In what’s already likely to be a tough year for the $1.4 trillion leveraged loan market, the biggest buyers of those loans now face an extra hurdle: time limits on their ability to freely reinvest their money.

(Bloomberg) — In what’s already likely to be a tough year for the $1.4 trillion leveraged loan market, the biggest buyers of those loans now face an extra hurdle: time limits on their ability to freely reinvest their money.

By the end of 2023, more than 40% of collateralized loan obligations will be subject to restrictions on their ability to easily manage their portfolio by investing in new loans, according to Bank of America Corp.

That means CLO managers will have less flexibility to keep their loan collateral safe just when they need it most. The share of CCC rated loans in CLO portfolios hit 5.6% by mid-December, according to the bank, not far from the carefully watched 7.5% level where individual CLOs may need to begin looking to divert cash flows from equity holders.

And that share may only grow from here. The first “real” credit cycle in 20 years is bearing down as the Federal Reserve raises rates, said Mark Okada, Sycamore Tree Capital Partners’ chief executive officer, on Bloomberg TV this week. It will take around two years for yields to adjust to fundamentals, he said.

Read More: CLO Issuers Near Limits on Loan Buying, Squeezing Junk Borrowers

The result for many CLO managers is an even greater focus on what’s rapidly becoming the most important kind of leveraged loan that they hold: loans rated B-. This type of loan is just one downgrade away from the all-important CCC rating.

“CLO managers are likely working hard to sort out the B- loans that will eventually be downgraded from those that won’t be downgraded,” said Steven Abrahams of Amherst Pierpont Securities, a broker-dealer owned by Santander.

One way they’ll be able to tell the good from the bad is by looking at prices. The universe of loans rated B- is trading at a wide range, from roughly 70 to 90 cents on the dollar. The main difficulty lies in what to do about loans at the bottom end of that range. It’s too late now to sell those loans without locking in steep losses.

“The ability to pick through loans to separate the ones that can be salvaged from the ones that can’t is what will distinguish managers this year,” said Abrahams.

Other Top Stories

- CLO Issuers Near Limits on Loan Buying, Squeezing Junk Borrowers

- Sycamore’s Okada Bets on Quality Securitized Debt as Cushion

- Car Owners Strain as More Loan Payments Soar to $1,000 a Month

- Credit-Card Costs Poised to Hit Highest on Record by End of 2023

- Subprime Auto Lender CAC Sued by NY Over ‘Predatory’ Loans (1)

- Credit Risk Transfer Scores Small Gain in 2022, Fontanilla Says

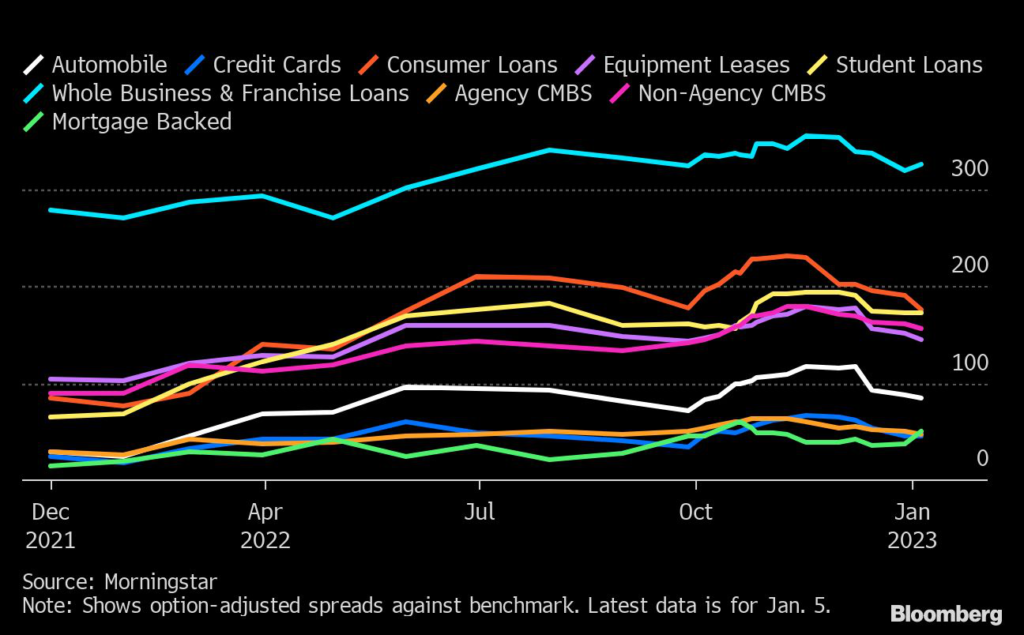

Spread Change

Quotable

- “There’s a durable arbitrage built into AAA CLOs. There’s a regulatory arbitrage,” said Sycamore Tree’s Okada. “You’re floating rate, you’re AAA. I’m pounding the table on that trade.”

What’s Next

- GM Financial, Westlake Financial, and Avis are marketing the first US ABS deals while Onslow Bay is in the market with a non-QM RMBS deal. The pipeline is building, with recent 15G filings from FREMF 2023-K153 Mortgage Trust and Verus Securitization Trust 2023-1, among others

For more details on new issue deal flow, see Structured Pipeline stories here

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.