Over 800,000 UK households will see their mortgage rates more than double this year as they come off low fixed-rate deals, adding to the pressure on living standards.

(Bloomberg) — Over 800,000 UK households will see their mortgage rates more than double this year as they come off low fixed-rate deals, adding to the pressure on living standards.

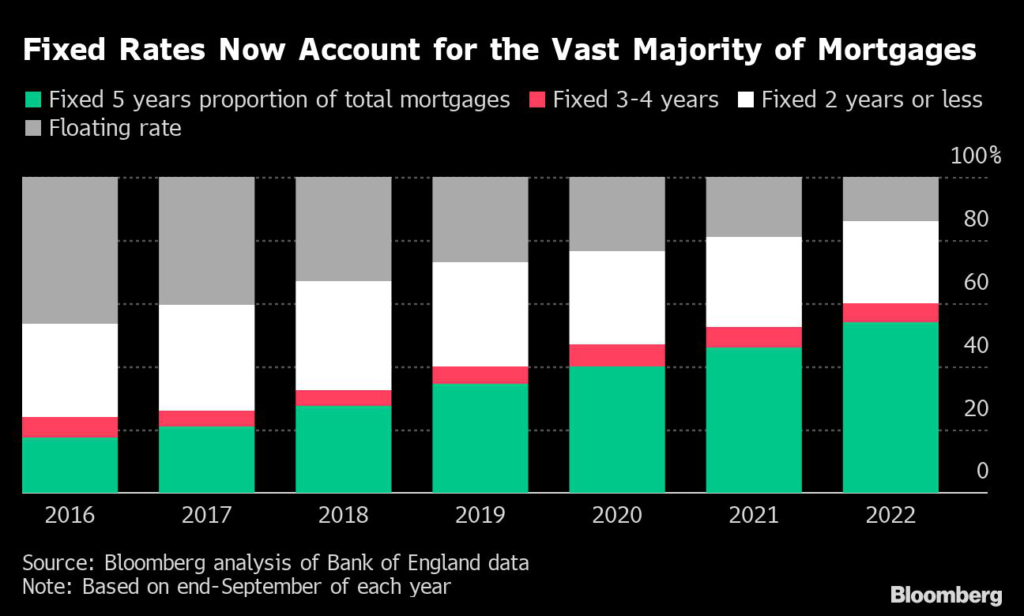

In total, more than 1.4 million fixed-rate borrowers will have to renew their mortgage in 2023, with 57% currently on deals of less than 2%, according to an Office for National Statistics analysis of Bank of England data. The average variable rate mortgage is currently 4.41% and fixed-rate deals start at around 5%.

A typical fixed-rate mortgagor faces a £250 ($300) increase in their monthly payments if their deal expires this year. The hit will squeeze incomes further for those already reeling from soaring prices of energy and other goods.

Including households on variable deals, a total of 4 million UK homeowners are exposed to rate rises this year, the BOE said in December.

Banks and building societies have raised their mortgage offers because the BOE raised interest rates from 0.1% in December 2021 to 3.5% last month to tame double-digit inflation. Rates are expected to reach between 4% and 4.5% this year.

The ONS warned that the living-standard squeeze may be even harder for private tenants as rents are currently rising at 4%, the fastest pace since records began in 2016 as landlords pass on higher mortgage costs.

Private renters spend on average £106.50 a week on rent, compared with £140.80 for mortgage holders. However, as homeowners tend to be wealthier, the sums amount to 24% of weekly spending for renters and just 16% for mortgagors. For low-income renters, housing accounts for 30% of spending, the ONS added.

The ONS’s opinions and lifestyle survey found that both renters and mortgage borrowers are finding their housing costs “increasingly difficult to service.”

Landlords are particularly exposed to rising rates because the majority are on interest-only deals. More than a third of deals expire in the next two years, at which point landlords will have to choose between increasing rents to cover their costs or selling.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.