European Central Bank Executive Board member Isabel Schnabel said borrowing costs must be lifted much further, with inflation only just having dipped back into single digits.

(Bloomberg) — European Central Bank Executive Board member Isabel Schnabel said borrowing costs must be lifted much further, with inflation only just having dipped back into single digits.

“Interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to our 2% medium-term target,” she said Tuesday.

“Inflation will not subside by itself,” Schnabel told a Riksbank conference in Stockholm, held in honor of Stefan Ingves, who recently ended a 17-year stint as head of Sweden’s central bank.

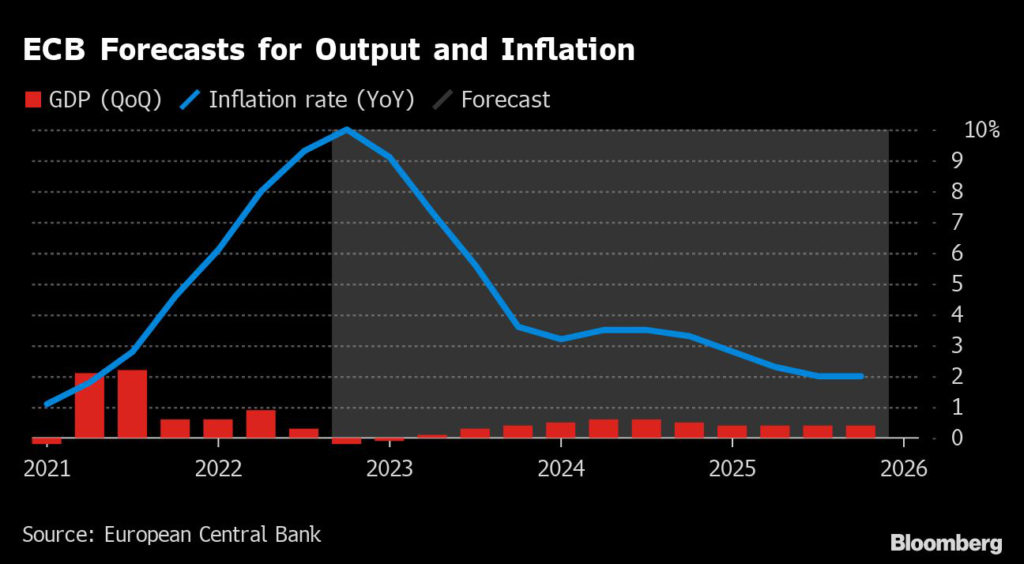

Despite headline inflation coming off euro-era highs in recent months, ECB officials are adamant that monetary policy must be tightened further to tackle underlying price growth that quickened to a record in December. A stronger-than-expected economy is boosting their case, with Goldman Sachs now predicting the euro-zone will dodge a recession.

Schnabel pushed back against complaints that higher borrowing costs complicate Europe’s green transition by making the necessary investments pricier.

“While a higher cost of credit will make the financing of renewable energies and green technologies more expensive, it would be misleading to use higher interest rates as a scapegoat for a further delay in the green transition,” she said.

Schnabel also flagged a potential shift in stance on how the ECB can contribute to greening the economy. While policymakers have in the past committed to considering environmental standards when reinvesting maturing corporate bonds held by the ECB, they aren’t currently swapping assets issued by polluting industries for cleaner options.

“Absent any reinvestments, actively reshuffling the portfolio towards greener issuers would need to be considered,” Schnabel said.

Any attempt to green the ECB’s stock of bond holdings also needs to include its sovereign-bond portfolio, she said — “in particular in the light of the review of the ECB’s future operational framework, which is likely to imply a larger steady-state balance sheet, potentially including a structural bond portfolio.”

As options, she mentioned increasing the share issued by supranational institutions and agencies, as well as a steady reshuffle of its holdings as governments expand green bond supply.

Schnabel also cited green targeted lending operations as a potential future instrument that could be considered when policy needs to become expansionary again.

“But they are not an option for the immediate future given the current need for a restrictive monetary policy,” she said.

–With assistance from Love Liman, Craig Stirling and Kati Pohjanpalo.

(Updates with Schnabel comments on bond portfolio starting in ninth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.