Optimists were still to be found in the world of US exchange-traded funds, where more than 400 new ETFs were launched despite a harsh bear market. Funds took in more than half a trillion dollars as more investors learned to embrace their easier-to-trade and tax-friendly structure.

(Bloomberg) — Optimists were still to be found in the world of US exchange-traded funds, where more than 400 new ETFs were launched despite a harsh bear market. Funds took in more than half a trillion dollars as more investors learned to embrace their easier-to-trade and tax-friendly structure.

Still, the $6.5 trillion industry was shaken by market turmoil. Many funds saw sharp drawdowns as equities and fixed-income strategies slumped beneath the Federal Reserve’s rate hikes to battle inflation. Trendy new ETF themes burned bright and then faded. Commodity funds rode sharp price increases driven by the war in Ukraine and Russian sanctions.

Here’s a quick tour of how ETFs fared in 2022:

Winners

Near-record launches: The market gloom did little to discourage new fund entrants, as 430 ETFs came to market, the second-most ever after a record following 2021’s 459 launches, data compiled by Bloomberg show. “The ETF vehicle gives investors control, and then the variety gives them precision,” Bryon Lake, global head of ETF Solutions at JPMorgan Asset Management, said last month.

Energy ruled: Only one S&P 500 sector gained in all of 2022: energy. It surged roughly 60% for the year, meaning that some of the best-performing ETFs also belong to that category. The Energy Select Sector SPDR Fund (ticker XLE) added more than 57% during 2022, as did the Fidelity MSCI Energy Index ETF (FENY). Eight of the 10 top-performing funds last year were related to the energy sector, according to data compiled by Bloomberg. “Energy outperformed everything last year,” said Mohit Bajaj, director of ETFs at WallachBeth Capital. “Part of it was supply crunch and of course increased demand.”

Mutual funds gave way: Investors spurned mutual funds at a record clip, driving a nearly $1.7 trillion gap in the flow of money from the older investment vehicles into ETFs. The divide this year between the two investment types widened to an all-time high, up from around $930 billion in 2021, according to data compiled by Bloomberg Intelligence, highlighting the speed with which ETFs are eating into mutual funds’ longtime market dominance.

Losers

Brutal bond year: The fixed-income space was a big underperformer as the Fed ratcheted up rates. Pacific Investment Management Co.’s exchange-traded fund business saw investors pull nearly $3.6 billion from over 20 of its Pimco and Allianz-branded funds, resulting in the biggest cumulative outflow ever for the asset manager, Bloomberg data show. The exodus was ranked the largest among US issuers in 2022.

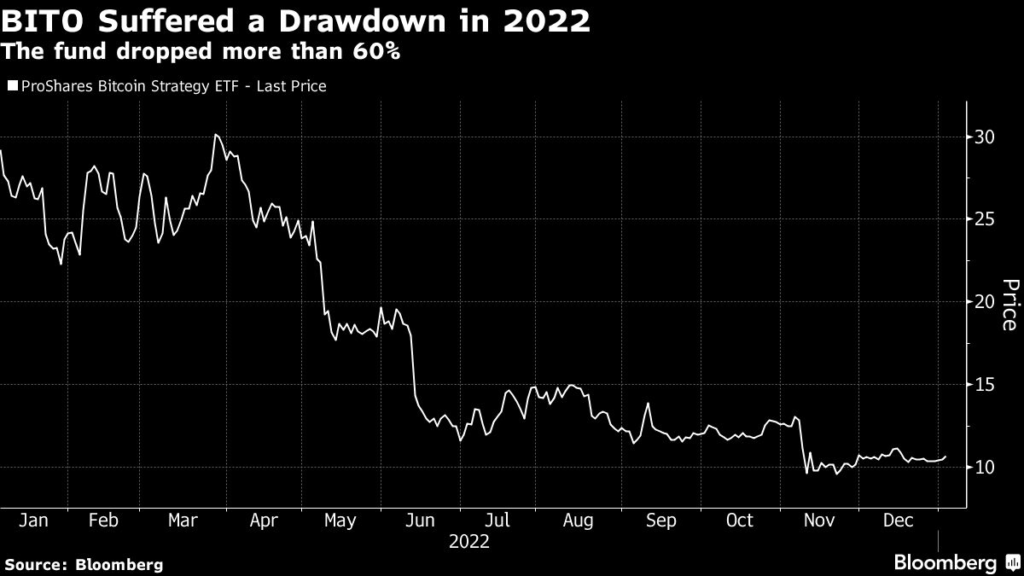

Crypto’s downfall: Everyone knows cryptocurrencies suffered last year. From the blowup of some once-vaunted projects to the monster drawdowns in everything from Bitcoin to Solana, the industry sustained one of its toughest stretches yet. Crypto-focused ETFs also slumped, with the ProShares Bitcoin Strategy ETF (BITO) falling nearly 64%. And even before the collapse of the FTX exchange in November, the cryptocurrency ETF pipeline had been deflating, with launches dwindling to a trickle and a handful of ETPs shuttering. Some market-watchers expect many more closures in the coming months.

SPAC bust: Funds built around special-purpose acquisition companies — which were one of the hottest things to emerge in the pandemic years — sank as investors walked away from the speculative investment vehicles. The Defiance Next Gen SPAC Derived ETF and the Morgan Creek – Exos SPAC Originated ETF both shuttered during the year as an index tracking the industry fell more than 24%.

Single-stock ETFs: A new type of fund captured headlines: single-stock ETFs that allowed investors to make leveraged or inverse bets on the daily performance of individual companies like Tesla Inc. But only a few months after the first single-stock ETFs debuted to American investors in July, the nascent category stalled on Securities and Exchange Commission officials warnings and tepid investor demand. And issuers withdrew applications for versions tracking non-US companies.

–With assistance from Athanasios Psarofagis and Emily Graffeo.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.