Even as US stocks are teetering again, a measure of expected market volatility is about as low as it’s been over the past year. That’s a concern for analysts who see trouble brewing in an earnings season that’s likely to highlight recession angst.

(Bloomberg) — Even as US stocks are teetering again, a measure of expected market volatility is about as low as it’s been over the past year. That’s a concern for analysts who see trouble brewing in an earnings season that’s likely to highlight recession angst.

For Nick Colas at DataTrek Research, the assumption of tranquility ahead — evidenced by the depressed levels of the CBOE Volatility Index — is hard to square with all the questions facing Corporate America as the economy slows and profits sputter.

The worry is that investors face a rude awakening from fourth-quarter results, which Bloomberg Intelligence projects will mark the start of a US earnings recession. The pain may extend into future quarters as well, as Federal Reserve policy tightening takes full effect, Colas said.

The CBOE index, dubbed the VIX, “seems too low to us as we go into the meat of Q4 earnings season,” said Colas, DataTrek’s co-founder. “A lot has to go right to justify current valuations and VIX levels, and only a little has to go awry to upset markets in the back half of January.”

The market’s so-called fear gauge has been unusually subdued for the past two months, coinciding with growing speculation that inflation is cooling enough for the Fed to slow its rate hikes further.

The last time the VIX was this low for this long was in 2021, until speculation around the tapering of Fed stimulus helped halt a seven-month rally in the S&P 500 Index. Now it comes amid a sputtering rebound from the market’s worst year since 2008, as investors appear to be shifting their focus after seven Fed rate increases in 2022.

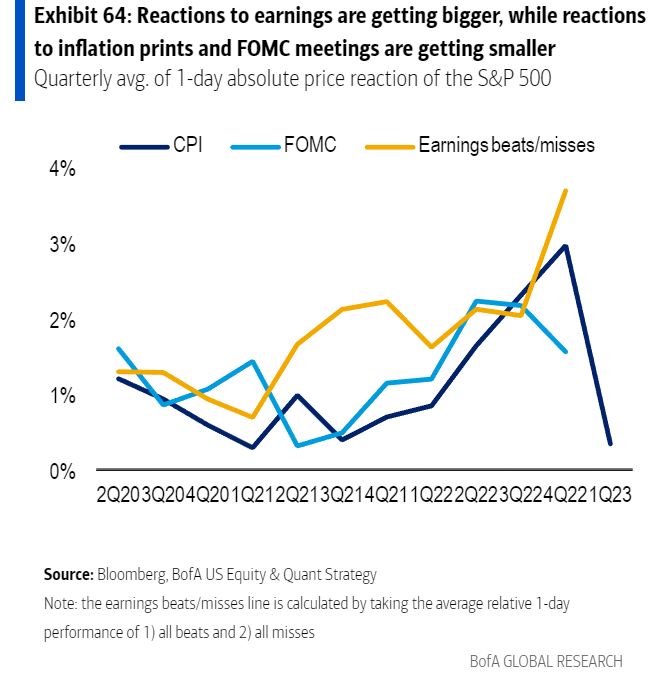

The reaction in stocks to inflation data and Fed meetings is diminishing, while the influence of earnings is getting bigger, according to Savita Subramanian of Bank of America Corp.

Granted, the market may not be as ill-prepared for a rough earnings period as the VIX suggests. Options analysts have debated how clear the VIX’s signals have been over the last year as more traders pivot to other volatility instruments. On the other hand, VIX proponents say it has performed generally as it should in a bear market.

To Colas, the key is that the next major catalyst for stocks — how predictable 2023 earnings turn out to be — is still developing with the US possibly inching closer to a recession. The prospect of an economic turning point means the profit outlook gets cloudier, demand declines by an unforeseeable amount and overstaffed companies are often caught off guard, he said.

That last dynamic point is becoming clear for technology companies including Microsoft Corp. and Amazon.com Inc., which began cutting a total of 28,000 jobs this week to offset slowing sales and a possible recession.

Meanwhile, Alcoa Corp. fell Thursday after saying aluminum shipments will be weaker than anticipated, and Procter & Gamble dropped after its fiscal second-quarter report showed volume trends are worsening.

“Earnings are probably the most important thing right now,” said Liz Ann Sonders, chief investment strategist at Charles Schwab & Co.

“Estimates where they are right now for both the fourth quarter as well as at least into the first half of 2023 — the path of least resistance is still down,” she said.

Elsewhere in corporate earnings:

Story Link: Stocks Still Aren’t Prepared for Profit Pain: Earnings Watch

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.