(Bloomberg) — Cathie Wood’s worst-ever year wasn’t even over before the clouds started to gather for 2023.

(Bloomberg) — Cathie Wood’s worst-ever year wasn’t even over before the clouds started to gather for 2023.

For the past few weeks, Wall Street has been slashing earnings expectations for some of the biggest holdings of her flagship $5.8 billion ARK Innovation ETF (ticker ARKK) — signaling more pain ahead for a strategy that was hammered throughout 2022 by the most aggressive Federal Reserve tightening in decades.

Those relentless rate hikes crushed many of Wood’s tech-focused, speculative bets, and her legion of die-hard followers were surely hoping for a better 2023. But with interest rates set to remain the highest they’ve been since 2007, analysts have downgraded their 12-month earnings estimates for half of the largest weights in ARKK, according to data compiled by Bloomberg.

The list includes Tesla Inc. and Zoom Video Communications Inc., which finished 2022 down 65% and 63%, respectively.

The earnings revisions threaten to heap more pain on investors who have sunk billions into Wood’s strategy of handpicking growth stocks with so-called visionary stories. ARKK fell 67% this year.

A spokesperson for Wood’s firm, ARK Investment Management, declined to comment.

“ARK’s portfolios are loaded up with longer duration tech stocks, which have been absolutely punished by higher rates,” said Nate Geraci, president of the ETF Store, an advisory firm. “If the Fed is more aggressive than expected in 2023, look out – it could be another bloodbath.”

To be sure, analysts are not just pessimistic about the outlook for disruptive innovation stocks. They have also been trimming their forecasts for next year’s S&P 500 earnings for months. Analysts now project S&P 500 earnings to grow 2.2% year-over-year in 2023, down from expectations of 6.5% growth they forecast in the beginning of September, according to Bloomberg Intelligence.

Read More: Wall Street’s Top Stars Got Blindsided by 2022 Market Collapse

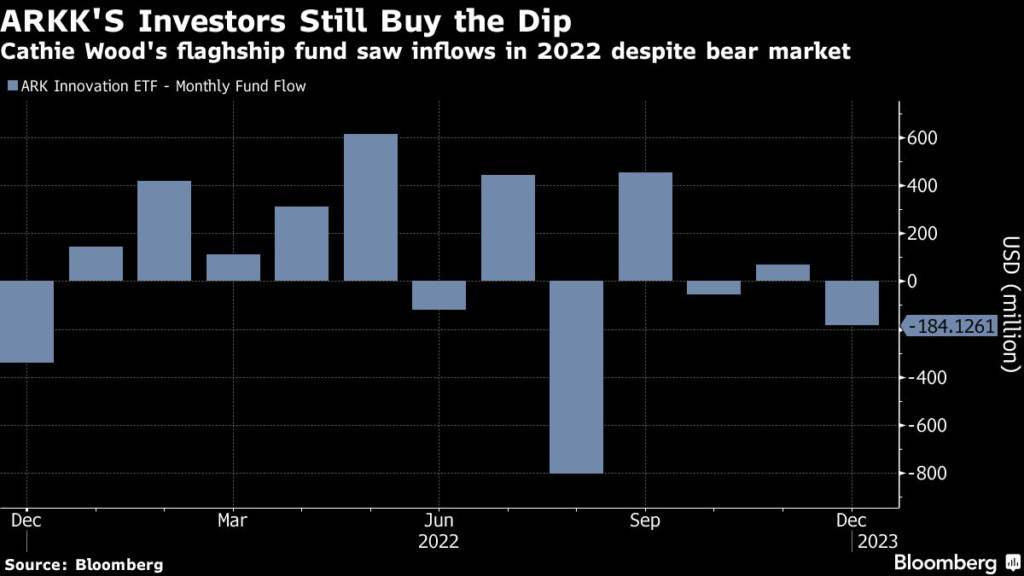

And even ARKK’s worst performance on record this year hasn’t deterred some of Wood’s fans. The fund has still garnered $1.3 billion this year, underscoring the cult following Wood has maintained ever since her nearly 150% run in 2020. The inflows however, are a far cry from the $4.6 billion and $9.6 billion ARKK amassed in 2021 and 2020, respectively.

“You clearly have longer-term investors who just believe in disruptive innovation and they want to have a small satellite holding in that,” Geraci said. “It’s a sleeve in their portfolio — so that’s always going to create inflows.”

–With assistance from Matt Turner.

(Updates to market close.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.