Russia’s Finance Ministry doubled the amount of Chinese yuan and gold it can hold in the national wealth fund with much of its savings frozen by international sanctions over the invasion of Ukraine.

(Bloomberg) — Russia’s Finance Ministry doubled the amount of Chinese yuan and gold it can hold in the national wealth fund with much of its savings frozen by international sanctions over the invasion of Ukraine.

The potential share of yuan was raised to 60% of the National Wellbeing Fund and gold to 40% to make investments in the National Wellbeing fund “more flexible,” the Finance Ministry said in a statement on Friday. The ministry said its accounts in British pounds and Japanese yen at the central bank have been set at zero.

The Wellbeing Fund increased to $186.5 billion in November from $154.8 billion in February, when President Vladimir Putin ordered troops into Ukraine.

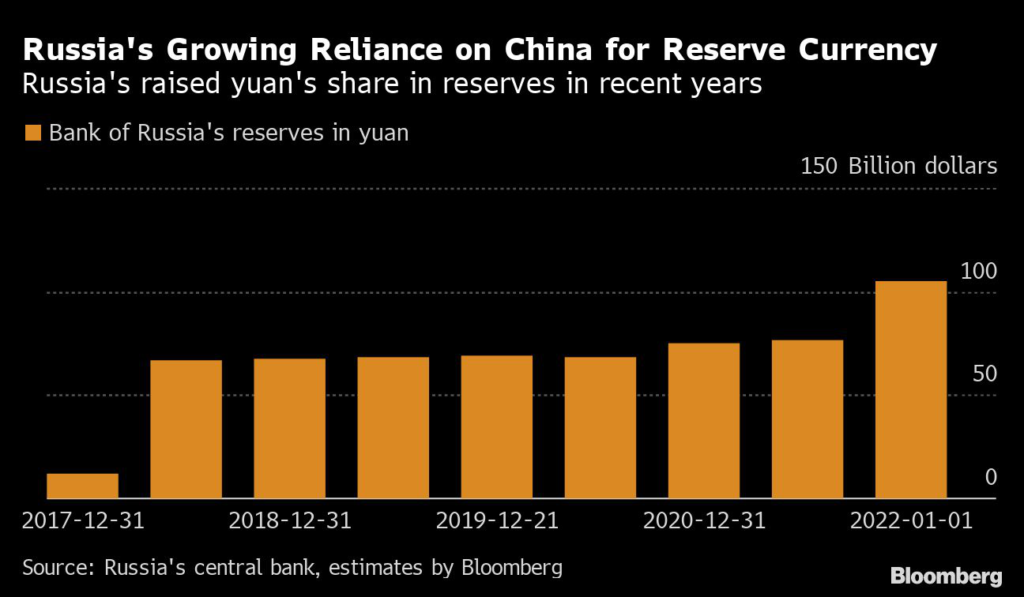

After years of accumulating savings in dollars and euros, the Kremlin overhauled its economic strategy and began limiting savings in assets of “hostile” governments as the US and its allies started imposing sanctions over the annexation of Crimea in 2014. Its assets denominated in dollars, euro, pounds and yen were frozen after the invasion this year. Of all “friendly” assets, the yuan is the most appropriate currency for the country’s reserves, Finance Minister Anton Siluanov said earlier this week.

The shift may not have a strong effect on the market, in part because it can be carried out by shifting assets the central bank already holds, according to Bloomberg Economics.

What Bloomberg Economics says…

The Finance Ministry’s move will have little immediate market implications for two reasons. First, the rule describes how the Bank of Russia should allocate windfall oil and gas revenues, i.e. revenues above 8 trillion rubles a year, but reduced oil export suggests there’ll hardly be such revenue in 2023. Second, the Bank of Russia will not need to sell or buy any assets on the open market to accommodate the new structure — this can be done inside the central bank’s balance sheet.

—Alexander Isakov, Russia economist.

The yuan was used for 14% of exports as of the end of the third quarter, up from close to zero at the start of the year as companies shift currencies, according to an estimate from Natalia Lavrova, chief economist at BCS Financial Group.

“These changes are a logical adaption to the ongoing market processes,” Lavrova said about the wealth fund’s new structure. “The yuan is becoming the ‘new dollar’ due to its growing liquidity and relatively low volatility.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.