Nearly a dozen major Chinese cities are reporting a recovery in subway use, a sign that an ‘exit wave’ of Covid infections may have peaked in some urban areas.

(Bloomberg) — Nearly a dozen major Chinese cities are reporting a recovery in subway use, a sign that an ‘exit wave’ of Covid infections may have peaked in some urban areas.

More and more people are taking the subway in 11 of China’s biggest cities, with Shanghai, Guangzhou, Shenzhen, and Nanjing among the latest metropolises to report a rebound in trips over the last week. This comes after places such as Beijing, Zhengzhou and Chongqing, which had already seen subway usage and traffic congestion increasing from a trough reached around mid-December.

Covid cases started soaring across the country from early December after the government suddenly dropped movement restrictions and testing requirements. The reopening initially caused a slump in activity as people stayed home sick or to try and avoid getting sick, but the subway data suggests the worst may be over for some urban areas.

The rise is evidence to support an official statement on Sunday that the Covid outbreak has peaked in the southern manufacturing hub of Guangzhou, where the number of patients at fever clinics have been declining since Dec. 23. Last week, health authorities said infections have peaked in Beijing, Tianjin and Chongqing.

That reopening has led to a spike in deaths, although exactly how many people have died is unknown as there is no reliable data being released. It’s also unknown how activities are developing in much of the rest of the country, especially in the vast rural areas.

The Hang Seng China Enterprises Index, which tracks Chinese stocks listed in Hong Kong, reversed earlier losses to gain as much as 1.9% on Tuesday, on course for its best start to a year since 2018. The onshore yuan also strengthened to a four-month high as traders bet on a further recovery in China’s economy.

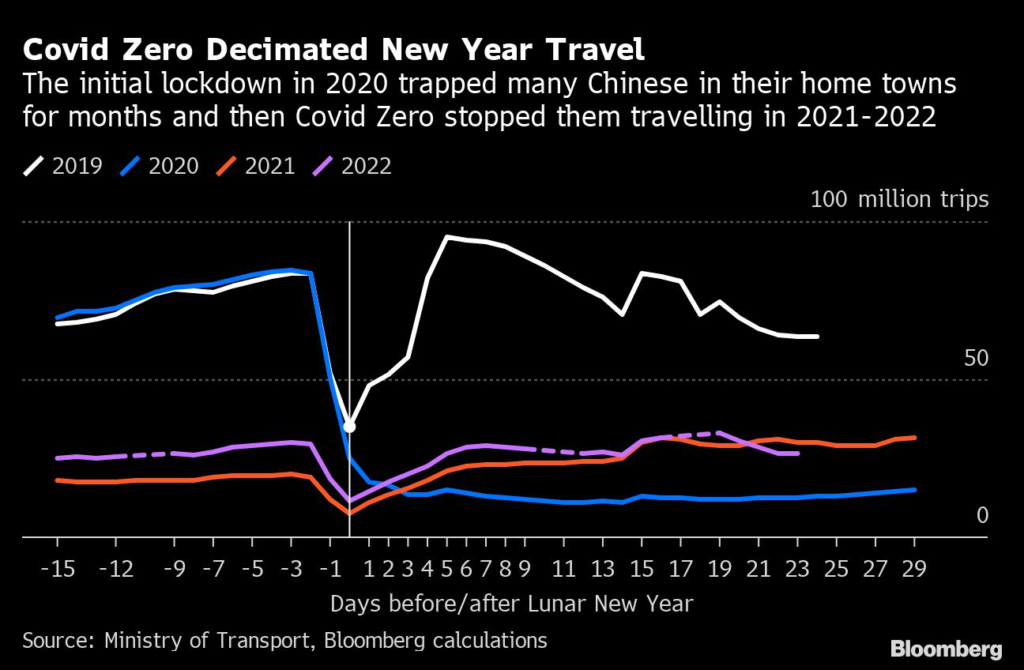

The coming weeks leading up to the Lunar New Year, a seven-day public holiday starting from Jan. 21, will be an important window to assess how widespread the rebound in mobility is, as hundreds of millions of Chinese are set to return to their hometowns. Trips before and after the holiday have plummeted since the outbreak of Covid in 2020, but the complete removal of domestic travel restrictions means that many more people may try and go to home for the break.

Although more people are moving around, they’re not spending freely just yet. Moviegoers have slowly been returning to theaters, but the national box office during the three-day New Year public holiday that just finished was only 554 million yuan ($80.5 million), down 46% from the 1.02 billion yuan in the same period in 2022, according to data from online ticketing platform Maoyan Entertainment.

And travel was relatively muted over the holiday, with the number of trips made little changed from a year earlier, while tourism revenue was up just 4% compared to the same period in 2022, the Ministry of Culture and Tourism said. Tourism revenue was just 35% of the levels reached in 2019, while there was only 43% the number of trips.

China State Railway Group Co., the national railway operator, aims to transport 2.69 billion passengers in 2023, according to a statement by the company on Tuesday. That’d be a 68% jump from the level in 2022, but only 3% higher than the 2021 level, according to the statement and official data.

–With assistance from Jinshan Hong, Lin Zhu, James Mayger and Lianting Tu.

(Updates with markets reaction, railway passengers details)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.