China’s removal of the last of its Covid curbs will likely bring more disruption to the economy through the first quarter as infections surge, while increasing the possibility of a faster and stronger rebound in growth next year, economists said.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

China’s removal of the last of its Covid curbs will likely bring more disruption to the economy through the first quarter as infections surge, while increasing the possibility of a faster and stronger rebound in growth next year, economists said.

The government’s easing of restrictions — including an announcement this week to scrap quarantine requirements for inbound travelers from Jan. 8 — has been more sudden and aggressive than most businesses and analysts had expected.

While that’s injected more uncertainty into an already fragile growth outlook in coming months, economists say the faster reopening shortens the duration of economic shocks. Losses are also likely to be concentrated in the months surrounding the Lunar New Year holiday, a period when production usually slows down.

“The government’s approach appears to be to pass the high wave of infections as fast as possible,” Yu Xiangrong, chief China economist of Citigroup Inc., wrote in a note Tuesday. “The quick policy shift is to pave the way to a fuller economic recovery.”

The impact of the Covid disruptions on annual growth next year “could be smaller” than previously estimated, he said.

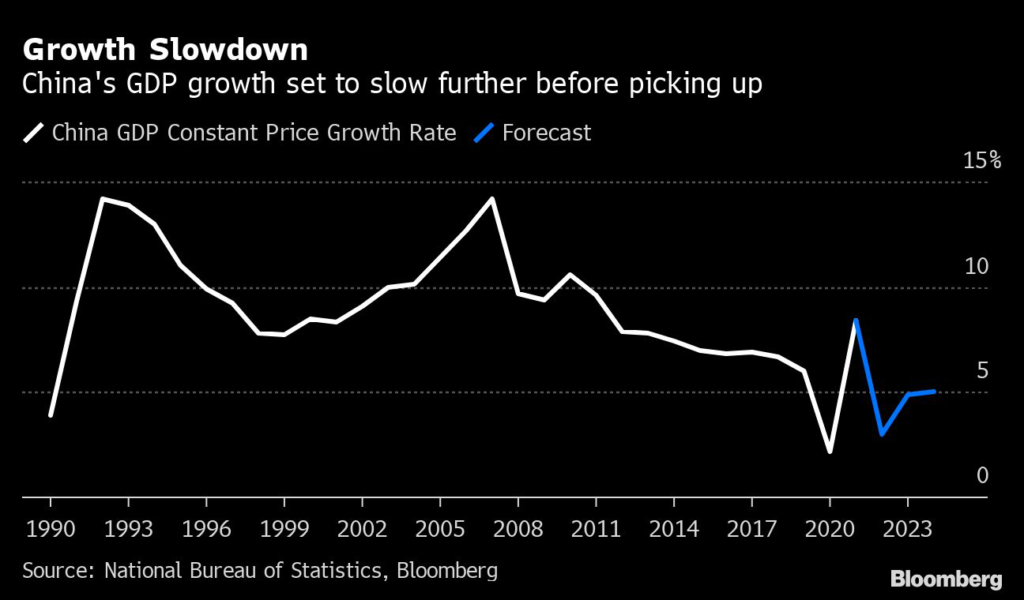

Analysts have already been downgrading their forecasts for China’s growth this year and raising projections for 2023 since the government abruptly put an end to the Covid Zero policy a few weeks ago. The median estimate in a Bloomberg survey of economists is for growth to weaken to 3% in 2022 and rebound to 4.9% next year.

What Bloomberg Economics Says…

We see increased upside risks to 2023 GDP: The quicker reopening could push full-year growth as high as 6.3%, well above our base case of 5.1%.

China’s reopening will be a mixed blessing for the global economy. A revival in Chinese tourism could boost business in service sectors around the world. Smoother business travel in and out of China may help ease supply-chain strains. But faster growth will spell stronger demand for commodities — pushing against an anticipated slowdown in global inflation.

Eric Zhu and David Qu

For the full report, click here

Foreign businesses are proceeding cautiously on any investment and staffing plans for now, given confidence levels remain still very weak.

“Many companies saw their people go through extreme duress throughout the Covid Zero era, which will lead to a ‘wait and see’ approach for many,” said Noah Fraser, managing director of the Canada China Business Council. “Qualified global talent has grown less and less eager to move to China, and the damage done to trust and reputation over the last three years is going to take time to rebuild.”

Joerg Wuttke, president of the European Union Chamber of Commerce in China, said companies are not in a rush to increase their stake in China, even though the government’s move will “potentially” boost business confidence.

“With China currently undergoing a paradigm shift in its approach to the Covid-19 pandemic, businesses will likely continue to wait to see how the situation on the ground evolves over the coming weeks, before making any long-term decisions on their China investments,” he said.

The recent scrapping of Covid curbs could see analysts revising forecasts again. Gary Ng, a senior economist at Natixis SA, said he’s cutting his projection for growth in the two quarters through the end of March to 3% from 3.5% but expects a “strong” cyclical rebound from April onwards.

“The policy shift will be a short-term pain but a long-term gain for the Chinese economy,” he said. “The initial turbulence will mean disruption in production and vanished consumption, causing a bumpy and steeper ride in the growth trajectory.”

Citi’s Yu expects people mobility and consumer services to recover sooner and faster than expected as the new year starts, noting that traffic in cities that have weathered the initial Covid shocks is picking up. He predicts retail sales will jump about 11% next year to around 50 trillion yuan ($7.2 trillion).

Looming over next year’s outlook is a potential global recession, which would curb export growth in China.

“The tricky part is that even though the Chinese government is working hard to open the domestic economy with an easing of Covid measures or even eliminating most of them, the timing is not perfect,” Iris Pang, chief economist for Greater China at ING Groep NV, wrote in a note Wednesday. “Export-related activities, including manufacturing, should slow, which would derail the recovery of the Chinese economy.”

Niu Li, an economist with the State Information Center, a think tank affiliated with the government’s economic planning agency, estimated growth in the value of exports will slow to 3% next year from 9.1% in the first 11 months of this year. Gross domestic product will likely increase 5.2% next year and inflation will remain around the same level as this year’s, he said at a briefing Wednesday.

–With assistance from Lin Zhu and Kathy Chen.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.