Chinese residents saw their confidence in the job market and their incomes plunge to new lows, while interest in buying homes also fell as the economic slowdown worsened this year.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Chinese residents saw their confidence in the job market and their incomes plunge to new lows, while interest in buying homes also fell as the economic slowdown worsened this year.

The People’s Bank of China’s Employment Sentiment Index — which is based on a survey of households’ outlook for jobs — declined to 33.1 in the last three months of 2022, worse than the prior quarter’s record low dating back to when data began in 2010.

Figures below 50 represent a contraction in the sector.

The Income Confidence Index — a gauge measuring expectations for income in the next three months — slid to 44.4, another record low dating back to 2001, according to the central bank’s report, which was published Tuesday.

The report’s findings are based on a central bank survey of 20,000 depositors across the country, taken every quarter.

The survey underscored how much damage Chinese households suffered this year as the economy faltered with the property slump, along with Covid outbreaks and controls.

The October-to-December survey added to already-grim data from the third quarter, which also measured weak prospects for jobs and the housing markets.

The government has in recent weeks rapidly pivoted away from its Covid Zero strategy, with quarantine for inbound travelers — the last major curb remaining — set to be scrapped in the next couple of weeks.

But while economic activity is expected to eventually rebound, it’s unclear how quick that will happen given the spread of infections and the weakness in confidence.

Unlike advanced economies such as the US, China has refrained from handing out subsidies directly to residents during the pandemic.

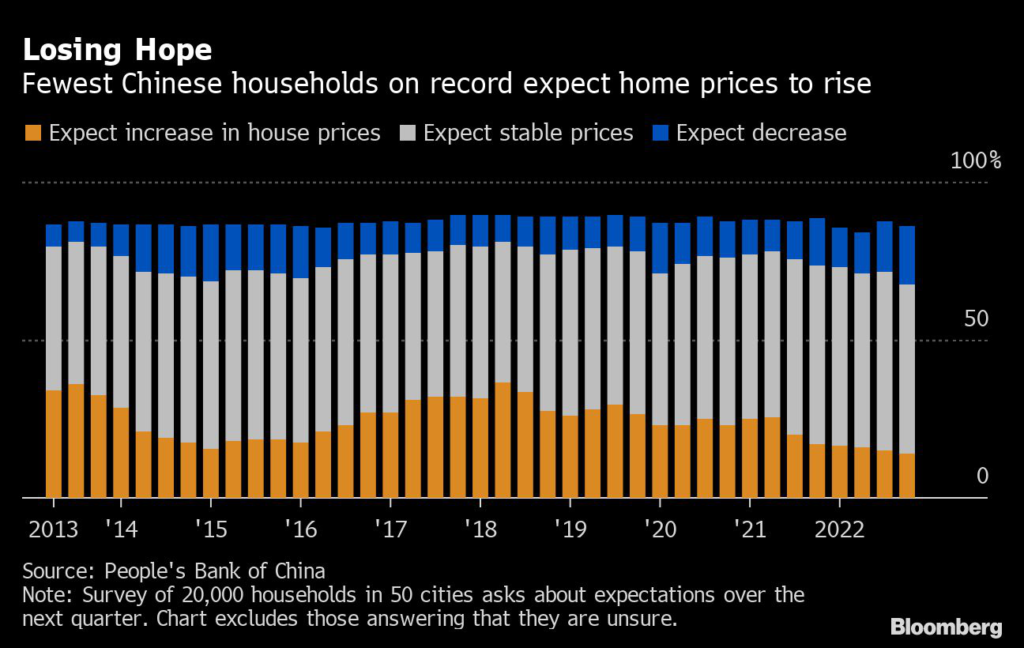

Housing market confidence also continued to deteriorate in the fourth quarter, even as the government stepped up efforts to rescue the sector.

Only 14% of respondents to the central bank survey expected home prices to rise next quarter — another fresh low in data going back to 2010.

Some 18.5% expected home prices to fall, the highest proportion since 2012.

Only 16% of respondents said they planned to buy a home in the next three months, down from 17.1% in the previous quarter.

Nearly 62% said they were saving more, up from 58%, according to the survey.

Another central bank survey showed business conditions and export orders among industrial companies in the final three months of the year deteriorated to the worst level since the second quarter of 2020.

Domestic orders, meanwhile, weakened from the previous quarter, based on indexes compiled from the survey of more than 5,000 firms.

Overall loan demand in the economy improved slightly, with a corresponding sub-index rising to 59.5 in the last three months from 59 in the previous quarter, according to a PBOC survey of 3,200 bank representatives.

That index still remains far below the levels of close to or above 70 seen through most of the last two years.

–With assistance from Fran Wang.

(Updates with additional details in last two paragraphs.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.