After US employment bounced back to its pre-pandemic level in 2022, the trajectory entering this year suggests payroll growth will level out or reverse course altogether.

(Bloomberg) — After US employment bounced back to its pre-pandemic level in 2022, the trajectory entering this year suggests payroll growth will level out or reverse course altogether.

Employers added 4.31 million jobs last year through November — second only to 2021’s surge, and data to be released Friday are projected to show that payrolls rose another 200,000 in December.

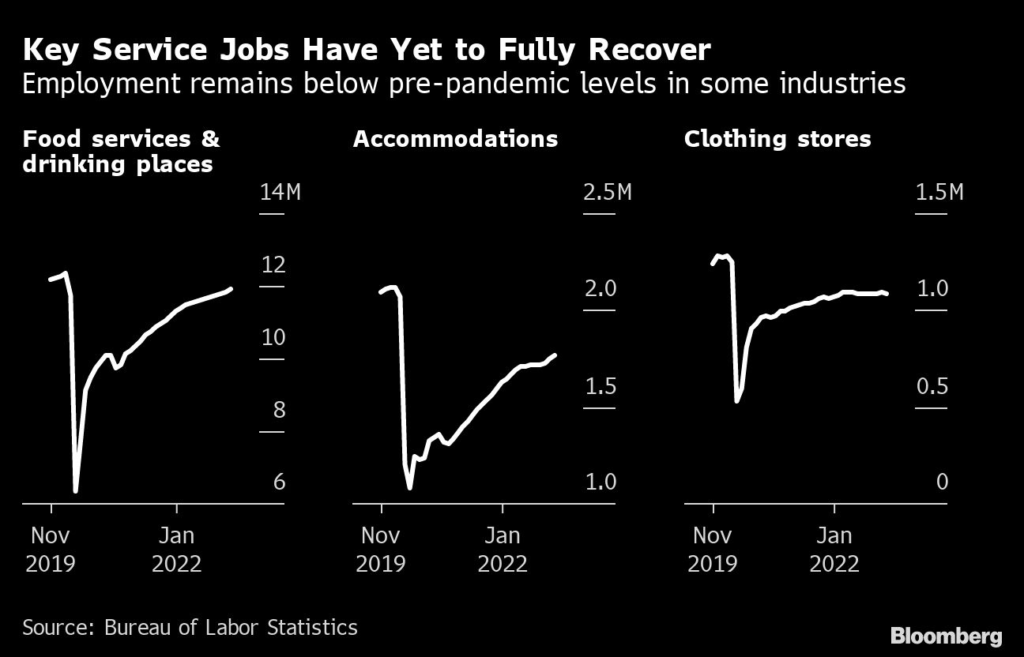

The return to pre-Covid payrolls was uneven. Industries like transportation and warehousing are now way above where they were before the pandemic, while hundreds of thousands of jobs are still missing in government as well as leisure and hospitality.

The Federal Reserve is set to pause its most aggressive interest-rate hiking cycle since the 1980s this year, and how long rates stay elevated depends in large part on labor demand and wage growth, which has contributed to rapid inflation.

Fed officials see the unemployment rate rising by nearly a full percentage point this year — albeit from a historically low level — which policymakers deem necessary to get inflation in check.

Whether that results in a recession, which most economists suspect is the case, remains to be seen.

Here’s a look at where jobs came roaring back in 2022, and where they failed to, and what that means for the year ahead.

Biggest Gains

Some industries, which had already recovered to pre-pandemic levels, continued their strong momentum into 2022. The transportation and warehousing sector employed nearly 6.5 million people as of November, compared to about 5.8 million at the start of the pandemic.

However, as some Americans pulled back on spending and others shifted their dollars from goods to services, employment in the industry started to struggle. Payrolls have declined for four straight months, the longest stretch since 2009.

Employment has grown substantially in industries that offer remote work, including professional and technical services. It’s a broad category that the Bureau of Labor Statistics defines as including lawyers, accountants, engineers and consultants, and it’s swelled by nearly 1 million payrolls since February 2020.

Sectors like banking and technology, which went on massive hiring sprees during the pandemic, are now cutting back due to a drop in demand, restructuring efforts and partly in response to the Fed’s rate hikes. Goldman Sachs Group Inc. is planning to reduce headcount in the first half of January, while Amazon.com Inc. is shedding more than 18,000 employees.

Those layoffs have started to roll over to administrative and support services. After recovering to pre-Covid staffing levels by the end of 2021 and setting a record in 2022, employment has now fallen for three straight months, the worst stretch since the onset of the pandemic.

Read more: It’s White-Collar Jobs That Are at Risk in the Next Recession

Front-Line Workers

The burnout from Covid has been most apparent in front-line professions like health care and education. While employment ticked up throughout 2022, the US is still down almost 320,000 nursing and residential care jobs since February 2020. Acute labor shortages and the cost burden of hiring replacements have already pushed some hospitals into bankruptcy and threaten to keep the sector under stress in 2023.

Teachers have also left en masse, keeping local education employment well below its pre-Covid level. At the start of the pandemic, schools laid off all kinds of educational support staff. But as students returned to the classroom, the sector struggled to retain teachers amid widespread stress, health concerns and low pay.

The sector is down about 270,000 jobs compared to February 2020, hovering near 2014 staffing levels.

Services Struggling

Despite a rapid snapback in demand for services, there are still over 1.5 million jobs open across the leisure and hospitality sector. While many employers have rapidly increased pay to attract and retain workers, wages in the industry are generally still lower than hourly positions in other professions like transportation and warehousing.

In sectors like retail, where payrolls for the larger industry are back above February 2020 levels, the details paint a different picture. For instance, employment at clothing stores has stagnated below pre-pandemic levels amid generally low pay and a move toward online shopping.

It’s the pace of wage growth in these types of jobs that has the Fed particularly concerned. Labor costs make up a big chunk of overall expenses in services industries excluding energy and shelter, which Chair Jerome Powell has zeroed in on as a sticky element of inflation.

Data out Thursday showed a sharp deceleration in wage growth in December while job growth at US companies far exceeded expectations. Another report showed applications for jobless benefits fell to a three-month low, reinforcing the strength of the labor market.

Government Exodus

One key laggard is government employment. After shedding over half a million jobs in early 2020, local government payrolls, excluding education, were still short nearly 175,000 jobs as of November. At the state level, the shortage is less severe but nonetheless present.

Part of the issue stems from an inability to keep up with private sector wage growth, but hiring and retention have also been challenged both by a wave of retirements and the in-person nature of many roles.

Regional Breakdown

The employment recovery has been uneven not only in terms of industries but also geographies. Twenty-four states, including New York and Illinois, have yet to see payrolls rebound to February 2020 levels. However, others like Florida and Texas benefited from migration shifts triggered by government responses to the pandemic.

–With assistance from Alex Tanzi and Jordan Yadoo.

(Updates with Thursday labor data)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.