China extended trading hours for the onshore yuan effective Tuesday as it attempts to internationalize the currency, but the move was met with tepid response with only a few local banks equipped to participate during those hours.

(Bloomberg) — China extended trading hours for the onshore yuan effective Tuesday as it attempts to internationalize the currency, but the move was met with tepid response with only a few local banks equipped to participate during those hours.

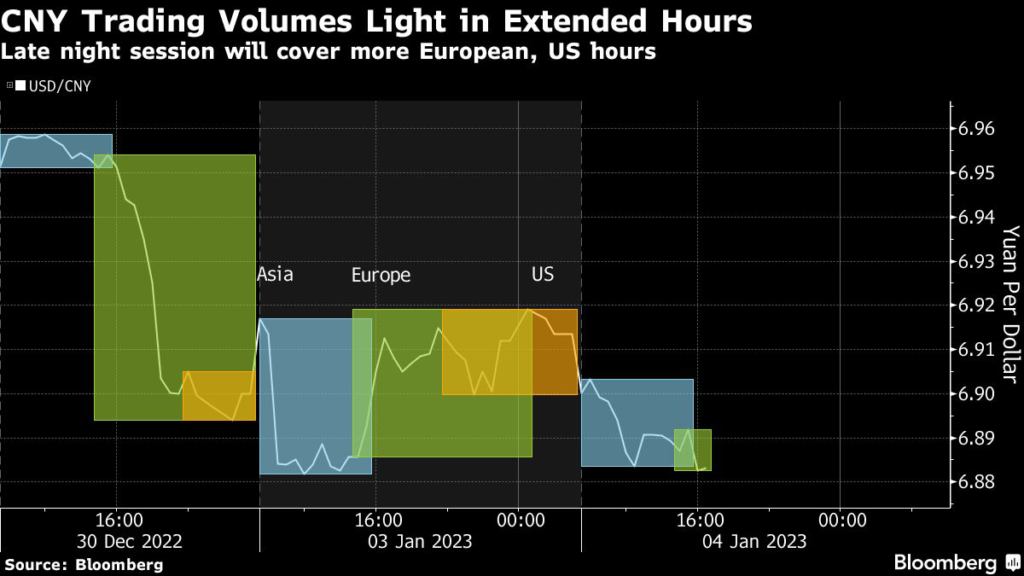

The dollar-onshore yuan trading volume during the extended hours, between 11:30 p.m. and 3 a.m. Beijing time, totaled $128 million on the first day, according to China Foreign Exchange Trade System. That’s just about 0.4% of the full day’s volume.

CFETS said 16 banks participated in the extended hours, including spot and derivative markets. Local traders said only a few major Chinese banks with European and US branches actively participated in the late night trading on Tuesday and no large transactions by US banks were seen. Other domestic institutions faced insufficient demand and manpower during those hours, said the traders who asked not to be identified as they are not authorized to speak publicly.

“It may need more time to see the full impact of the extension of onshore yuan trading hours,” said Stephen Chiu, chief Asian foreign exchange strategist at Bloomberg Intelligence in Hong Kong said. “Logically speaking, there could be limited help to boosting onshore yuan trading volume in the Europe and US trading hours, as after all offshore yuan could still be preferred.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.