China’s economy proved more resilient than analysts forecast as a virus wave swept the nation, suggesting the worst of the slump may be over as a challenging recovery begins.

(Bloomberg) — China’s economy proved more resilient than analysts forecast as a virus wave swept the nation, suggesting the worst of the slump may be over as a challenging recovery begins.

While gross domestic product growth of 3% last year was the second slowest pace since the 1970s, fourth quarter and December data came in better than economists had expected.

Economists see a recovery in coming months once the current Covid wave passes, predicting growth of close to 5% in 2023. But the rebound won’t be straightforward: Consumer confidence remains near record lows, the population has started shrinking for the fist time in six decades and the property market remains in the doldrums.

“The outlook for GDP growth in 2023 has improved compared to our prior outlook,” said Iris Pang, chief economist for Greater China at ING Groep NV, who now sees China’s economy growing 5% in 2023. “That is not to ignore the fact that China still faces considerable headwinds, including external demand, with recessions likely in the US and Europe this year.”

The CSI 300 gauge of onshore stocks ended the day little changed, erasing declines of 0.5%. Hong Kong’s Hang Seng Index extended its drop to as much as 1.5%.

GDP growth last year was far lower than the 8.4% recorded in 2021, when strict virus controls kept the nation largely Covid free. But the reading was higher than the median estimate of 2.7% in a Bloomberg survey of economists as growth in the fourth quarter came in at 2.9%, topping forecasts for 1.6%.

The government had initially set a growth target of around 5.5% in 2022, before Covid lockdowns and the sudden abandoning of restrictions in December put that goal out of reach. Activity was weak in December, though again beat economists’ gloomy forecasts.

- Industrial output rose 1.3% from a year ago, higher than a forecast of 0.1%

- Retail sales contracted 1.8% versus a predicted 9% decline

- Fixed-asset investment gained 5.1% last year, largely in line with forecasts

- The urban jobless rate fell to 5.5% last month from 5.7% in November

Policymakers have signaled they’re prioritizing economic growth in 2023, with a key focus on boosting consumption and investment in the country. More fiscal and monetary stimulus could be on the cards, while the government also recently took steps to ease its regulatory overhaul of the technology industry and reverse some of the restrictions on the real estate market.

What Bloomberg’s Economists Say

China’s fourth-quarter GDP should be viewed with both concern and a degree of relief. The overshoot relative to expectations will assuage worries about a crash. The data were still very weak — there’s no hiding the fact that the economy took a very heavy blow from the messy exit from Covid Zero and outbreaks that swept across the country in December. Even so, high-frequency indicators suggest that the economy may have have bottomed. We see a solid rebound taking hold in 2Q23.

— Chang Shu and Eric Zhu

For the full report, click here

Tuesday’s data deluge also highlighted longer-term challenges, with the population contracting in 2022 for the first time since 1961. That will have repercussions for the labor market, demand for housing and the country’s pension system in coming years.

Read More: What China’s Falling Population Means for Its Future: QuickTake

“China cannot rely on the demographic dividend as a structural driver for economic growth,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “Going forward, demographics will be a headwind. Economic growth will have to depend more on productivity growth.”

Beyond the domestic challenges, China also faces risks from a slowing global economy. Demand for Chinese-made goods has plummeted in recent months, eroding a key pillar of growth.

The NBS said the recovery’s foundation is “not solid yet,” highlighting an international environment that remains “complex and severe.”

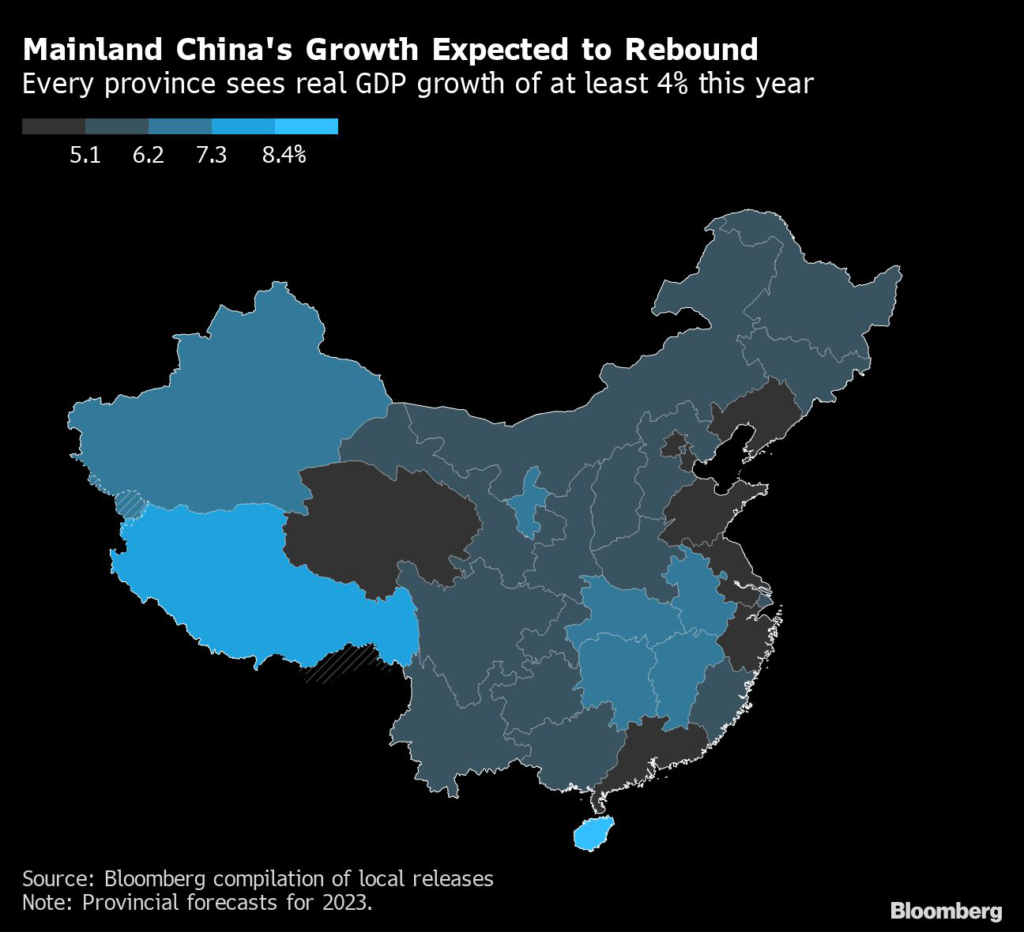

China’s provinces are almost all targeting economic growth of 5% or more in 2023. Officials are debating a national economic growth target of around 5%, Bloomberg News reported last month.

The better-than-expected retail sales last month was partly due to strong growth in car purchases as buyers took advantage of subsidies before they wound up and an almost 40% jump in spending on medicines. Restaurant sales plunged, contracting 14.1% in December from a year ago, as the virus wave kept people at home.

Read More: What Lunar New Year Treks Mean for China Covid Surge: QuickTake

Data Doubts

Some analysts expressed skepticism about the data, which contained a few notable discrepancies. Most major industrial sectors fell in December, but the overall figure for industrial production was up in the month. Car output fell 16.7%, yet sales increased 4.6%. For the entirety of 2022, cement output was down just 10.8%, although housing sales plunged 28.3%.

“The market won’t care about fourth quarter figures too much,” Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “Even if they were very weak, they’d look past the weakness and be more concerned about the outlook.”

–With assistance from James Mayger, Malcolm Scott, Fran Wang, Ishika Mookerjee, Chester Yung and Jing Li.

(Updates with market reaction.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.