The bond market humbled Wall Street’s best and brightest in 2022. Oblivious to what lay ahead — the most-aggressive interest rate hikes in decades — one bond fund manager after another was saddled with heavy losses.

(Bloomberg) — The bond market humbled Wall Street’s best and brightest in 2022. Oblivious to what lay ahead — the most-aggressive interest rate hikes in decades — one bond fund manager after another was saddled with heavy losses.

Except for Scott Solomon and William Eigen.

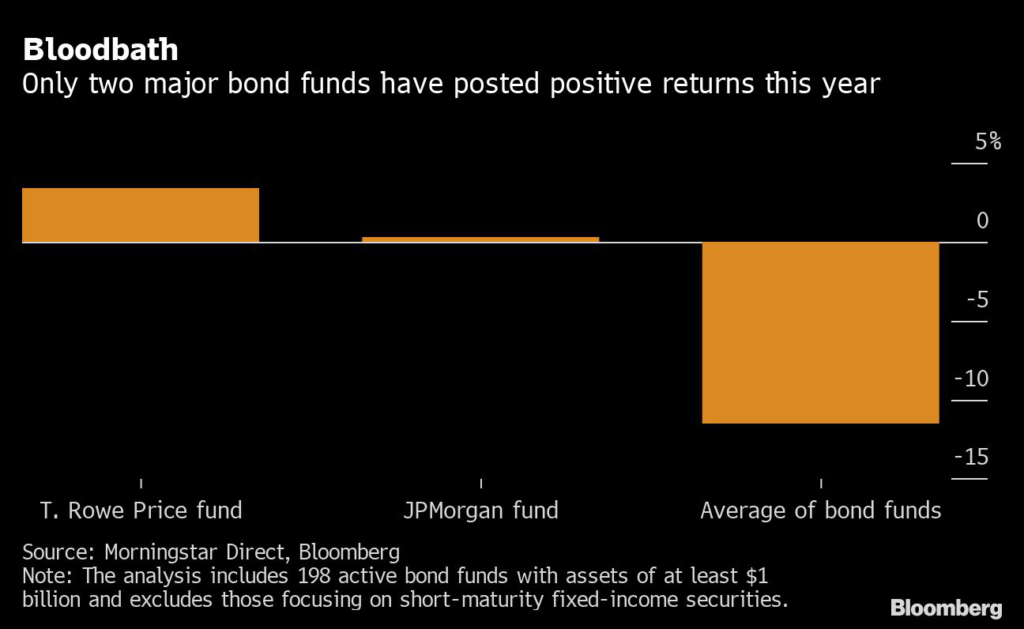

Of the 198 bond funds in the US that actively manage at least $1 billion, the ones they oversee — the T. Rowe Price Dynamic Global Bond Fund and the JPMorgan Strategic Income Opportunities Fund — are the only two that have managed to record a gain this year.

Their formulas for success were similar. Both men detected the flaws early in the inflation-is-transitory argument that swept across trading floors and, as a result, managed to shield their portfolios from the full fury of the Federal Reserve’s tightening cycle. Solomon, who co-manages the T. Rowe fund with Arif Husain in London, used derivatives that made money and protected the portfolio as interest rates rose. Eigen unloaded risky bonds and plowed the proceeds into cash.

And now, just like at the end of last year, these bond managers see their rivals committing a crucial mistake. This time, they say, the error is interpreting evidence of cooling inflation as a sign the Fed will begin looking for opportunities to lower rates shortly after it’s done raising them, to avert a deep recession. That sentiment is what’s driven much of the rebound in Treasuries since early November.

That’s a stance backed by Morgan Stanley Investment Management’s Jim Caron, who says markets just aren’t prepared for how far US central bankers are willing to go to tame the hottest inflation in a generation. “People expect rates to come down and I think we need to listen to what the central bankers are saying,” and their worries about inflation, said Caron, the firm’s chief fixed-income strategist.

Indeed, with core inflation still at 6%, triple the Fed’s target level, Solomon and Eigen believe policy makers will be in no hurry to start cutting rates. Fed Chair Jerome Powell said as much last week, pushing back against market positioning for the Fed to quickly reverse course, after he led the board in lifting borrowing costs at a seventh straight meeting.

“The Fed has let the inflation genie out of the bottle,” Eigen said. “It’s very difficult to put it back in.”

Defensive Strategy

Solomon expresses it this way: “The worst-case scenario for the Fed is an inflation path that bottoms and goes back up again, which is why we believe they will be slow to signal significant cuts. Not a lot of the market is willing to recognize that risk.”

Both managers are, for now at least, sticking to the defensive strategies they staked out late last year.

It’s a posture that has certainly been vindicated to this point. The average return among those 198 funds — which were screened using data compiled by Bloomberg and Morningstar Direct and exclude short-duration offerings — is a loss of 11.5% this year through Dec. 16. Meanwhile, the $4.5 billion T. Rowe fund gained 3.4%, and JPMorgan’s $9.2 billion fund earned 0.3%. (The story was similar in stocks, where a prescient call on inflation also led to rare gains.)

Looking at the past five years, the T. Rowe fund returned 2.7% annually — beating roughly 98% of peers, according to data compiled by Bloomberg. Meanwhile, the JPMorgan fund earned 1.6%, outperforming about 84%. That compares with a 0.3% average annual gain for the Bloomberg USAgg Index.

Limiting Losses

After these funds, the next-best performers this year are those who merely managed to limit losses.

That group is made up of investors like Lindsay Rosner, who readily acknowledges that she and her colleagues overseeing the PGIM Absolute Return Bond Fund started the year “very much in the transitory inflation camp.”

Realizing their error, they quickly changed course, unloading longer-term bonds, which got punished the most as rates rose. At one point, they brought the duration of their fund all the way to zero and still had about 6% in cash or the equivalent as of Nov. 30. Their $1.4 billion fund has lost about 1.4% this year.

Last week’s consumer-price report, which showed a second consecutive monthly slowing in a core inflation gauge, “still is not an invitation to jump back in the pool,” Rosner said.

Eigen is more attuned to developments on Main Street than most of his peers.

He owns an athletic facility in the New England area as a side business. In the summer last year, he noticed that costs — from food bills to gym equipment — were surging. That’s when he concluded the wave of elevated inflation wasn’t transitory, as Fed officials were claiming at the time.

He started to sell the risky assets in his portfolio, such as high-yield bonds. By January, the fund had shifted more than 60% of its assets into cash, which earns a return that climbs steadily as the Fed raises rates. As of late November, that amount was about 72%.

Eigen says he sees no signs of cost pressures subsiding at his facility. He can’t find workers, and when he does, they don’t stick around long, leaving him paying more to entice employees.

It also means Eigen still doesn’t find yields attractive enough to swap for his cash. And while historically Treasuries have rallied during an economic downturn as the Fed cut borrowing costs, he said there’s no guarantee that will happen this time because of higher inflation. Like the other managers keeping cash on hand, he’s waiting for market opportunities that he expects will arise as Fed tightening pressures parts of the market like lower-rated corporate debt.

“Right now people are assuming that the Fed’s going to be rapidly easing by the time we get to mid-year next year,” Eigen said. “I just don’t see it.”

–With assistance from Garfield Reynolds and Nicholas Reynolds.

(Corrects firm name in sixth graph of story originally published Dec. 21)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.