European natural gas prices declined for a second day as strong LNG supply vied with forecasts for colder weather next week that could boost demand.

(Bloomberg) — European natural gas prices declined for a second day as strong LNG supply vied with forecasts for colder weather next week that could boost demand.

Benchmark futures fell 6.7%, settling at the lowest level in a week.

Imports of liquefied natural gas have been undeterred by the halving of gas prices over the past month, as demand in Asia remains muted. That’s providing a safety net against expectations of colder-than-usual conditions in the UK, Nordics and parts of southwest Europe.

LNG has been critical for the region to fill in the gap left by Russia’s deep pipeline-supply cuts following the country’s invasion of Ukraine last year.

While a few weeks ago it became more profitable for US providers to sell to Asia, that premium hasn’t lured cargoes away from Europe. An uptick in Asian demand could still swing the balance.

Also read: Europe Still Winning on LNG Imports Even as Prices Slump

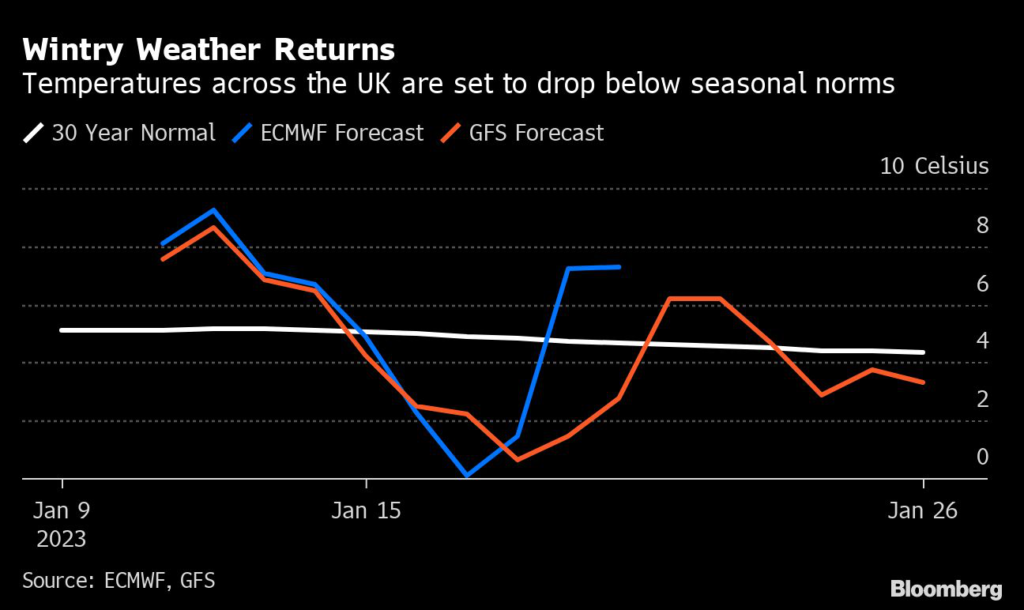

Meanwhile, the weather remains a key risk for Europe.

Gas stockpiles are fuller than they usually are for this time of the year thanks to the recent mild temperatures. Traders will be focusing on the severity of the cold spell next week and the impact on demand.

Analysts at Energi Danmark see no “real winter” for northern and western Europe in the days ahead.

Click to read the daily Europe Energy Crunch blog

“Despite the risk of a colder end to January and early February, the abundance of gas in Europe will continue to curb the upside risk, even with increased demand from Asia,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Dutch front-month gas futures, a European benchmark, settled at €65.346 a megawatt-hour, after rising as much as 4.2% at the start of the trading day.

The UK equivalent contract dropped 6.2%. German power fell 2.5%.

–With assistance from Anna Shiryaevskaya.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.