European natural gas posted its biggest weekly decline since September, driven lower by mild weather which is expected to remain over most of the region during the holiday season.

(Bloomberg) — European natural gas posted its biggest weekly decline since September, driven lower by mild weather which is expected to remain over most of the region during the holiday season.

Benchmark futures closed 9.8% lower on Friday, losing 28% for the week. Temperatures are forecast above-average through early January in many parts of Europe, easing pressure on energy systems. Plentiful supplies of liquefied natural gas, fuller-than-normal inventories and a typical year-end slowdown in industrial demand are also helping push prices down.

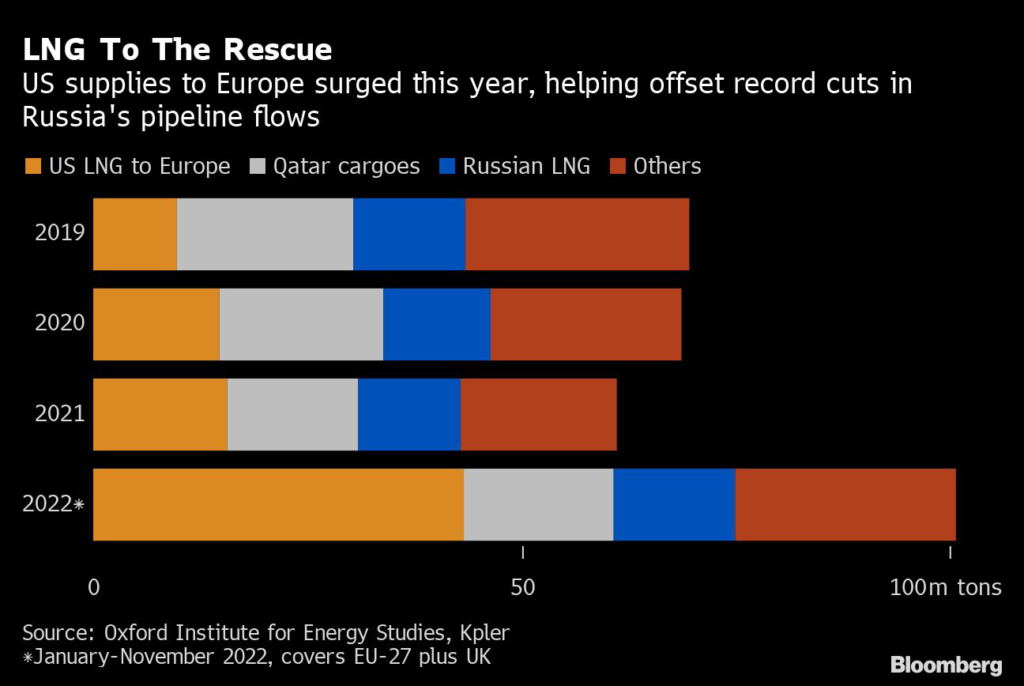

Even near-term risks to shipments from the US, Europe’s top provider of LNG, haven’t changed the dynamics before traders left for the long weekend. That includes a once-in-a decade winter storm, threatening to temporarily disrupt fuel exports from the Gulf Coast, as well as another delay to restart of the Freeport LNG plant damaged by a fire this summer.

Europe’s “bearish weather keeps offsetting other factors,” analysts at trading firm Energi Danmark A/S said in a note.

Freeport LNG said Friday its initial restart isn’t expected until the second half of January due to regulatory delays. The Texas plant had previously targeted December, with full operations resuming in March.

Dutch front-month gas, the continent’s benchmark, closed at €82.98 a megawatt-hour, the lowest level since June 10. The UK equivalent fell 12%, also finishing this week with the biggest decline since early September.

Strong winds in parts of Europe are also helping reduce gas demand. Wind power generation in Britain is forecast at near-record levels early next week, and again at the start of January.

Read also: UK Power Prices Drop as Mild, Windy Weather Seen Over Christmas

Still, traders are closely watching Europe’s price difference with Asia, as spot LNG cargoes could end up there if it becomes more profitable. Separately, there are risks that Russia may cut the little gas it’s still sending by pipelines to Europe after severe curbs earlier this year, which had pushed energy prices to records, hammered economies and drove inflation to the highest in decades.

If a price cap, planned by the European Union, violates deals between Gazprom PJSC and its counterparties, Russia “reserves the right to think about whether we’re obliged to honor these contracts,” President Vladimir Putin said Thursday.

“A sustained influx of LNG and higher Norwegian flows — set to backfill 80% of 2022 Russian gas cuts — and a 15% price-driven demand-destruction scenario look sufficient to navigate a mild winter,” analysts at Bloomberg Intelligence said in a note. “Yet a cold snap, coupled with the full halt of Gazprom’s remaining two pipelines into Europe, could stoke price volatility and deplete storage by the end of winter, likely extending this crisis into another.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.