Sri Lanka will probably clinch a debt restructuring deal with its creditors only by the end of the year, with Standard Chartered Plc predicting losses for both domestic and dollar bondholders.

(Bloomberg) — Sri Lanka will probably clinch a debt restructuring deal with its creditors only by the end of the year, with Standard Chartered Plc predicting losses for both domestic and dollar bondholders.

The International Monetary Fund board approval of a $2.9 billion bailout for the island nation is likely to happen in the second rather than first quarter of the year, “given delays in securing financing assurances from bilateral creditors,” analysts at Standard Chartered including Shankar Narayanaswamy and Saurav Anand wrote in a note. That means talks with commercial creditors are likely to be pushed to the second half of the year, they wrote.

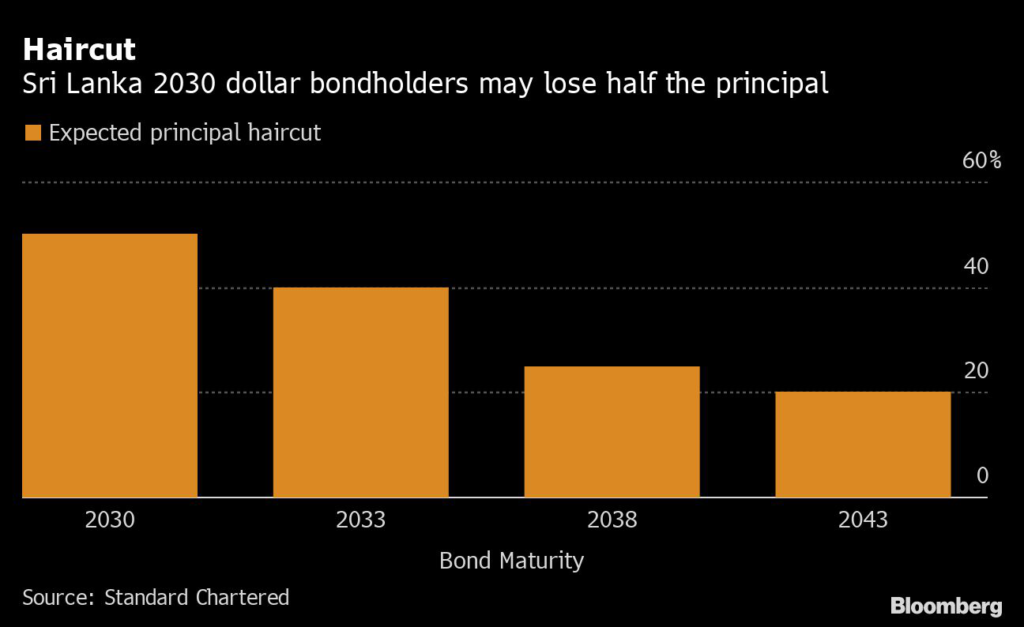

Debt negotiations have yielded little progress since Sri Lanka defaulted in May, with creditors bickering on the size of losses they are willing to accept and whether local debt should be included in the restructuring. Standard Chartered estimated an exit yield of 11% to 15% on the dollar bonds, resulting in a recovery value of 22 to 33 cents on the dollar, in line with where the notes are currently trading.

The 7.55% 2030 dollar bond was indicated 1 cent lower at 30 cents on the dollar on Thursday.

Debt restructuring will also likely include a coupon reduction and maturity extension for both local and dollar bonds, the analysts wrote. Sri Lankan authorities want to avoid including domestic debt over concerns about the impact it may have on the country’s banking system.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.