Norway’s central bank paused monetary tightening while signaling a likely quarter-point increase in borrowing costs in March is still needed to bring inflation under control.

(Bloomberg) — Norway’s central bank paused monetary tightening while signaling a likely quarter-point increase in borrowing costs in March is still needed to bring inflation under control.

Norges Bank kept the key deposit rate on hold at 2.75% on Thursday, as forecast by the majority of economists in a Bloomberg survey.

Governor Ida Wolden Bache said the benchmark “will most likely be raised in March,” an outlook that would chime with guidance in December that the key interest rate would increase to “around 3%” this year.

A slowdown in inflation from a three-decade high has been “broadly in line” with central bank forecasts, with energy costs also coming down and damping international price pressures, Wolden Bache said in an interview.

“The decision to keep policy rate unchanged at this meeting should be seen in light of the fact that we have raised the policy rate over a short period of time and we have not yet seen the full effect of that tightening,” she said.

The krone reversed earlier gains, trading 0.7% weaker at around 10.75 against the euro as of 11:20 a.m. in London. Norway’s currency has weakened more than 7% over the past 12 months versus the euro, the biggest depreciation among G-10 peers together with the Swedish krona.

Traders trimmed bets on rate hikes by June to 52 basis points, the lowest in more than a month, according to forward-rate agreements.

“The policy rate will need to be increased somewhat further,” officials said on Thursday.

The decision doesn’t give any clear indication on whether Norway may be among the first in the G-10 sphere of major currency jurisdictions to end monetary tightening, after it led that group to start rate hikes in September 2021.

“We emphasized that the outlook is more uncertain than normal and that the development of the policy rate will depend on what happens in the economy,” Wolden Bache said, adding that signs of a tighter labor market made for “some arguments for raising the policy rate at this meeting.”

“Of course a tight labor market could contribute to keeping inflation up going forward,” she said.

Marius Gonsholt Hov, an analyst at Svenska Handelsbanken AB in Oslo, said he believes the peak is at hand.

“Norges Bank will deliver another 25 basis-point rate hike in March, to 3%, but that is also the peak in our view,” Gonsholt Hov said. “Further ahead, we believe that Norges Bank will stick to 3% for the remainder of this year, to be sure that inflationary pressures are in fact abating.”

In contrast, Nordea Bank Abp’s Kjetil Olsen and Dane Cekov continue to forecast a last hike to 3.25% in June after a March move, saying they “still think developments in the economy going forward will be slightly better” than the central bank forecasts, “and there is also upside risk to wage growth.”

Easing Inflation

With inflation slowing to a seven-month low and the fossil-fuel-rich economy facing a mild recession, the central bank has adopted a more cautious stance just as the government also considers a slowdown in inflation to be its key priority.

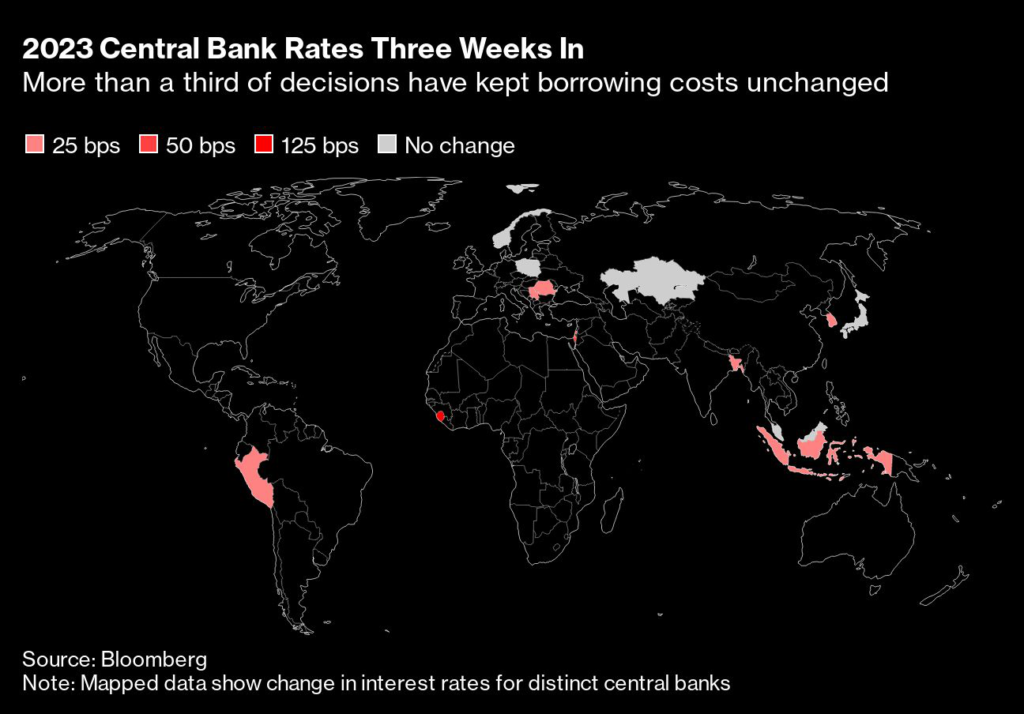

If Norway does conclude rate hiking in coming months, it won’t be the only one among other advanced economies. Australia and Canada have also signaled they are nearing an end to rate hikes.

Officials at the European Central Bank are pondering whether to start slowing down in due course even as the ECB has indicated more increases in borrowing costs.

The announcement didn’t feature new economic forecasts or projections for rates, as the decision was a so-called interim one.

–With assistance from Joel Rinneby, Harumi Ichikura, Zoe Schneeweiss, Constantine Courcoulas and Stephen Treloar.

(Updates with governor’s comments from fifth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.