(Bloomberg) — Federal Reserve Governor Michelle Bowman said the central bank has more work to do to curb inflation, noting that further interest-rate increases are needed and officials should hold them at restrictive levels for some time to stabilize prices.

(Bloomberg) — Federal Reserve Governor Michelle Bowman said the central bank has more work to do to curb inflation, noting that further interest-rate increases are needed and officials should hold them at restrictive levels for some time to stabilize prices.

“In recent months, we’ve seen a decline in some measures of inflation but we have a lot more work to do, so I expect the FOMC will continue raising interest rates to tighten monetary policy, as we stated after our December meeting,” Bowman said Tuesday in prepared remarks for an event in Miami with the Florida Bankers Association.

Policymakers are driving home the message that they aren’t done tightening policy as they work to squash inflation that rose to a four-decade high last year. Officials unanimously approved a half-point hike in December, bringing the target on their benchmark rate to a range of 4.25% to 4.5%.

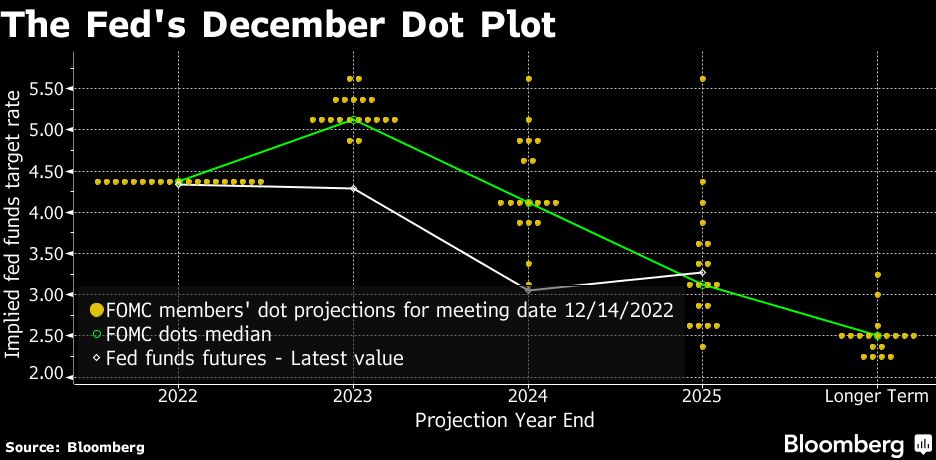

Fresh economic projections released at the meeting showed that 17 out of 19 Fed officials see rates rising above 5% this year. No policymakers expect to cut interest rates in 2023. Officials will next meet on Jan. 31-Feb. 1.

Bowman said the scale of future rate moves and the point at which officials stop hiking will be determined by what happens with inflation, adding that she wants to see “compelling signs that inflation has peaked” and is looking for “consistent” evidence that it is on a downward path.

The Fed governor is the latest official to make it clear that policymakers expect to hold interest rates at higher levels for a while, allowing time for their aggressive increases to work their way through the economy, slowing growth and creating better balance between supply and demand. She said it is likely the labor market will weaken as inflation comes down.

“I expect that once we achieve a sufficiently restrictive federal funds rate, it will need to remain at that level for some time in order to restore price stability, which will in turn help to create conditions that support a sustainably strong labor market,” she said.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.