First Abu Dhabi Bank PJSC said it explored a potential bid for Standard Chartered Plc, in what would have been a complex deal aimed at building an emerging markets lender with more than $1 trillion of assets.

(Bloomberg) —

First Abu Dhabi Bank PJSC said it explored a potential bid for Standard Chartered Plc, in what would have been a complex deal aimed at building an emerging markets lender with more than $1 trillion of assets.

The Middle East’s largest bank was previously in the “very early stages of evaluating a possible offer for Standard Chartered” but is no longer doing so, it said in a regulatory filing Thursday. Bloomberg News reported earlier that FAB had been assessing Standard Chartered for more than six months as it considered a potential bid for the London-based lender.

The Abu Dhabi bank had been considering a full takeover of Standard Chartered, according to people familiar with the matter. FAB, as the firm is known, had been working with advisers though no formal approach had been made, the people said, declining to be identified as the deliberations are private.

The Gulf lender was also considering other deal structures, such as an acquisition of parts of the UK-based firm, one of the people said. Any deal faced significant hurdles given the complexity of the transaction, they said. A representative for Standard Chartered declined to comment.

Under UK takeover rules, FAB’s statement means they are precluded from making an offer for the lender in the next six months, except under certain circumstances including a third party announcing a firm intention to make an offer.

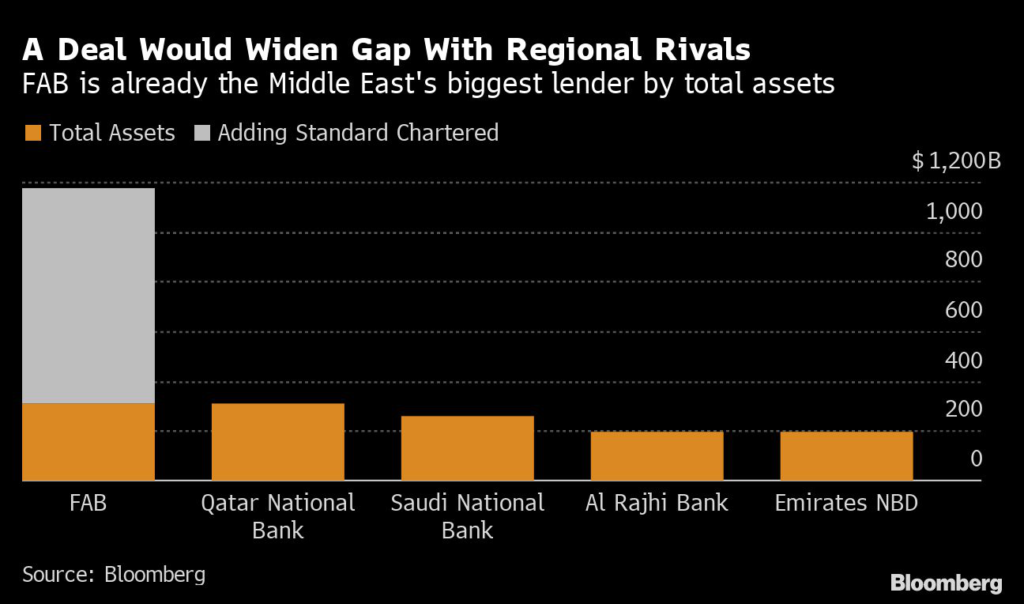

Their exploration of such a deal shows the growing ambition of Middle East lenders and the wealthy oil-rich nations that back them. Such a deal would have been the biggest foreign takeover by a company in the Gulf region and one of the largest bank mergers in the past decade. Standard Chartered was worth about $23.1 billion before the report, compared with FAB’s $51.9 billion valuation.

Shares in Standard Chartered rose as much as 21% on the reported takeover interest before giving up most of those gains to trade up 6.9% at 3:06 p.m. in London.

Flush with cash from last year’s commodity boom, Middle East investors from Abu Dhabi, Saudi Arabia and Qatar are on the prowl for opportunities after oil prices reached their highest level since 2008. Meanwhile, a weak pound and struggling economy is making British companies vulnerable to bids. Still, any takeover deal would be complicated because of the difference in size and scale of the two banks.

World’s Richest

FAB is roughly half owned by Abu Dhabi sovereign wealth fund Mubadala Investment Co. and members of the emirate’s ruling Al Nahyan family — the world’s richest with a $300 billion fortune. With debt markets largely closed elsewhere and concerns over a global recession hammering asset prices, Gulf sovereign wealth funds have recently been involved in some of the biggest takeover deals.

In recent years, FAB has built up a lucrative investment banking business and amassed about $312 billion in assets at the end of September. That compares with Standard Chartered’s $864 billion. With about $1.18 trillion in assets, the merged lender would be about a third the size of HSBC Holdings Plc — Standard Chartered’s historic rival.

Because Standard Chartered is classified as a Global Systemically Important Bank — unlike FAB — the Abu Dhabi lender would need to go through a particularly rigorous approval process, including seeking the green light from multiple regulators, to get a deal done. Another issue could be the large capital buffer that regulators may require FAB to hold, which may mean the bank would need to raise additional funds.

FAB was created in 2016 when Abu Dhabi combined its two largest lenders — National Bank of Abu Dhabi PJSC and First Gulf Bank PJSC. That merger was seen as a precursor to more deals in the UAE’s financial services industry, where dozens of lenders compete in a market of about 9 million people.

FAB bought Bank Audi’s Egyptian unit in 2021, but hasn’t made any other significant acquisitions. Last year, it withdrew a billion-dollar bid for investment bank EFG-Hermes after facing lengthy regulatory delays in Egypt.

Despite being headquartered in London, Standard Chartered makes the vast majority of its revenue and profit in Asia, the Middle East and Africa. The bank’s largest single market is Hong Kong, where the economy has been hit by drawn out pandemic restrictions which have curtailed business. It also has large hubs in Singapore and Dubai.

After struggling with historical misconduct issues and bad debts, the bank has long been seen as a potential takeover target for US and Asia-based banks, given its network in around 60 countries. Since Bill Winters took over as chief executive officer in mid-2015, shares have lost about a third of their value.

Speaking at a conference in 2021, Winters said he was unconcerned about the prospects of a takeover bid and that the bank was a “complicated beast” that few would want to buy.

“I don’t feel very vulnerable, but by the same token if there’s a very valuable combination out there and somebody wants to give it a go and explain to our shareholders why they are better off in combination than they are sticking with us alone, be my guest,” he said at the time.

New Hubs

In recent years, Standard Chartered has been exiting selective countries across Africa and the Middle East to focus on more fast growing markets in those regions. In 2019, it said it was creating two new hubs for its Asian operations in Singapore and Hong Kong to pare down its network and cut costs.

FAB’s current interest in Standard Chartered isn’t the first time the bank has attracted a potential suitor. In 1986 the lender fought off a takeover by Lloyds Bank and then took on the late Singaporean billionaire Khoo Teck Puat as its largest shareholder. In 2006, Khoo’s family sold its holding to Singaporean state investment firm Temasek Holdings, which remains a key investor.

European banks are long used to backing of wealthy Middle Eastern investors. Saudi National Bank is set to become one of Credit Suisse Group AG’s biggest shareholders following an investment late last year. The struggling Swiss lender already counts Saudi conglomerate Olayan Group and the Qatar Investment Authority among some of its top investors. Some of the region’s funds also stepped in to invest billions in lenders including Barclays Plc, Credit Suisse and Citigroup Inc. during the 2008 financial crisis.

–With assistance from Archana Narayanan, Jan-Henrik Förster and Harry Wilson.

(Adds takeover rules to fifth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.