The worst year for equity bulls since 2008 will also be remembered as one when the predominant investment strategies veered from one another by the most in two decades.

(Bloomberg) — The worst year for equity bulls since 2008 will also be remembered as one when the predominant investment strategies veered from one another by the most in two decades.

Divergent fortunes befell the most famous U.S. stock benchmarks, with the S&P 500’s annual loss of almost 20% more than twice that of the Dow Jones Industrial Average. A more precise comparison involves style categories — value and growth — with the latter trailing the former by a factor of 3 and losing to it in percentage terms by the most since 2000.

It’s been a refrain of quantitative bulls for years: value was due for a win. In 2022, it happened — at least in relative terms — due to a confluence of anti-growth forces ranging from rising bond yields to a tightening Federal Reserve. Going got tough for the supercharged megacaps that dominated the decade following the financial crisis. In their place came energy, insurance and food shares.

“2022 was the year the tide went out and we got to see who was swimming naked,” said Andrew Adams at Saut Strategy. “It’s the first year in a while that required doing something other than just buying the dips and holding to make money.”

Doing well in 2022 came down to a single decision in terms of portfolio construction: immunize yourself from interest-rate sensitivity. It was a request fielded by Mahmood Noorani, the chief executive of London-based analytics research firm Quant Insight, about a year ago from a client worried about growth and credit risk. At Noorani’s behest, the portfolio manager trimmed once-hot names like Meta Platforms Inc. and PayPal Holdings Inc. by 25%, and raised by the same amount in companies such as Coca-Cola Co. and Shell Plc.

Four months later, the shuffling paid off: an improvement of 4 percentage points in returns over what would’ve happened if no such tweaks were executed.

The case study highlights the main theme of 2022: When the path of inflation and Fed policy becomes the overarching force of the market, everyone becomes a macro trader. Heeding big economic trends may again overshadow stock picks in the new year as China just removed the last of its Covid curbs while recession debate heat up in the US.

Money managers “ultimately accept that the world we are in means that if they want to hold onto their single-stock alpha and all the fundamental research they do, then macro comes along and blows them of course more and more regularly,” Noorani said in an interview. “In order to get through these macro periods so they can actually harvest that alpha, they need to be macro aware.”

With inflation and Fed policy dominating news flows, investors contended with an all-or-nothing market where fundamentals of individual companies retreat to the backseat. Lockstep stock moves, one day up and the next down, swept through the market like storms, as paranoia over inflation alternated with optimism the economy can weather the Fed’s battle against it. For 83 separate sessions in 2022, at least 400 members in the S&P 500 moved in the same direction, a rate that tops all but one year since at least 1997.

From commodities to bonds to currencies, almost every asset was at the mercy of events such as Russia’s invasion of Ukraine and the Bank of England’s dramatic intervention in government bonds. A measure of cross-asset correlation tracked by Barclays Plc almost doubled this year through August, putting it among the highest levels of the past 17 years.

In this rates-obsessed world, one notable pattern emerged: Stocks moved in tandem with Treasuries and against the US dollar. In fact, that happened for 28 different weeks this year, a frequency not seen since at least 1973.

While the persistent cross-asset relationship was a boon for trend-following quant funds, it brought pain to stock pickers, particularly those who held tight to the old darlings in tech and growth.

“If we’re all being honest, the people that did very poorly this year did poorly because they weren’t really macro aware of what was broadly going on with interest rates and this new shift in paradigm,” said Matt Frame, a partner at Bornite Capital Management, a stock-picking hedge fund that raised shorts against tech shares and cut equity exposure in anticipating of a hawkish Fed. “And those that did fairly well this year didn’t really see it coming, but knew how to adapt to that kind of changing landscape.”

The peril of failing to heed the central bank’s action is best illustrated by the timing of the S&P 500’s worst performance during 2022. All of the index’s five biggest weekly declines took place immediately before or around a Fed meeting.

More pros are acknowledging the importance of getting a grip on how macro forces affect market performance, according to Quant Insight’s Noorani. The firm’s macro risk product — which offers analysis on the relationship between asset prices and more than 20 risk factors such as liquidity and rate expectations — signed up a dozen new clients this quarter after establishing a partnership with Goldman Sachs Group Inc. in the summer. That’s up from a total of four additions during the prior nine months.

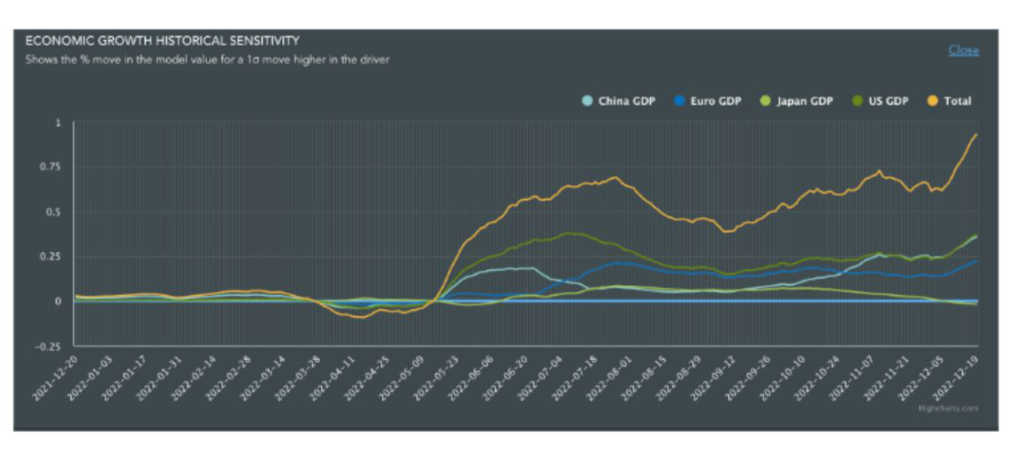

Heading into next year, growth in gross domestic product has emerged as one dominant factor for the equity market, the firm’s model shows.

“The risk for 2023 is recession and a turn in the credit cycle,” Noorani said. “The focus for us now is to go to our clients and prospects and encourage them to look at their exposures to global GDP growth and credit spreads.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.