In a year of contradictions that was the worst for stocks and bonds in more than a decade, the ticket to big gains was volatility. A host of strategies built around it paid off.

(Bloomberg) — In a year of contradictions that was the worst for stocks and bonds in more than a decade, the ticket to big gains was volatility. A host of strategies built around it paid off.

Hedge funds that shorted stock turbulence delivered stellar returns as equity price swings held below levels seen in previous routs thanks in part to the slow-burn nature of the 2022 crash.

At the same time, money managers who thrive on uncertainty also managed to notch big gains with deftly timed bets on volatility in an uneven year for trading that was marked by brief but outsized cross-asset swings. The volatility of volatility was also high, meaning traders found a host of opportunities to ride extreme market gyrations.

Take Martin Petherick at Oxeye Capital Management. He sold bearish options to bet on calmer equity markets that paid off during periods when stocks rallied. Using leverage, the strategy generated returns as high as 45%. Meanwhile, Boaz Weinstein of Saba Capital Management, used credit-default swaps to take advantage of cross-asset volatility. Those long-volatility trades, including on bonds, earned 25% for the Saba Master Fund through October, according to a person familiar with the performance.

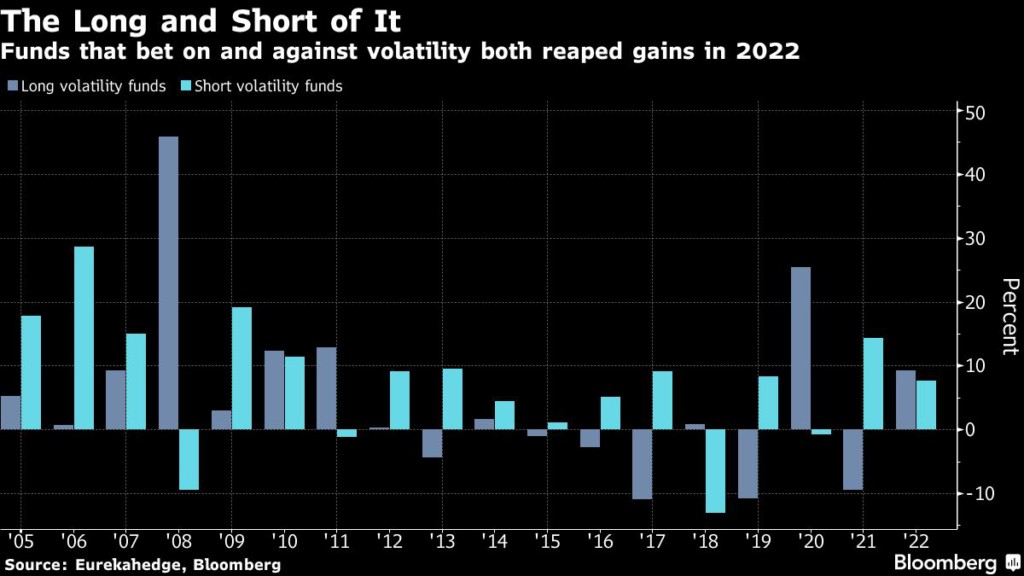

Overall, long-volatility hedge funds and their short counterparts have gained 9.3% and 7.7% respectively, according to Eurekahedge Pte Ltd. Simultaneous strong performance for both trades is an anomaly last seen in 2010 and this year it owes to short-volatility benefiting from calmer equity markets while long-vol strategies were riding gyrations across assets and were lifted by the turmoil in bonds and currencies. Additionally, the repeated cycle of optimistic equity relief rallies followed by meltdowns has supported both sides of the trade.

“There were a lot of opportunities for volatility traders on both sides,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

Volatility traders generally buy or sell derivatives to take advantage of the discrepancies in current implied moves versus expectations of subsequent implied or realized swings. Strategies that bet on market turmoil are more likely to have exposure to more than just equity volatility and add bets on bonds and currency markets to diversify the trade. In most years, the volatility trade is one-way, with either the long or short side winning. The past 12 months have been unusual.

In Salisbury, England, Oxeye Capital Management Ltd.’s short-volatility strategies are wrapping up the second best year in two decades. CEO Martin Petherick didn’t approach 2022 very differently from the last 25 years since he set up the funds that run about $25 million of assets.

Oxeye’s unleveraged strategy gained 11%. The five-times leveraged version is headed for a 45% return. His volatility strategies sell bearish options, hoping that volatility will fall or remain low and the options will expire worthless. Petherick contends that selling options wins more often than not given that risk.

“Short volatility will always have longer positive performance as options are priced for sellers rather than buyers,” he said in an interview. “But in the wrong hands, it could be very dangerous because you have unlimited liability.”

This year has been a vindication for volatility funds that have been hit with closures and low returns in the past decade as markets remained relatively subdued. Their sudden gains puts them at odds with vast numbers of real-money funds that hew to balanced strategies allocating 60% to equities and 40% to bonds. Rampant inflation drove both asset classes down together this year, blasting their basic premise. The annual gains from both strategies compare with a loss of almost 4% for hedge funds overall, and a decline of 17% for balanced portfolios.

Saba, which manages about $4.8 billion, runs a long-volatility fund that struggled in the calm years before the pandemic. Then came the 2020 market turmoil and the fund returned 73% — its best year on record. The Master Fund identifies potential short targets through credit-default swaps that are used to insure bonds against default.

“Most of our alpha is generated through single-name CDS selection,” Saba Capital’s Weinstein said by email. “We are shorting unsafe credits, with a bias toward cyclical companies, and going long safe credits to offset most of the carry.”

Saba’s fund has cross-asset exposure which is different from the traditional concept of a volatility fund that trades options on an index like the S&P 500.

The Cboe Volatility Index that spiked in the spring helped long-volatility funds with equity exposure betting on market turbulence. It also fell fast numerous times throughout the year to bring gains to those who were positioned for market calm. The VIX was into a channel between 20 and the low 30s for most of the year, offering upside to both bullish and bearish bets.

For instance, long-volatility hedge funds gained 5.9% in April as the VIX jumped 13 points, according to Eurekahedge. That delivered the best month since a record 20% gain in the pandemic bear market of March 2020. Six months later, short-vol hedge funds rang up a 3.6% gain in October.

“This year, we’ve had a real two-way market,” said Michael Purves, chief executive officer at Tallbacken Capital Advisors, who has switched his recommended trades between short- and long-volatility a few times this year.

Some derivatives experts say the performance is logical in a market where the investing community is extremely defensively positioned and has shifted hedging preferences to areas not captured by the VIX, like shorting index futures and trading volatility across assets.

“Many equity index option based strategies have faltered in 2022, as the downward moves in the market have not been sufficiently extreme to justify the premiums,” said Dean Curnutt, founder of Macro Risk Advisors. “In currency markets, however, massive gyrations in assets like the British Pound have supported long volatility positions.”

–With assistance from Sid Verma.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.