The resurgence in volatility that sent markets into a tailspin could not have come soon enough for quant fund pioneer David Harding.

(Bloomberg) — The resurgence in volatility that sent markets into a tailspin could not have come soon enough for quant fund pioneer David Harding.

Reeling from losses and an exodus of clients that reached a nadir in 2020, Harding’s hedge funds rode the ferocious macro-driven price trends in global markets last year to emerge as one of the industry’s biggest winners. The multi-strategy Winton fund rose 17% for its best year since 2008, while another fund chasing broader market trends returned 18.7%. Peers tracked by Bloomberg gained 5.5%.

The end of near-zero rates as central banks began rolling back years of quantitative easing proved a boon to systematic trades deployed by quant funds. The effect of rising interest rates was to abruptly end the low-volatility bull market that had caused a near-existential crisis for computer-powered portfolios.

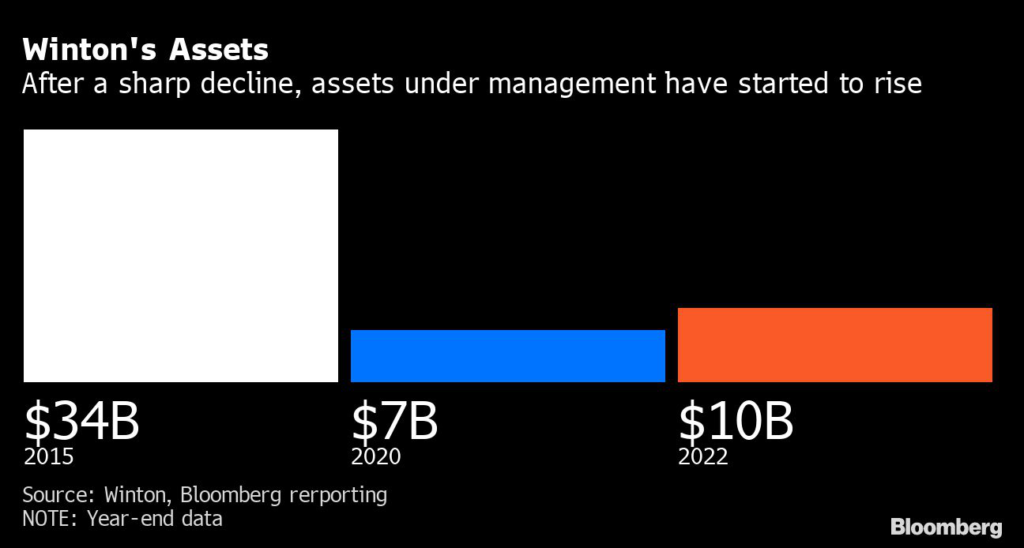

London-based Winton had been among the worst hit. Its assets fell by 80%, shrinking by almost $27 billion from its peak to $7 billion in 2020. A rebound in performance over the past two years is helping to win back clients and assets have risen to $10 billion, according to a spokesman for the firm.

“We arrive in 2023 with nearly 40 years of successful trend-following experience, not an easy ride, but a successful one for anyone who has been effectively lashed to its mast,” Harding, 61, said in a January letter to clients seen by Bloomberg.

Part of the reason behind Winton’s decline in fortunes can be traced to a decision in 2018 to move away from a popular quant strategy called trend following that aims to profit from persistent rises or falls in prices of securities.

Harding helped develop the strategy in the 1980s and gained a following after gliding through the 2008 global financial crisis with double-digit gains. But 10 years later, after a period of mediocre returns, Winton slashed trend-following from a more than 50% weighting in the fund to 30% as it looked to diversify into new markets and securities and develop fresh trading signals.

The radical change coincided with poor returns. The fund plunged almost 21% in 2020, its biggest-ever annual decline in more than two decades of trading and underperforming peers who had stuck more closely to trend following.

That’s when his clients started to leave. An attempt to stem outflows by starting a dedicated trend-following strategy had little effect.

“Our accelerated attempts at diversification met with mixed success, and in 2020 we met a severe challenge when several of our diversifying strategies, almost simultaneously, performed poorly,” Harding wrote in the January letter, reflecting on 25 years of starting Winton following an acrimonious departure in 1996 from what is now Man Group Plc’s AHL division, a company he co-founded. Harding is the H in AHL. “Since then, our systems have bounced back strongly.”

The firm joins peers such as Brevan Howard Asset Management in rebounding from a precipitous decline in assets, with a change in market direction providing timely help.

While most of the growth at Winton has been a result of performance gains, the firm has also raised hundreds of million of dollars via a sales team that is at its smallest in 15 years, according to a spokesman.

Instead, Winton has doubled down on its team of researchers and mathematicians with the investment and technology team making up 70% of the total headcount, he said.

Unlike in the past, when Winton confined itself to hiring from academic institutions, the firm has begun recruiting senior people from other quant firms or from other parts of the industry to add expertise it doesn’t have in-house. Last April, Winton hired Laurent Henrio and Laurent Cousot from Squarepoint Capital to build a quant-credit team.

Meanwhile, the humble and commoditized trend following strategy has gained new respect among the maths wizards after it produced its best ever returns in a year when global markets collapsed.

The funds were among few strategies that lured fresh capital last year, raising $8.7 billion through October when the industry overall suffered $75 billion in outflows, according to data compiled by eVestment.

In his three-page letter, Harding mentioned “trend” 21 times and said that Winton still places a high weight on the strategy he helped to develop.

“Other strategies have evolved in other sectors of the market, such as high-frequency strategies from market making and alpha capture from equity research analysis,” Harding wrote. “There has been an entrepreneurial flowering of companies exploiting these opportunities and Winton has only had some success thus far in creating a fund combining all of them.”

“Our dreams of the 90s remain partially unfulfilled,” he added.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.