Credit defaults are set to more than double in Europe this year to levels approaching the worst days of the global coronavirus pandemic.

(Bloomberg) — Credit defaults are set to more than double in Europe this year to levels approaching the worst days of the global coronavirus pandemic.

That’s the view of S&P Global Inc., which expects the trailing 12-month speculative-grade corporate default rate to reach 3.25% by September 2023, up from 1.4% a year earlier, according to its latest estimate.

The increase in defaults is expected as companies in Europe struggle with challenges including an energy crisis, soaring materials costs and cash-strapped customers. At the same time, refinancing existing debt has become increasingly expensive after central banks globally hiked rates to tackle soaring inflation last year.

“Limited refinancing alternatives for an increasing number of issuers with high leverage and principal maturities from 2023 to 2025 contributes to the increase in our European 2023 and 2024 default rates,” Fitch analysts including Eric Rosenthal and Joao Gaspar Tovolli wrote in a report in December.

They see default rates for European high-yield bonds reaching 2.5% in 2023, up from 0.7% last year, and predict leveraged loan defaults will surge to 4.5% from 1.3% in the same period.

Meanwhile, Moody’s Investors Service sees corporate defaults from borrowers which have issued junk bonds and leveraged loans rising to 4.2% in November compared to 3.1% in the same month in 2022.

The ratings agencies’ forecasts are still some way short of the 6% peak seen in late 2020-early 2021, when the impact of coronavirus lockdowns roiled companies, but they may stay higher for longer as central banks are unlikely to shift back to expansionary monetary policies anytime soon.

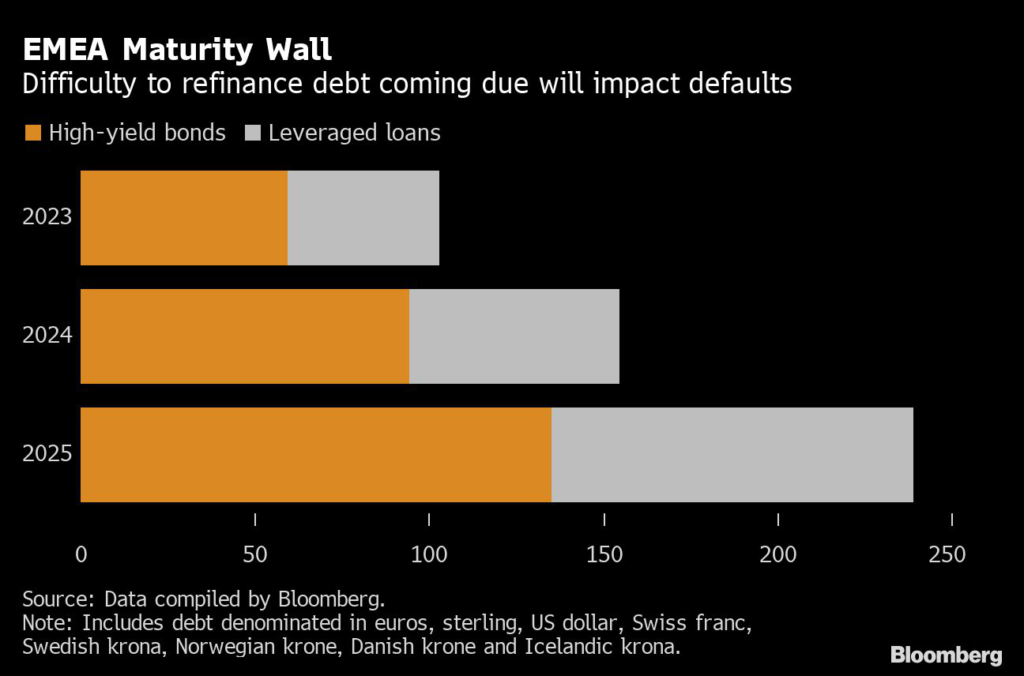

Underpinning the predictions are the amount of debt due to mature over the next few years. There’s around €103 billion ($109 billion) of sub-investment grade debt maturing in Europe, the Middle East and Africa this year, rising to €154.9 billion next year and €238.9 billion in 2025, according to data compiled by Bloomberg.

As those dates loom, more borrowers may seek to push back maturities and agree to pay more interest at a later date — and thereby fall into ratings agencies’ classification of default.

“We expect stressed borrowers to engage current lenders in amend-and-extend transactions that are likely to trigger our distressed debt exchange criteria,” Fitch’s analysts wrote. Last year, such debt accounted for 56% of defaults in EMEA in Fitch’s data.

If more companies fail to meet their obligations or engage in restructuring processes, writedowns for banks will also be a theme to watch this year. S&P Global expects credit losses for banks in Western Europe to rise by around 20% to $87 billion in 2023, and remain around this level in 2024.

Still, it may not be a huge problem for lenders. “We expect the higher losses we forecast to be manageable for banks, largely thanks to rising interest rates benefiting net interest margins,” S&P analysts including Osman Sattar and Gavin Gunning wrote in a December report.

In terms of geographies, corporate distress is accelerating faster in the UK than Europe, with Germany coming second to the UK, according to a December study by law firm Weil, Gotshal & Manges. And in Fitch’s report, France and Germany are the two countries in Europe with a higher share of their high-yield and leveraged loan markets expected to default in 2023.

To take part in Bloomberg Intelligence’s European high yield investor survey for the first quarter, click here.

Elsewhere in credit markets:

EMEA

UBS Group AG and Deutsche Bank AG are among 24 issuers to offer bond sales on Wednesday, marking Europe’s busiest day of bond sales in a year, according to people with knowledge of the matter. The borrowers are set to raise a minimum of €20.3 billion ($22 billion), the people said.

- Air France-KLM will offer at least €300 million of sustainability-linked bonds to repay state aid that helped it see through the pandemic

- Investors have placed more than €1.5 billion of orders for a new contingent convertible bond by Banco de Sabadell SA as the Spanish lender taps the market almost three months after it broke with convention and skipped a call option

- The Bank of England said 46,075 new loans for house purchases were approved in November, the lowest since June 2020

- Hungary is selling a three-part benchmark bond in dollars, as it seeks to finance its budget and current account shortfalls as a chunk of its European Union funding remains frozen

Asia

Hong Kong began marketing green bonds in multiple currencies Wednesday, adding to a global rush of deals, as borrowers take advantage of a recent debt-market recovery.

- Japanese credit spreads increased to the highest in two-and-a-half years as the Bank of Japan’s surprise decision last month to raise its bond-yield cap stoked speculation of tighter monetary policy

- Thai builder All Inspire Development Pcl has defaulted on its debt after missing an interest payment on local-currency bonds

- Indonesian flag carrier Garuda filed a case in a Jakarta court against two lessors that appealed against its debt revamp deal

Americas

It’s likely to be another busy day for issuance in the US, with as much as $40 billion in debt expected to be marketed this week. A total of 19 issuers including Commonwealth Edison Co. and Connecticut Light and Power Co. brought new deals on Tuesday, making it the busiest day since the beginning of September.

- Amazon.com entered into a credit agreement with lenders on Jan. 3 for an unsecured $8.0 billion term loan that will mature in 364 days

- Credit cards offered by banks including Wells Fargo & Co. and Synchrony Financial intended to cover expensive health-care services may be causing unnecessary financial pain for consumers, according to a group of US senators

- Mexican consumer finance company Credito Real said Tuesday that as of Dec. 31, 2022, and to this date, it has no debt with SMBC nor with any of its subsidiaries or affiliates

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

–With assistance from Molly Price and Lucca de Paoli.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.