Meta Platforms Inc. is expected to be the top-performing megacap internet stock this year, according to a JPMorgan survey of investors, suggesting a rebound for the Facebook parent after its worst year on record.

(Bloomberg) — Meta Platforms Inc. is expected to be the top-performing megacap internet stock this year, according to a JPMorgan survey of investors, suggesting a rebound for the Facebook parent after its worst year on record.

According to the survey, 41% of respondents named Meta as the company they expect will perform the best this year, followed by Amazon.com Inc. at 36%, though e-commerce is expected to be the best-performing subsector. Streaming-video company Netflix Inc. is expected to be the worst-performing megacap.

Shares of Meta are up 0.7% as of 10:10 a.m. New York time Tuesday, while Amazon and Netflix gained 1.8% and 1.5%, respectively.

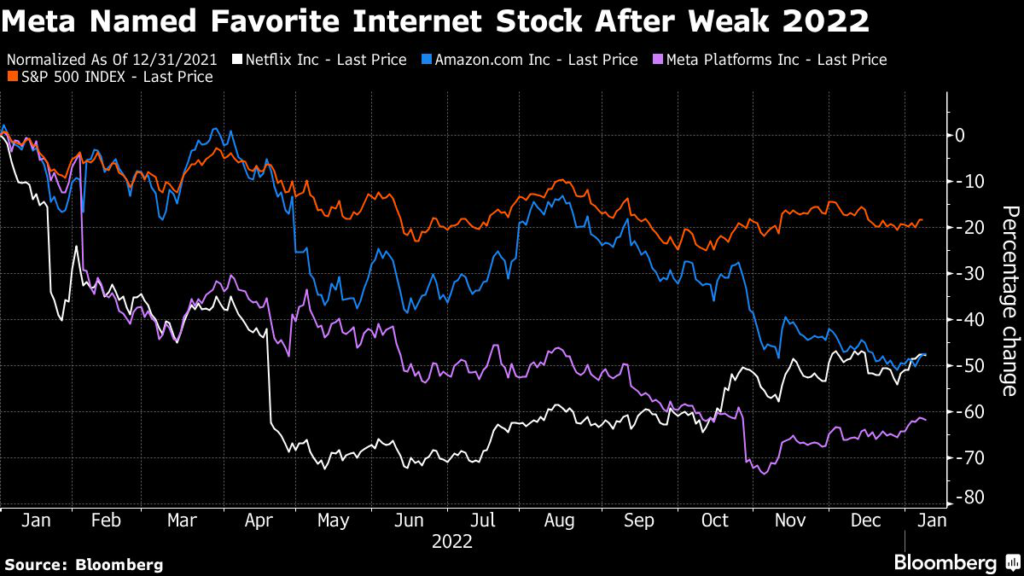

All three companies are coming off sizable drops; Meta fell 64% in 2022, making it one of the 10 worst performers among components of the S&P 500 Index, which itself fell 19%. Amazon fell 50% in its biggest one-year drop since 2000 and Netflix fell 51%, though it is up nearly 90% off a June low.

The group saw widespread pressure as the Federal Reserve aggressively raised interest rates to combat inflation, weighing on the multiples of so-called growth companies, while also raising the prospect of a recession. Meta saw outsized weakness as it struggled with a changed privacy policy at Apple Inc., which diminished its ability to sell targeted ads on iPhones. Investors also questioned Meta’s controversial plan to invest heavily in the metaverse.

Following last year’s selloff, “respondents to our buyside survey expect the US Internet sector to slightly outperform the S&P 500 this year,” wrote JPMorgan analyst Doug Anmuth. Per the survey, 43% of respondents expect market-cap weighted internet stocks to be up more than 5% this year, while 30% expect it to be flat. To compare, 30% of respondents expect the S&P 500 to be up more than 5% in 2023, while 45% expect flat returns.

The JPMorgan survey shows investors see three primary tailwinds for the internet sector, including attractive valuations, easing year-over-year comparisons, and improved cash flows and margins. The respondents cited macroeconomic concerns — including rates and inflation — as the biggest expected headwinds, along with a deceleration in revenue and growth.

Beyond the market’s biggest companies, the survey indicates investors expect Match Group Inc., the parent company of dating app Tinder, to be the best-performing mid-cap internet stock this year, and for apparel retailer Farfetch Ltd. to be the top small-cap. Twenty-four percent of respondents named Farfetch, which JPMorgan wrote was “higher than we expected.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.