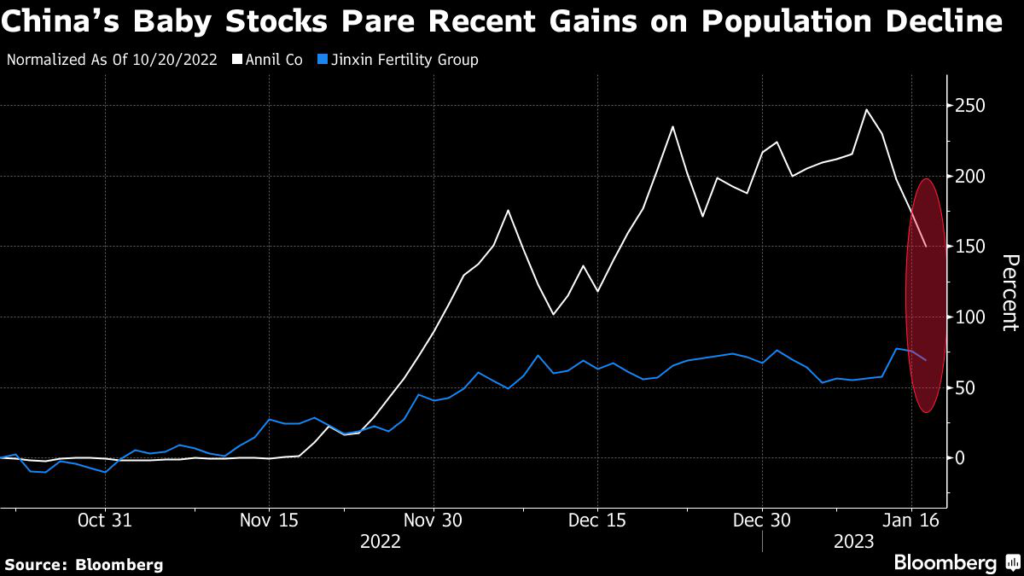

Chinese stocks related to baby goods and fertility treatments slumped after data showed the population of the world’s largest nation declined for the first time in over 60 years.

(Bloomberg) — Chinese stocks related to baby goods and fertility treatments slumped after data showed the population of the world’s largest nation declined for the first time in over 60 years.

Incubator maker Ningbo David Medical Device Co.

plunged as much as 11%, while apparel manufacturers Kidswant Children Products Co. and Annil Co. fell more than 7% each. In Hong Kong, Jinxin Fertility Group Ltd. and formula maker China Feihe Ltd. each slipped more than 3%.

China had 1.41 billion people at the end of last year, 850,000 fewer than the end of 2021, according to the National Bureau of Statistics.

That marks the first drop since 1961.

China’s Population Starts Shrinking, First Drop Since 1960s

The data confirm a weak outlook for China’s population growth, despite family-friendly moves including a policy change to allow all couples to have a third child.

Baby and maternity stocks had been active since census data in 2021 showed the number of new births had fallen to the lowest in 60 years.

Investors bet that further tax breaks, better childcare services and looser home-purchase restrictions for larger families would serve as incentives.

Still, the number of women at childbearing age declined by about 4 million in 2022, compounding a drop in people’s willingness to have children, Kang Yi, head of the statistics bureau, said after a briefing Tuesday.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.