The Bank of Japan’s shock move to double its yield cap was aimed at keeping stimulus on tap, not at changing the trajectory of policy, according to a summary of opinions from the December meeting that contributed to a weakening of the yen Wednesday.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Bank of Japan’s shock move to double its yield cap was aimed at keeping stimulus on tap, not at changing the trajectory of policy, according to a summary of opinions from the December meeting that contributed to a weakening of the yen Wednesday.

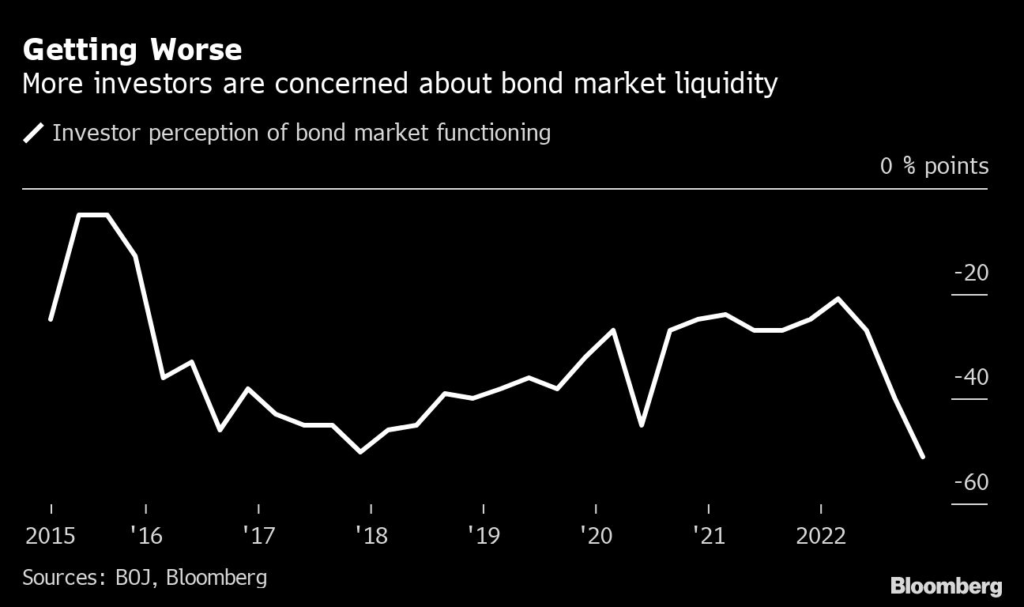

Board members expressed concern over a deterioration in the functioning of the Japanese government bond market, with the number of comments focusing on the issue increasing sharply from the previous meeting in October.

At the December gathering, the BOJ blindsided economists and investors by widening the range of movement of benchmark 10-year yields to 0.5 percentage point either side of its target.

“The expansion of the range of 10-year JGB yield fluctuations from the target level is not intended to change the direction of monetary easing,” said one member. The measure was instead meant to make the current monetary easing more sustainable by helping improving bond market functioning, the member added.

One board member also ruled out the need to review the BOJ’s 2% price target, a theme of strong speculation before the meeting.

The yen weakened as much as 0.7% against the dollar after the release of the summary, with the central bank’s relatively dovish message reinforced by another volley of unscheduled fixed-rate bond-buying operations as global debt markets weakened. The currency later erased losses against the greenback, trading at around 133.52 per dollar as of 1 p.m. in London.

Global Bonds Extend Losses Prompting BOJ to Boost Purchases

The bank’s surprise move at the December meeting roiled global markets, with many investors concluding it was aimed at paving the way to possible normalization of policy under a new leadership. Governor Haruhiko Kuroda and his two deputies are due to step down in the spring.

While the summary backs up Kuroda’s message that the move did not take place with a view to overhaul policy, market participants are likely to view the communications of the bank with heightened caution going ahead given the lack of telegraphing of the sudden move. The December decision suggests future changes could also come without any prior warning.

“Markets will remain on high alert for surprises, just like when the bank announced the introduction of negative interest rates,” said Takahide Kiuchi, economist at Nomura Research Ltd and a former BOJ board member, speaking after the release of the summary. “The market can’t help being skeptical for a while.”

Kiuchi, who voted against the negative rate decision in 2016, said the bank likely ended up making the surprise decision in December because officials were rushing to get something done by a year-end deadline or because Kuroda may have resisted the move right up till the last minute.

The widening of the yield range came after investors’ perceptions of Japan’s bond market functioning fell to a record low in a BOJ survey earlier this month. The 10-year bond targeted by the central bank also failed to trade for four straight days in one stretch between the October and December meetings, an indication of dried-up liquidity in the market.

One member said the deterioration in functioning of the bond market could also impact issuance conditions for corporate bonds and limit the transmission of monetary stimulus. The summary doesn’t indicate which members made each comment.

In another opinion, a board member said the current situation warranted attention, flagging cautious investor sentiment and a widening of spreads on corporate bond yields.

In a separate view, a member said the impact of strong easing would still be felt through lower real interest rates even after the bond yield range was widened.

The member who referred to arguments favoring a review of the 2% price target, suggested a change would complicate the bank’s messaging on policy.

“Revision of that value is not appropriate since it could make the target ambiguous and the monetary policy response inadequate,” the member said.

–With assistance from Ritsuko Ando and Libby Cherry.

(Updates yen move in sixth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.