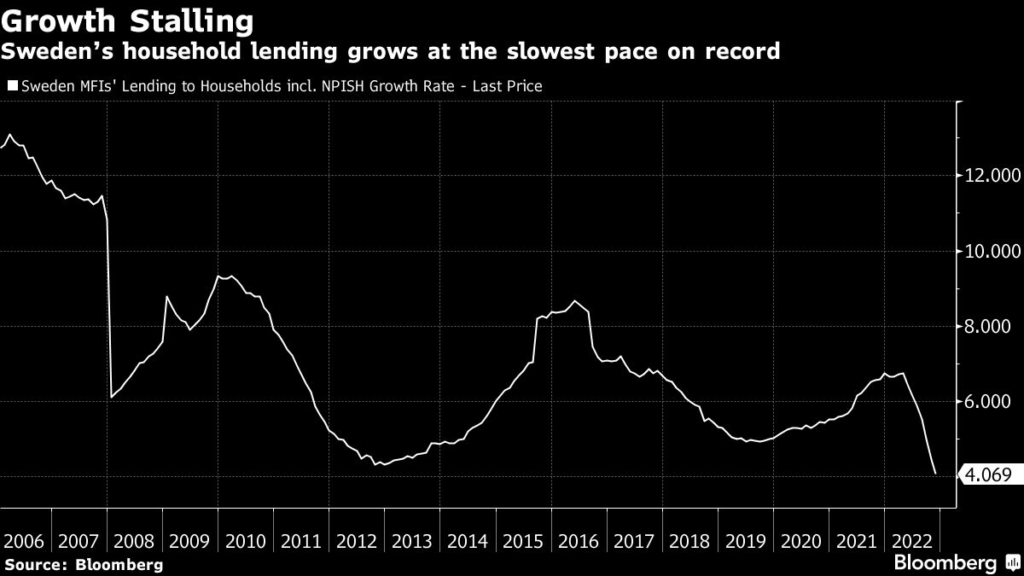

Sweden’s household lending grew last month at the slowest pace on record, as rates rise and home prices plunge.

(Bloomberg) — Sweden’s household lending grew last month at the slowest pace on record, as rates rise and home prices plunge.

In November, lending to households grew by 4.1%, which is the lowest annual increase since Statistics Sweden began collecting the data in 2006. Mortgages accounted for 82% of all new loans, the office said in a statement.

New lending has slowed considerably in recent months, as central bank moves to curb inflation sent interest costs skyrocketing. Since lifting its policy rate from zero in April, the Riksbank has followed peers in the most aggressive monetary tightening in decades, culminating in a September decision to increase the benchmark rate by a full-percentage point.

With the central bank rate now at 2.5%, the average interest rate on new agreements for mortgages was 3.42% in November. Floating rates were more than twice as high as a year earlier and reached the highest level since late 2012, according to Statistics Sweden.

Higher borrowing costs, combined with expectations of a looming recession, have had an immediate impact on the Swedish housing market, which had seen decades of virtually unbroken price gains until this year. Recent data indicate that homes on average have lost about 15% of their value since the first months of 2022, and most forecasters expect the slump to continue, reaching 20% from the highest levels.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.