Real, Brazilian stocks trail global peers amid political concerns after Sunday’s insurrection

(Bloomberg) — Brazilian assets, already being shunned by investors, retreated further on Monday after an insurrection led by supporters of former President Jair Bolsonaro reignited fears of political instability in Latin America’s largest economy.

Strategists from Citigroup Inc. to UBS Global Wealth Management and JPMorgan Chase & Co say the fresh slump may be short-lived as the government re-establishes order. But the chaotic scenes of rioters storming public buildings are unlikely to foster optimism with local markets, which are trailing global peers in the new year as investors worry about Luiz Inacio Lula da Silva’s policies.

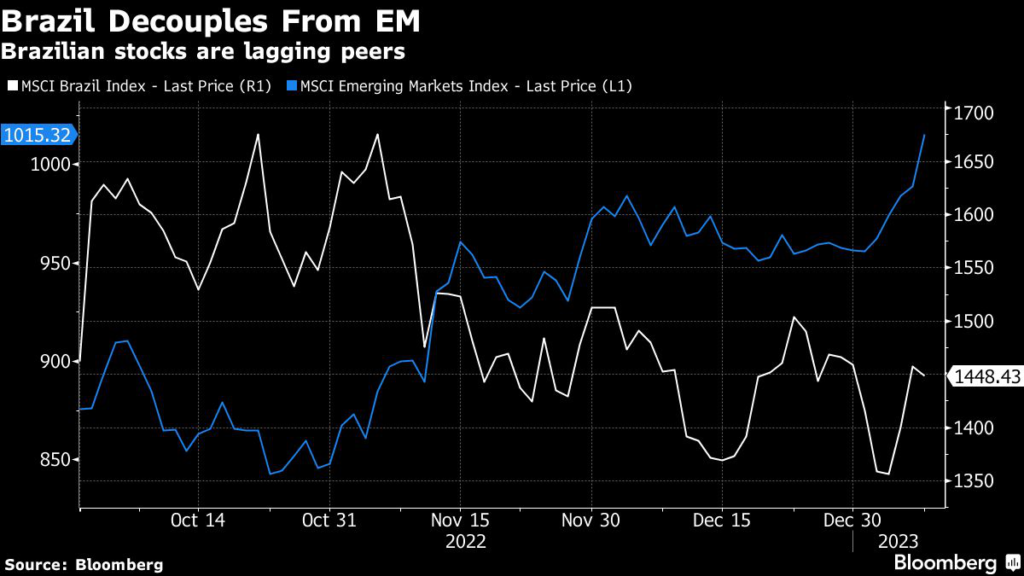

Brazilian hedge funds have largely ditched domestic assets amid signals the new government may reverse market-friendly measures done in recent years and damage fiscal accounts by overspending. Foreigners increased their bearish bets in the real by $3 billion in the first week of 2023, making it one of the worst-performing currencies in emerging markets. The MSCI Brazil index is down 1.3% year-to-date, compared with a 6% advance for the developing-nations benchmark.

United front

Lula, who was inaugurated just last week, is putting on a united front together with lawmakers and the nation’s judiciary. The president held a meeting with the heads of the Supreme Court, congress and several of his cabinet members at a presidential palace left in shambles. Authorities have dispatched additional police forces to the capital, removed the local governor and arrested hundreds of rioters.

Read More: Lula Asserts Authority in Brazil as 1,500 Bolsonaro Backers Held

“Decisive government action and support by congressional leaders will help, but ultimately the situation on the street and in Brasilia needs to remain under control,” said Gordian Kemen, head of emerging-markets sovereign strategy at Standard Chartered Bank.

This is not the first time investors are sanguine to political turmoils in the Latin American country. Traders shrugged off pro-government protests that followed the presidential runoff in late October, even as Bolsonaro fostered fears of a contested election by remaining silent after losing the vote.

As long as investors realize the riots won’t alter the bigger picture and social unrest doesn’t escalate further, Brazilian assets are likely to recover from the events, according to Brendan McKenna, a New-York based emerging-markets economist & FX strategist at Wells Fargo.

“At the end of the day, Lula is sworn in and Brazil’s democracy is very unlikely to be disrupted,” he said.

The real weakened 0.7% on Monday, leading losses among the world’s 16 major currencies tracked by Bloomberg, while the benchmark Ibovespa equity index swung between gains and losses. The declines come amid a positive day in global markets, with gauges of emerging-market currencies and equities climbing at least 1.1%.

No help

Still, investors are far from optimistic. Foreign inflows expected when Lula won the Oct. 30 runoff, promising to restore Brazil’s image abroad, have so far failed to substantially increase.

Sao Paulo-based hedge fund manager Verde Asset Management told its clients last week the country risks missing out on a big opportunity to stand out among its peers. A Bank of America Corp. survey with Latin American money managers who oversee $79 billion released last month showed that investors are keeping cash levels close to record highs. More than half of them are taking protections against a sharp fall in the region’s equity markets, above the historical average of 35% of the poll.

“By themselves, the weekend events are not a game changer. But it comes at a time when questions on Brazil are a bit higher than before,” said Guillaume Tresca, Global EM strategist at Generali Insurance. “There is a lot of risk premium related to the new administration, risk related to the power transition. Weekend events did not really help the risk premium to decline.”

–With assistance from Davison Santana.

(Updates with context, chart starting in third paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.