economy that has not sufficiently cooled to bring down too-high inflation,” Citigroup Inc. economists Andrew Hollenhorst and Veronica Clark said in a note. “While goods price pressure has softened along with demand, we see no similar dynamic in services.”

What Bloomberg Economics Says…

“November’s deceleration in the Fed’s preferred price measure, the PCE deflator, adds to evidence of near-term downward momentum for inflation… Nonetheless, robust wage income and real income suggest the labor market has yet to cool meaningfully, and officials are unlikely to view this report as convincing enough to cause them to back off from a terminal rate fed funds rate above 5%.”

—Anna Wong and Eliza Winger, economists

To read the full note, click here

Other parts of the economy show a more notable impact from the Fed’s most intense tightening cycle since the early 1980s, separate government data out Friday showed. Orders placed with US manufacturers for non-defense capital goods excluding aircraft rose 0.2% in November after a sharp downward revision to the prior month, and total bookings for durable goods sank 2.1%, the most since April 2020.

The housing market, which is particularly sensitive to changes in interest rates, may be stabilizing as mortgage rates retreat from a two-decade high. Sales of new homes unexpectedly rose in November for a second month, though the data are extremely volatile.

“I suspect that builders are much more motivated sellers (especially given the surge in financing costs) than current homeowners, who do not want to part with their 3% or lower mortgages,” Stephen Stanley, chief economist at Amherst Pierpont Securities LLC, said in a note. “This may explain why new home sales are rising while existing home sales plunge.”

Read more: US Existing-Home Sales Weaken Further, Extending Record Retreat

Consumers are growing more optimistic about the path of price pressures, with short- and long-term inflation expectations dropping this month, the University of Michigan data showed. That reflected easing price pressures and relief at the gas pump, which boosted sentiment, but the data reflect a high degree of uncertainty.

“While sentiment appears to have turned a corner from its all-time low from June, its trajectory, as well as that of consumer spending, will be contingent on strength in labor markets and incomes,” Joanne Hsu, director of the survey, said in a statement.

–With assistance from Reade Pickert.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.