(Bloomberg) — Federal Reserve officials last month affirmed their resolve to bring down inflation and, in an unusually blunt warning to investors, cautioned against underestimating their will to keep interest rates high for some time.

(Bloomberg) — Federal Reserve officials last month affirmed their resolve to bring down inflation and, in an unusually blunt warning to investors, cautioned against underestimating their will to keep interest rates high for some time.

Going into the meeting, markets were pricing in rate cuts in the second half of 2023. The tone of the minutes of the Federal Open Market Committee’s Dec. 13-14 gathering suggested frustration that this was undermining the central bank’s efforts to bring price pressures under control.

Fed officials noted that “an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability,” according to the minutes released in Washington on Wednesday.

US stocks pared gains following the report, while the Fed policy-sensitive two-year Treasury yield rose and the dollar remained lower. Pricing in financial futures continues to show investors betting the Fed will begin lowering rates before the end of 2023.

“A big concern of their messaging here is that the market is pricing in cuts by the second half of this year,” said Michael Feroli, chief US economist at JPMorgan Chase & Co. With inflation too high, officials “realize that the risk of overtightening is just something that they have to swallow and stomach,” he told Bloomberg Television.

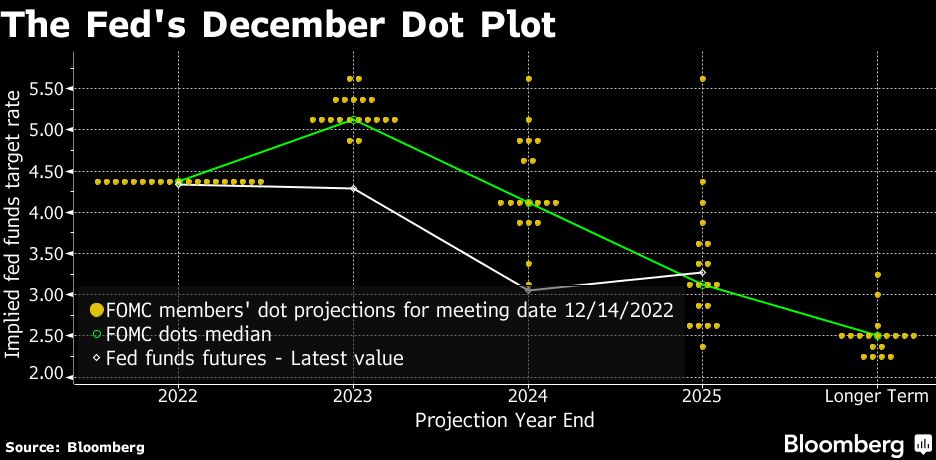

US central bankers raised the benchmark lending rate by half a percentage point at their gathering, slowing down after an aggressive string of four straight 75 basis-point increases. Officials also issued fresh forecasts that showed a hawkish tilt with more hikes projected in 2023 than investors expect. No fed official forecast rate cuts this year.

“They don’t see light at the end of the tunnel yet with inflation,” said Derek Tang, an economist at LH Meyer in Washington. “They’re so alert of financial easing that’s ‘unwarranted’ that the scale should tilt to staying with 50 basis points in February. That’ll drive the message home.”

The minutes showed Fed officials intent on lowering inflation back toward their 2% target at the risk of rising unemployment and slower growth.

The record also highlighted the Fed’s rate projections being “notably above” market expectations for the path of policy, which several officials argued should underscore the FOMC’s determination to lower inflation to its 2% goal.

The Fed’s move last month extended its most aggressive tightening cycle since the 1980s. Starting from near zero in March, officials lifted their benchmark lending rate through successive meetings to a target range of 4.25% to 4.5%, the highest since 2007.

‘More Work’

Still, Chair Jerome Powell said at a post-meeting press conference that the committee has “more work to do,” explaining that how high rates ultimately rise and how long the Fed holds them there was more important than the pace at which officials reach that destination.

He also described the labor market as “out of balance,” and “extremely tight,” and warned that restoring stable prices is likely to require some “softening” in job market conditions.

A report earlier Wednesday showed that job openings — a key metric for Powell — were little changed at an elevated level in November. US payrolls are projected to have risen by a still-solid 200,000 in December, according to economists polled Bloomberg ahead of the release of the monthly employment report on Friday.

Quarterly economic estimates updated by Fed officials last month showed rates rising to 5.1% this year, according to their median projection, up from 4.6% in the prior round of forecasts in September.

The Fed’s staff said the possibility of a recession was “a plausible alternative to the baseline” outlook for slow economic growth for 2023.

Downside Risks

“The sluggish growth in real private domestic spending expected over the next year, a subdued global economic outlook, and persistently tight financial conditions were seen as tilting the risks to the downside around the baseline projection for real economic activity,” they said.

Seventeen of 19 officials projected rates at or above 5.1% this year. By comparison, not a single Fed official in September had forecast rates above 5% in 2023.

Policymakers next meet Jan. 31 and Feb. 1. Ahead of Wednesday’s minutes, futures markets were pricing in an increase of at least a quarter percentage point.

The minutes said officials will decide “meeting by meeting” on rates.

The more restrictive policy stance is expected to lift the unemployment rate to 4.6% by the end of the year, compared with 3.7% seen in November, the Fed’s latest projections showed.

Their forecasts also showed a higher median estimate for core inflation of 3.5% in 2023, about a percentage point lower than the 4.7% November reading of the core personal consumption expenditures price index.

–With assistance from Kate Davidson, Steve Matthews and Molly Smith.

(Updates with comment from economist in fifth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.