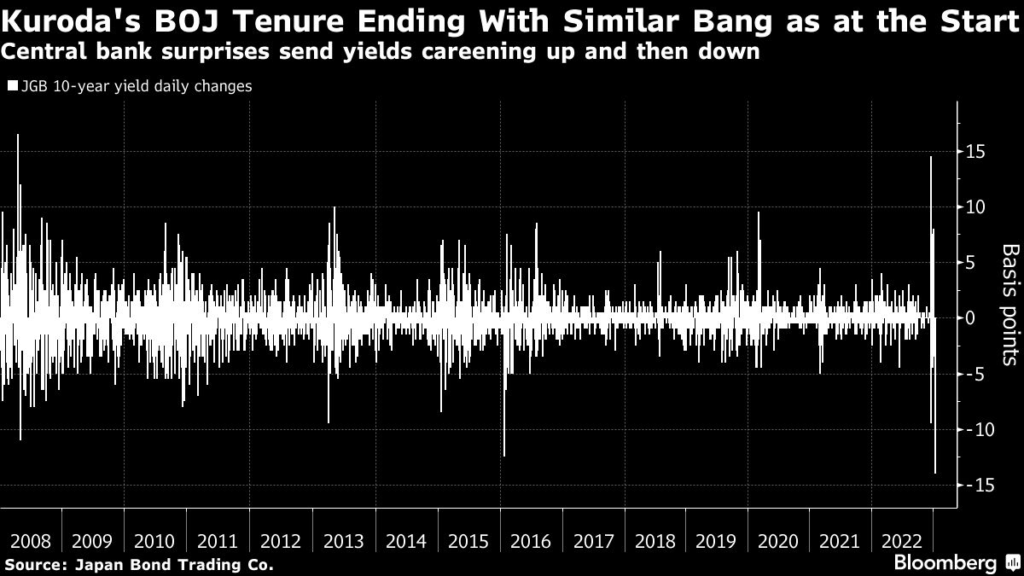

Bank of Japan Governor Haruhiko Kuroda looks set to end his tenure the same way he started it: sending yields careening in the world’s second-largest government bond market.

(Bloomberg) — Bank of Japan Governor Haruhiko Kuroda looks set to end his tenure the same way he started it: sending yields careening in the world’s second-largest government bond market.

Japan’s benchmark 10-year yield tumbled as much as 14 basis points Wednesday after the BOJ defied some expectations for another shift in policy.

The size of the move matches the intra-day drop on April 5, 2013, just after Kuroda initiated quantitative easing by pledging to double the monetary base.

The latest jolt underscores how traders have consistently struggled to read Kuroda, whose decade-long reign is likely to be associated with the central bank’s ultra-loose settings.

While Japan’s quickening inflation is fueling bets for a policy shift, global markets may once again find it hard to divine the exact timing for a move.

“Markets continue to get the BOJ wrong, especially when it comes to the timing of actual policy changes,” said Martin Malone, chief economist at Aurel in London.

“Even as the growth and inflation outlook is developing in a way that would allow the central bank to end curve control, any actual change is still some ways off.”

Kuroda similarly wrong-footed investors in December when the BOJ unexpectedly doubled the cap on the benchmark yield curve.

The 10-year bond yield posted its biggest intraday jump since 2003 while the yen surged almost 4% following the shift.

Read: BOJ Blindsides Traders to Echo Christmas Day Shock of 1989

Tensions in the market are likely to remain elevated, with a growing number of investors becoming convinced that the BOJ can’t hold on to its accommodative stance while the Federal Reserve forges ahead with more rate hikes.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.