The most beaten-down European stocks of 2022 are leading gains into the new year in an early sign of a reversal of the risk-off sentiment that hit swathes of the market from real estate to retailers to growth stocks.

(Bloomberg) — The most beaten-down European stocks of 2022 are leading gains into the new year in an early sign of a reversal of the risk-off sentiment that hit swathes of the market from real estate to retailers to growth stocks.

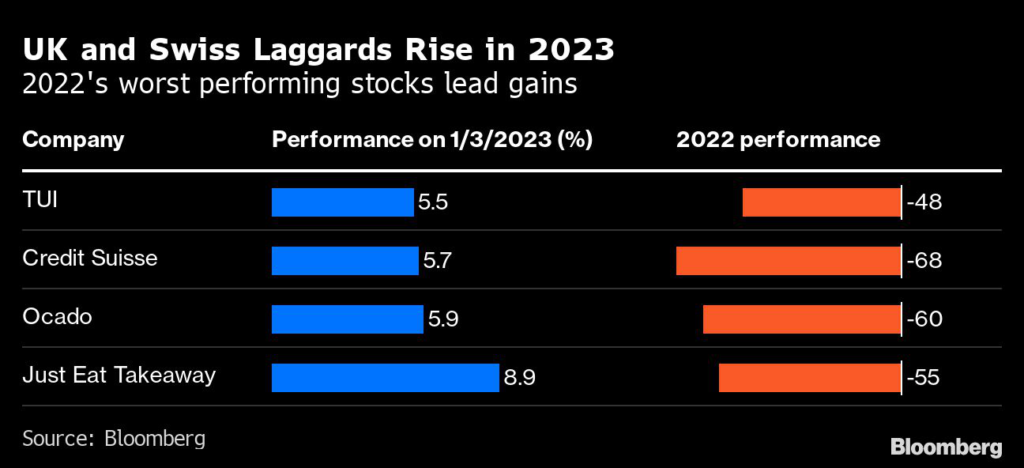

Stocks in food-delivery companies, battered last year by souring investor appetite for stocks seen as vulnerable to the cost-of-living crisis, were among the best performers, notching up gains in excess of 7% as UK and Swiss markets also opened after the holiday.

In Switzerland, Credit Suisse Group AG, which lost two thirds of its market value last year, bounced back by 5.6% on Tuesday. In the UK, Ocado Group Plc and Rolls-Royce Holdings Plc led gains.

HelloFresh SE helped lead the advance for the Stoxx 600 benchmark as it jumped by as much as 10% to undo part of last year’s 70% decline. Just Eat Takeaway.com NV, which tumbled more than 50% in 2022, rose as much as 8.2%, while Delivery Hero SE gained by more than 7%.

Among technology shares, ams-OSRAM AG jumped as much as 12%. The stock fell more than 59% last year as sentiment toward the sector took a pummeling from the rapid ascent of interest rates.

Some stocks, including Ocado and HelloFresh, also rebounded due to a short squeeze. Shares out on loan, an indication of short interest, was 13% of Ocado’s free float, according to data from S&P Global Market Intelligence, as of Dec. 30.

Builders Rebound

British builders Persimmon Plc gained about 4.5% after losing 53% in 2022, while Barratt Developments Plc, which also plunged last year, advanced as much as 5.7%.

Travel shares jumped with TUI AG surging as much 6.6%. British Airways parent IAG SA also climbed after Citigroup Inc. analysts listed strong pricing power among the multiple catalysts that should benefit European long-haul carriers in 2023.

“This the period of the year when one can make bets on the stocks that have underperformed,” Andrea Tueni, head of sales trading at Saxo Banque France,

However, he said he didn’t see a clear long-lasting recovery trend emerging. Macroeconomic data due in the coming days would likely provide more visibility, according to Tueni.

(Adds comment from penultimate paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.